A Data-Hungry World is Driving Demand for Wireless Connections

Broadband subscriptions are experiencing exponential growth as global connectivity expands. More users mean more data — and more equipment to deliver it.

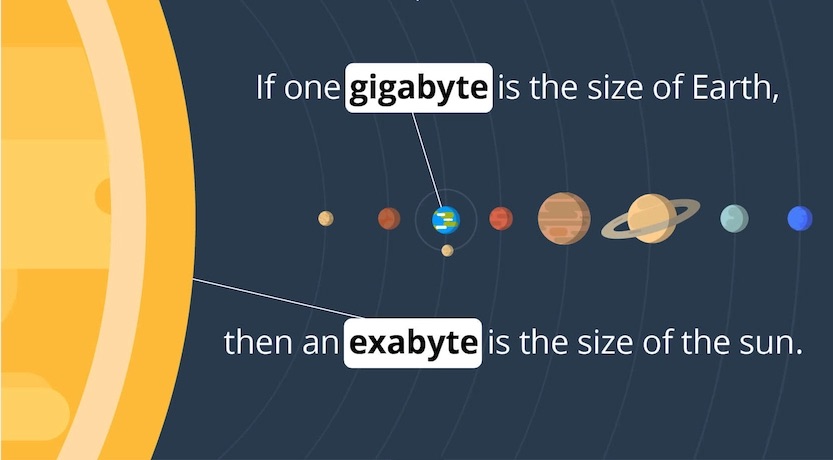

The most profound change occurring in the technology world is the huge increase in the amount of data that flows through our data communications systems every day. Until recently, we measured this flow in terms of petabytes per month. One petabyte equals one million gigabytes or one trillion bytes, which in more easily conceivable terms equates to 13.3 years of non-stop HD video data. Cisco estimates that monthly internet traffic in 2010 totaled 21,380 petabytes per month, or 10.9 GB per month per user. Today, there are over 7.7 billion people in the world and more than 51% of these people are connected to the internet. If each only used 10.9 GB of data per month, which is roughly equivalent to 11 hours of standard streaming video, or just shy of four hours of HD streaming video, that would equal 42.5 exabytes (EB) of data passing through the internet each month. One exabyte equals 1,000 petabytes, or roughly 13,300 years of HD video data. In fact, a petabyte is so enormous, it’s better imagined in terms of our solar system: As BACKBLAZE put it, “If one gigabyte is the size of the Earth, then an exabyte is the size of the sun.” What’s more, the 42.3 EB/month figure doesn’t even count machine-to-machine (M2M) communications, which will approach 14.7 billion connections by 2023. The amount of data the world produces each day is extraordinary!

Image courtesy of BACKBLAZE, a world leader in computer backup and cloud storage, and originally published in its “Defining an Exabyte.”

The drivers for connector use by the telecom market are largely based on consumer behavior and the consumption of data. Today, everyone wants to be connected all the time, whether it is for work or leisure. Consequently, these connections are increasingly becoming wireless.

According to data collected by the International Telecommunication Union (ITU), fixed telephone connections are decreasing while mobile connections are increasing, and both mobile and fixed broadband connections continue to rise.

Telecommunication systems have undergone considerable evolution to handle the increased volumes. Fixed systems have gone through over a century of evolution. For example, switching equipment has advanced from manually operated switchboards to mechanical switching, analog electronic switching, digital switching, packet switching, and routing. Today, digital IP switches are deployed throughout the world.

Transmission equipment has gone through a similar progression, from coaxial and twisted-pair media to TDM multiplexing, early fiber optic transmission, wavelength division multiplexing (WDM/DWDM), reconfigurable optical add-drop multiplexers (ROADM), and now the maturing Optical Transport Networks (OTN). The synchronous optical network and synchronous digital hierarchy (SONET/SDH) families of transmission products were the dominant technology for many years. But they have since given way to OTN, which carries the legacy SONET/SDH, DWDM, and most importantly, Carrier Ethernet.

