New Report Examines Performance and Outlook for the European Connector Industry

Bishop & Associates has tracked the activities of the European connector industry for 41 years. Find out how things went in 2022 and what’s to come in the years ahead.

Europe is a vibrant center of great technological innovation. Home to more than 200 connector companies and many more end users of electronic components, it’s the third largest connector region in the world, after North America and China, comprising 20% of the global connector market for 2022. EU connector companies play a significant role in the electronic industries, and it’s leading the way in sectors including renewable energy, automotive design, and automation. Despite the challenges of the ongoing war in Ukraine, shifts between the dominance of Western Europe and Central and Eastern region, and continuing supply chain issues in the pandemic recovery period, the outlook for the European electronics industry is strong.

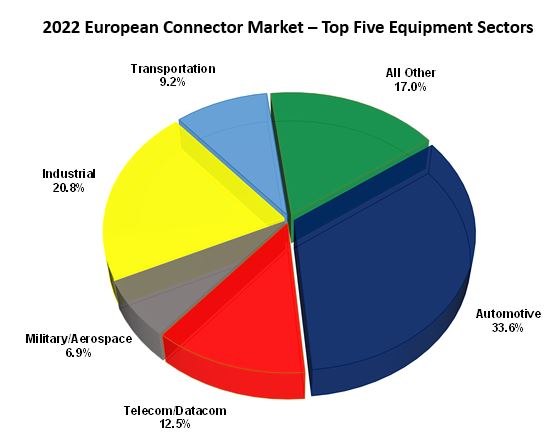

A new market research report by Bishop & Associates, European Connector Market 2021, 2022, 2023F and 2028F, finds that Europe has achieved a compound average growth rate of +4.7% over the 41-year period tracked by the firm, with connector sales of $17.329 billion in 2022. The report covers 23 countries, including the member states of the European Union as well as the United Kingdom (U.K.), Turkey, Norway, Switzerland, and selected others. (Russia is not included in this report.) The report tracks the performance of major end-use sectors, beginning with the largest, Automotive, followed by Industrial and Telecom.

The report also examines sales for the major connector companies operating in Europe, including those based there and elsewhere. European companies are making a significant impact with innovative solutions, and companies including Rosenberger, HARTING, Phoenix Contact, Weidmüller, WAGO, and Lumberg take significant positions in the Top 10 Connector Companies based on 2021 European sales. Also examined are the Top 10 companies with European based headquarters.

Growth in the European connector industry varies by country. This report examines the unique regional contributions of Switzerland and Scandinavia, the rise of the Benelux (Belgium, Netherlands, and Luxembourg) connector market, the outsized performance of the Irish connector market, and smaller markets, including Turkey, Romania, and the Iberian Peninsula. A detailed examination of the U.K. market focuses on the booming Aerospace, Transportation, Defense, and other industries, as well as the less rosy fortunes of the U.K. Automotive industry.

For each country, sales by market sector and product type are provided for 2021 and 2022, with a forecast for 2023 and 2028.

Despite strong performance in 2022, the European connector market was limited in growth compared to the rest of the world due to several factors, including the attack on Ukraine by Russia and the resulting disruption in the supply chain, particularly in the automotive sector. The attack also had a significant effect on energy prices, particularly natural gas prices, and depressed consumer confidence in general, which was passed on to investors. Another key factor was the exchange rate; the value of the euro changed rapidly as we entered 2022.

Visit Bishop & Associates to learn more about the European Connector Market 2012, 2022, 2023F and 2028F.

Subscribe to the Bishop Report, a publication by Bishop & Associates, to receive monthly updates on the performance of the connector industry.

Like this article? Check out our other Market Updates, our Mil/Aero Market articles, and our 2022 and 2023 Article Archives.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.