The 5G Revolution is Coming…Slowly

Years of hype have brought us to the year 5G was supposed to go big. But we’ll have to be patient to see it make an impact.

The hype about the 5G revolution has been intense as every market awaits its arrival and impact. When the fifth-generation wireless network is fully installed and operational, its high speeds, low latency, and reliability will be transformational, enabling automation across urban and transportation infrastructure and numerous industries. The rollout has been slow, hampered by lack of compatible equipment, geopolitical tensions, and even pushback from citizen groups, but it is on track.

“5G is rolling out ahead of the original plan. There was a lot of pressure from service providers to reinvigorate device and subscription sales, which were stagnant and declining. Consumers also hold onto their devices longer, as devices have become more expensive in recent years…especially flagship devices,” said Travis Amrine, global industry marketing manager, I-PEX. “This first phase has a lot of unknowns and uncertainty. Combined with a nascent 5G network infrastructure, it is difficult for consumers to see the benefits of 5G. Everyone will enjoy the enhanced mobile broadband (eMBB) portion of 5G first, because it was part of the 3rd Generation Partnership Project (3GPP) release 15. The ultra-reliable low latency (uRLL) and massive machine-type communication (mMTC) portions are being defined in release 16 and we should see functionality and use cases that employ these advances in late 2020.”

One sticking point has been the dominance of the Chinese telecom giant Huawei in 5G equipment. Huawei is believed to have a close relationship with the Chinese government, leading to concerns about security risks. The US and several other countries have banned Huawei equipment in telecommunications infrastructure, but some countries have signed on with the company, citing its lower costs as the driving factor since it makes installation more viable. Using Huawei is a risk, but so is being left behind. The UK’s Boris Johnson is expected to allow Huawei to take part in “less-contentious” parts of the UK’s future 5G network. Less wealthy countries may feel their only choice to be part of the 5G revolution is to give Huawei more access.

Telecommunications companies are also facing added pressure to educate the public on the scientific realities associated with 5G technologies. On January 25, protests erupted around the world as people pushed back against installation of 5G towers in their areas, fearing health impacts could be caused by increased radiofrequency electromagnetic fields. Russian misinformation network RT America has created a campaign claiming that 5G signals cause cancer, infertility, autism, learning disabilities, and Alzheimer’s disease and will spark a “5G apocalypse” that will reduce the human population. Australia has pledged to spend $5 million to combat misinformation and build public confidence in the network. They must work fast; infrastructure is being installed now and most countries are expected to activate networks at some point in 2020.

By the end of 2019, dozens of cities around the world had launched 5G networks, but they are limited by the lack of equipment that can take advantage of them. That is changing quickly. “5G is coming in 2020,” said Amrine. “We should see an acceleration of network availability and devices over the next few years. 5G will make steady gains versus 4G devices in terms of market share.”

Data centers are expanding their racks to handle the increase of traffic that will arrive with 5G. At the Consumer Electronics Show earlier this month, 5G-compatible routers, phones, laptops, and Internet of Things devices were on display. DesignCon, which kicks off this week in Santa Clara, California, will showcase interface connections for 5G infrastructure, including base stations, cabling, and data centers, and well as components used in the higher-bandwidth products that the impending 5G revolution will enable.

Electronics companies are launching new product lines to address these needs. On the product end of the network, small, low-weight, and high-density products are in demand. 5G applications utilize the mmWave spectrum at 30GHz and beyond, which demands high-speed data rates of 10Gb/s (4G is at 1Gb/s) and requires precision interconnects.