Early datacom network access consisted of analog current loops and, later, pair-gain systems. Subsequent developments included digital subscriber line systems (DSL), which run on an asynchronous transfer mode (ATM) physical layer, and optical networks, which may be active or passive in design. The latest service offering is driven with Carrier Ethernet, since it is the lowest-cost access technology and the language of the internet. Carrier Ethernet networks can be based on either copper or fiber optic cable.

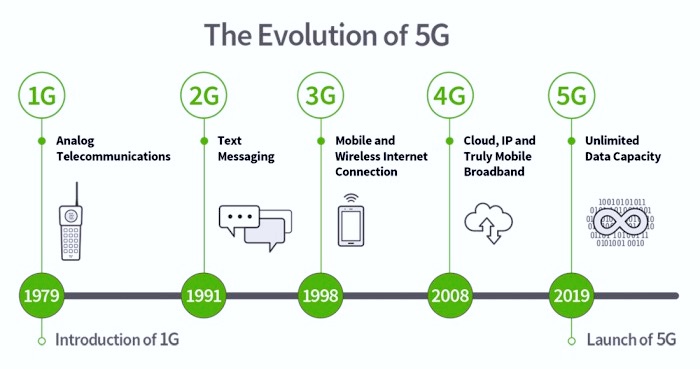

The mobile/wireless infrastructure used to provide cellular service has changed significantly in the last three decades, and these changes will continue into the next decade. Originally intended for just voice transmission, wireless networks have morphed into the primary access for the internet, particularly in developing countries.

In just three decades, demand for telecommunications products and services have driven enormous growth in data consumption. (Image courtesy of Digi International)

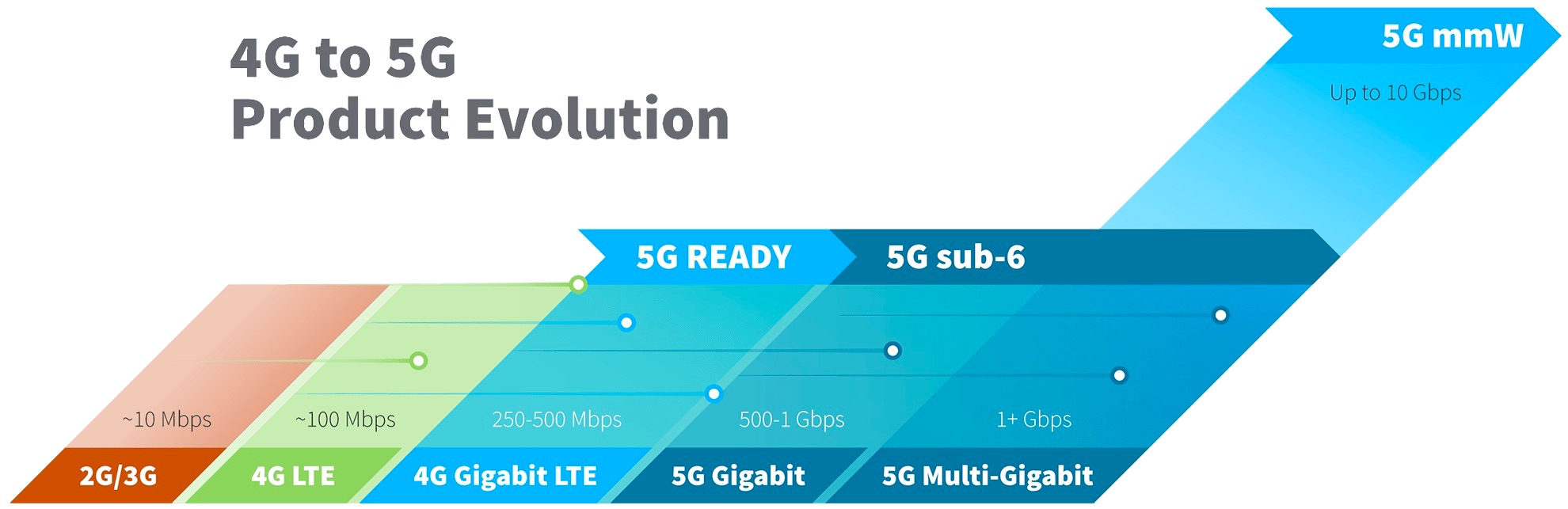

In 2008, the ITU introduced 4G specifications, which required transmission rates of 100 Mb/s for mobile applications and 1 Gb/s for stationary applications. Long-Term Evolution (LTE) has been the quest to achieve those rates, which became synonymous with 4G LTE. This was really the first truly mobile broadband.

