Facts & Figures: Performance Results for OEM Markets in 2014

Bishop & Associates tracks sales and profits in 13 market sectors. Based on the 120 companies it follows, it evaluated the performance results for OEM markets in 2014.

How are OEMs faring in the current economic climate? The objectives in tracking sales and profits of these 120 companies in 13 market sectors are to determine how selected electronic markets have performed, identify sales and profit trends for forecasting purposes, and monitor company performance within market sectors. Below we look at the performance results for OEM markets in 2014.

The combined annual revenue of all the 13 market sectors Bishop follows for electronic interconnects sales trends was $4.35 trillion in 2014, with growth of 1.9% over 2013.

The following table provides the 2012/2013 percent change in revenues, and the 2013 versus the 2014 sales and percent change in sales by market sector.

Sales Performance – Percent Change

Of the 13 market sectors Bishop tracks, nine had year-over-year growth in 2014. Instrumentation grew the most at 13.0%. Four sectors had declining sales year over year. The consumer sector had the largest year-over-year decline at 2.5%.

Seven of the market sectors had year-over-year increases in their fourth quarter sales. Six of the sectors were flat or had declining sales in the quarter from the prior year.

Eight market sectors had an increase in net income during 2014. Five of the market sectors had double-digit increases in net income in 2014 including telecom/datacom, transportation, semiconductor, and electronic distribution. Six market sectors had declines in net income including automotive, computers, consumer, medical, and contract manufacturing.

The following tables and charts are for the top three performing market sectors by sales growth.

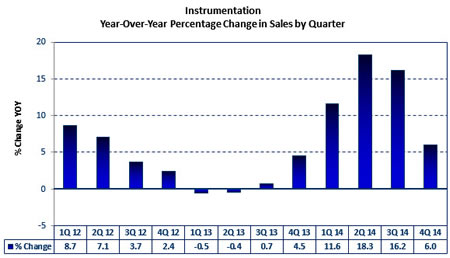

Instrumentation

The top performing company in instrumentation was ThermoFisher Scientific with 29% growth over the prior year.

Instrumentation has experienced six consecutive quarters of growth.

Semiconductors

![]()

Micron Technology was the fastest growing company in this group with sales up 49.7% over 2014. The semiconductor industry as a whole had a record year in 2014 with sales of $335 billion, an increase of 10% over the prior year.

![]()

The semiconductor sector has had seven consecutive quarters of year-over-year growth.

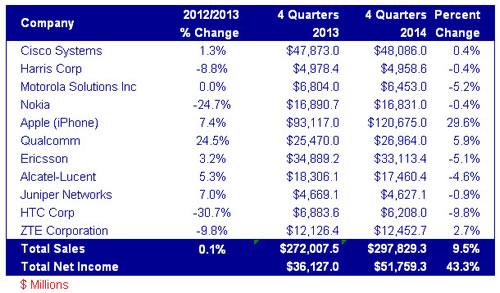

Telecom/Datacom

Apple had the most growth in this group of companies at 29.6% over the prior year. Much of this growth was driven by the iPhone 6 in the fourth quarter. Given Apple’s size and performance, it also drove the higher growth number in this sector.

[hr]

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019