New 5G solutions from I-PEX

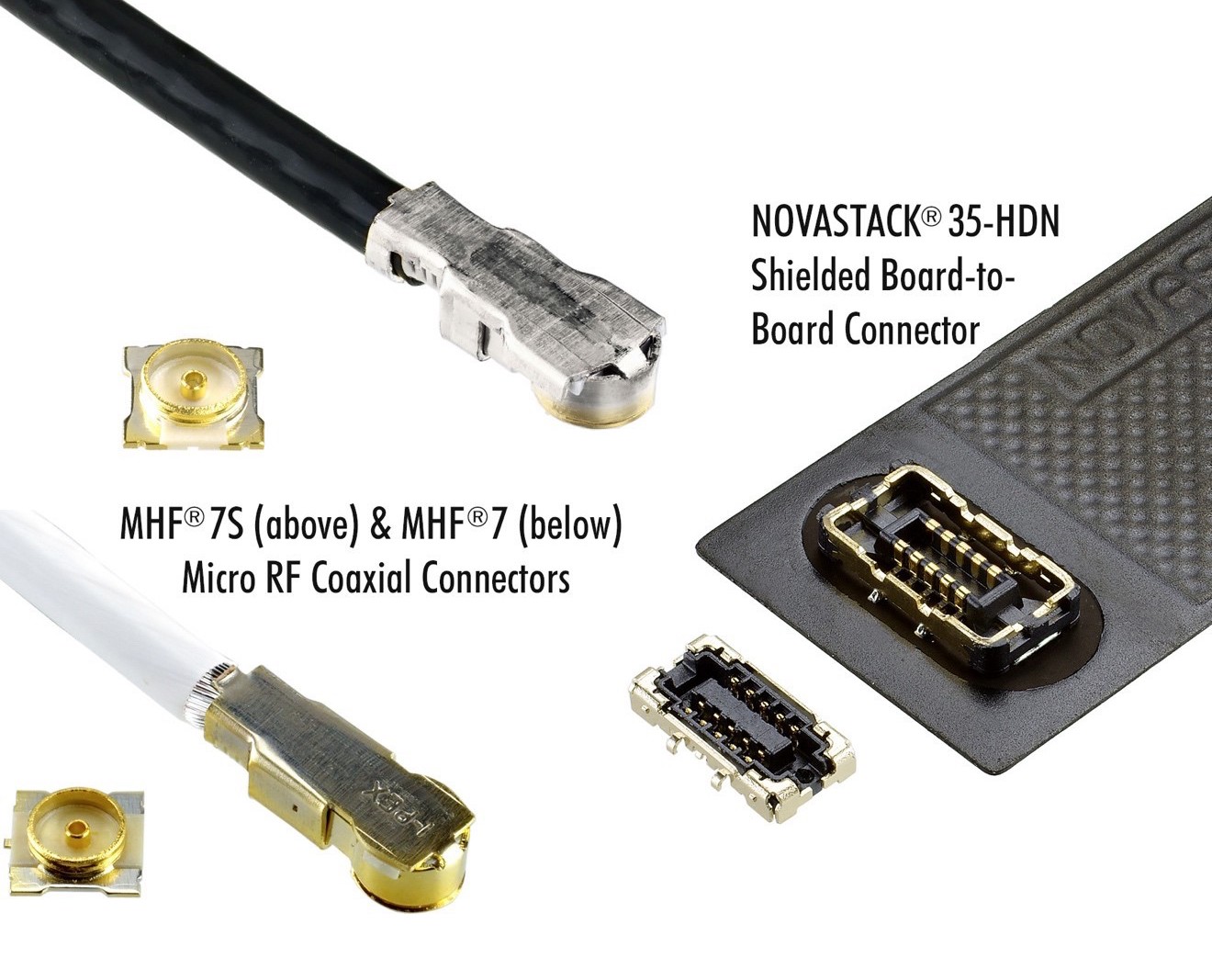

“I-PEX has learned many things about what the connector industry needs to offer to enable device makers to get their products to market. We have three new connectors (one board-to-board and two coaxial) that solve problems posed by various 5G use cases from smartphones to small cells and CPE devices,” said Amrine.

I-PEX has released a new series of micro RF connectors for mmWave that targets 5G applications. The MHF 7 provides electrical performance through 45GHz in a 2.0mm x 2.1mm footprint and has a shielded design with the industry’s first stripline-terminated signal pin inside the receptable ground ring. The company’s NOVASTACK 35-HDN is designed for high-frequency 5G applications.

Cinch Connectivity Systems’ Johnson product line includes connectors, cable assemblies, and adapters designed for 5G applications.

Cinch Connectivity Solutions’ Johnson product line includes connectors, cable assemblies, and adapters designed for 5G applications in which space-savings and package density are priorities. These connectors are 30% smaller than standard SMP connectors, meet the packaging requirements of the aerospace, defense, instrumentation, and telecom markets, and operate at frequencies ranging from DC to 65GHz.

Midwest Microwave, another Bel company, has released new SMP connections for 5G applications that support the MIL-STD-348A standard interface. They exhibit 50Ω impedance, support a maximum frequency of 26.5GHz, and are suitable for test boards, high-reliability, and military applications.