In 2019, implementation of the infrastructure needed for the first version of 5G started in limited installations in major cities. The higher frequency bands, 30 GHz or more with faster transmission rates, are limited by distance and transmission media. They cannot, for instance, penetrate walls and glass windows, and they are absorbed by the atmosphere. They require a direct line of sight between the user’s device and the cell tower. When a 5G phone is not within range of these high-frequency 5G systems, they revert to using 4G signals, which typically utilize signals in the 2.4 GHz to 6 GHz range. These signals are better able to travel longer distances and penetrate barriers.

In “The Journey to 5G,” wireless communications pioneer Digi International charts the evolution of frequencies and transmission rates. (Image courtesy of Digi International.)

Wireless Communications Components

Many electronic technologies play a role in 4G and 5G installations, including antennas, RF and microwave products, fiber optics, and others key elements, notably:

- Active antenna systems, which improve the performance of transceivers and can be mechanically adjusted to direct energy to the user. These systems electronically form the signal in a process called beamforming.

- mMIMO (massive multiple-input, multiple-output) antennas, which aim the beams through interference patterns and potentially contain hundreds of small antenna elements per antenna.

- Integration (aggregation) of different elements of the radio, the radio network controller, control units, distribution units, and front haul and backhaul equipment.

- Virtualization of many functions, such as authentication and billing systems. The continuing proliferation of internet protocols (IP) and the Open Compute efforts to allow the management of voice, video, and data through generic routers and servers versus the specialized equipment that has been the mainstay of the industry up to now.

AVX/Ethertronics’ Active Steering antenna systems significantly boost wireless connectivity by continually optimizing the antenna’s direction in real-time on a per-millisecond basis, creating multiple radiation patterns and then selecting the ideal pattern to hit its targeted device with the best signal. The result is a major increase in range, reliability, and speed between devices living on the fringes of a network or hidden behind walls and hard-to-reach spaces.

Hermetic Solutions Group has acquired Cristek Interconnects, Inc., which offers a wide range of microwave and RF connectivity solutions, including 50Ω SMA connectors (left) that provide excellent electrical performance from DC to 26 GHz and robust, miniature, high-frequency, push-on SMPM connectors (right) for performance through 65 GHz.

SV Microwave’s 2.92mm connector was developed for use to 40GHz in high-speed digital, instrumentation, military, aerospace, satcom, and test and measurement applications that require high reliability in rugged operating conditions. They deliver low RF leakage, low VSWR, and excellent reliability and are compatible with both SMA and 3.5mm connectors.

All of these fixed and mobile broadband access points have been enabled by the proliferation of IP systems versus the old analog systems used in the network.

Amphenol RF’s fixed length cable assembly product line includes reverse polarity (RP) SMA connector configurations and RP-SMA assemblies for antenna applications. These can support frequencies through 6GHz with all of the features and benefits of the traditional SMA connector, including the threaded coupling mechanism.

Looking Ahead

As a result of increasing consumer and commercial business demands, the demand for connectivity equipment needed for these systems is growing at significant rates. With an overgrowth rate exceeding 8% in the next five years, connector sales are expecting to reach almost $21 billion in 2025. The two fastest growing equipment sectors are wireless infrastructure and enterprise equipment, such as server farms. The fastest growing region is China, and the fastest growth connector product type is fiber optics. The implementation of 5G infrastructure and products that use this accelerated level of connectivity will only increase the amount of data the world produces and consumes.

David Pheteplace is the author of the Bishop & Associates’ World Telecom Connector Market report, which provides an in-depth review of the explosive growth of the telecom market, including trends impacting IP-based equipment, 5G, and growth forecasts. This report includes analyses by primary equipment group, equipment type, region, and connector type, with detailed statistics of the world telecom connector market.

Check out our other 5G, networking, sensors and antennas, and Market Update articles, our Datacom/Telecom Market Page, and our 2021 and 2020 Article Archives.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019