2015 Cable Assembly Market Wrap-Up

Bishop & Associates crunched the numbers for the first three quarters of sales in the cable assembly market to present a snapshot of how the industry fared in 2015.

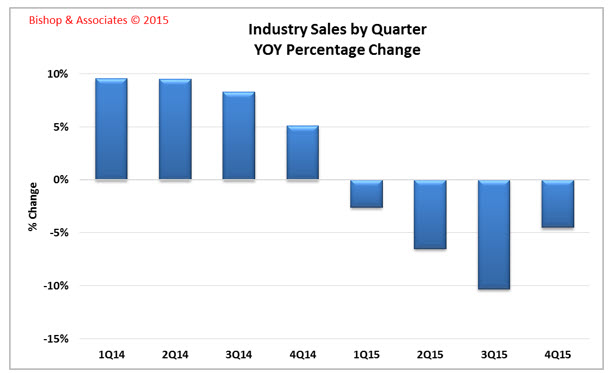

2015 is three quarters of the way into the bank, and the year, so far, has been a disappointment for many companies in the interconnect industry. Industry sales have declined almost 7% year to date and are projected to finish the year down 6%. This will result in four consecutive quarters of sales declines after good growth in 2014.

So, what is driving the industry sales in 2015?

On the positive side, the automotive industry has continued to sell its products even though economic growth has been slow (or slowing) for much of the year. Although interconnect sales are down in the low single digits for the year, there are still a lot of interconnects being sold into this industry. Unit sales of cars are expected to be up 2 – 3% over 2014 with good sales in Europe and North America. China, which usually sees double-digit growth in car sales, will have to settle for 5% growth in 2015 as its economy cools off. Interconnect sales into the automotive industry will exceed $36 billion for the year. To some extent, worldwide sales continue to be helped along by the availability of relatively cheap financing to buy cars.

Datacom has also been driving the interconnect industry in 2015. First, the unit sales of smartphones are up 7% year over year in the third quarter of 2015. For the year, unit sales are expected to be up over 10% to more than 1.4 billion units with revenues exceeding $250 billion. Interconnect sales for these smartphones will exceed $3 billion worldwide. The double whammy of smartphone sales comes from the bandwidth they chew up on the Internet. Service providers and website-hosting companies have been scrambling to keep up with the demand for high-speed transmission and storage capabilities. The equipment used in these systems is interconnect-intensive with very sophisticated, high-speed connectors and cable assemblies. Total sales into the datacom/telecom market sector in cable assembly will reach almost $20 billion in 2015.

Other than these two market sectors, which happen to be the two largest market sectors in the cable assembly industry, many of the other sectors are expected to be down between 8 – 10% worldwide:

- The computer sector is down due to the reduced number of PCs and tablets sold this year.

- The medical sector is down due to Medicare reforms and fewer private practices in the US and government austerity budgets in Europe.

- The industrial sector is down as companies buy less equipment due to slower economic growth. The low cost of oil has also slowed the purchase of exploration and refining equipment.

- In the transportation sector, the sale of narrow-body and regional airplanes continues to do well as they fulfill the demand for regional air travel. The low cost of agricultural and mineral commodities has, however, slowed the sales for farm and mining/construction equipment.

- The military/aerospace sector continues to contract. Military budget cuts in the US and Europe have eliminated almost all new spending.

- Consumer sales are generally down as people are saving (money) at record rates and being judicious with their spending.

Factors Affecting Economic Growth

Behind these contractions are some general factors affecting economic growth.

GDP is growing slowly in many of the world economies. In North America, Europe, Japan, and China, GDP growth depends on consumers spending money (a large percentage of the GDP in the US is generated by consumer spending). When people don’t feel confident in their environment and their economic well-being, they spend less money. There have been plenty of issues in 2015 making people feel less confident. Some of the main issues include instability in the stock markets and financial markets, the slow growth of wages in North America and Europe, social instability caused by the war in Syria and the mass immigration of Syrians (and other ethnic groups) into Western Europe, the terrorist activities of ISIS, and political gridlock in the US, just to name a few.

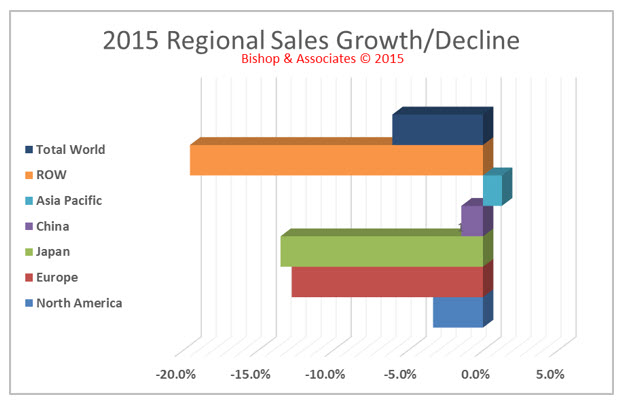

The following chart shows the industry growth/contraction by region of the world for 2015.

Regionally, Asia-Pacific is the only area that will experience growth in 2015. All other regions will contract.

Shifting Exchange Rates

As these calculations are made in US dollars, there has been a major impact on the performance of Europe and Japan due to shifting exchange rates. Year to date through September, the euro is down -17.1% to the dollar and the yen is down -14.4% to the dollar. Without the currency impact, the interconnect market in total would be down approximately -1% for the year (instead of -6%).

For 2016, Bishop expects the market to continue to contract slightly in the first half of the year (year over year), and then to grow in the second half to achieve an overall growth of about 2%.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector and cable assembly industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019