Antennas are another critical component of 5G products. Every 5G device will require an antenna that can support higher frequencies and Massive MIMO beamforming. Antennas are also integrated into the 5G infrastructure, including towers and small-cell transmitters. Numerous connector companies have developed and acquired antenna expertise in recent years.

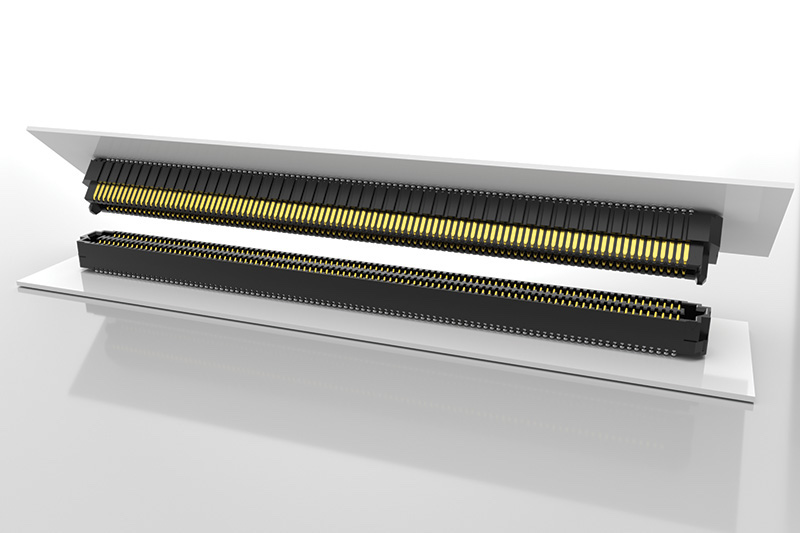

Samtec’s AccelRate-HD

Molex, for example, has developed antennas for devices, towers, buildings, and transportation equipment and infrastructure that will accommodate 5G performance. The company’s LTE antenna family has expanded to include a 5G module that can be used in networks and applications and its rectangular NFC antennas operate in devices as tiny as car keys. TE Connectivity’s 5G antenna offering includes standard and custom antennas designed to support protocols including Bluetooth, WLAN, cellular, and ZigBee. Blue Danube’s Beamcraft Series High-Definition Active Antenna Systems use Samtec’s high-speed board-to-board connectors to route signals from the main digital board to the antenna modules. In addition, HUBER+SUHNER has added a new line of 4G-compatible 5G small-cell antennas to its extensive line of coaxial connectors, offering immediate utility.

New cabling designed for use in 5G infrastructure as also available. Copper-based cabling is the dominant choice for 5G systems but fiber optics deliver higher speeds, greater bandwidth, and more security. Fiber can also perform over long distances without losing signal strength. Verizon CTO Kyle Malady has described the wireless networks of the future as “fiber with antennas hanging off of it.”

“Fiber optic connectivity is an essential piece of 5G networks for low latency, high-speed transmissions in cellular and edge computing applications,” said Nick Soricelli, associate project leader at Siemon Interconnect Solutions. “Siemon offers a wide range of infrastructure solutions required for 5G applications and is constantly developing new solutions for this emerging technology.” One upcoming fiber product the company has for this market is currently known as the MPO-to-LC Ruggedized Breakout Cable Assembly, which was designed for the 5G infrastructure buildouts.

Siemon’s MPO to LC Ruggedized Breakout Cable Assembly

HUBER+SUHNER’s new Direct GPS-over-Fiber (GPSoF) solution enables a fiber optic connection to be made directly onto an antenna, eliminating the need for a separate power line.

Copper remains dominant for now, however. As such, Amphenol SV Microwave offers a portfolio of RF connectors and cable assemblies for 5G applications ranging from infrastructure to devices.

At CES, T-Mobile promised that 200 million of its customers would have 5G by the end of 2020. Right now, that means little more than a faster download of streaming media. But as infrastructure continues to advance, we expect the 5G revolution to soon live up to its full potential.

Like this article? Check out our other New Technology, 5G, High-Speed, and Fiber Optics articles, and 2019 Article Archive, and our Datacom/Telecom Market Page.

- Meet the Connector: DIN Standard Connectors - April 16, 2024

- Software-Driven Radio Reinvigorates Old Technology - April 9, 2024

- What is a Busbar? - April 2, 2024