Robotics Help Medical Providers Improve Care

A new generation of robotic medical equipment is helping medical providers deliver automated care protocols, sterilize facilities, and conduct surgical procedures, as well as reduce risk and improve patient outcomes.

Surgical suites and intensive care units are some of the most high-risk work environments within hospitals. It is imperative to clean, disinfect, and sterilize surgical suites, patient rooms, and equipment between patients. The presence of highly infectious airborne pathogens like COVID-19 calls for even more stringent cleaning processes. The cleaning of medical devices and electronic systems must be accomplished using appropriate methods, and these devices are themselves becoming important tools in sterilization protocols.

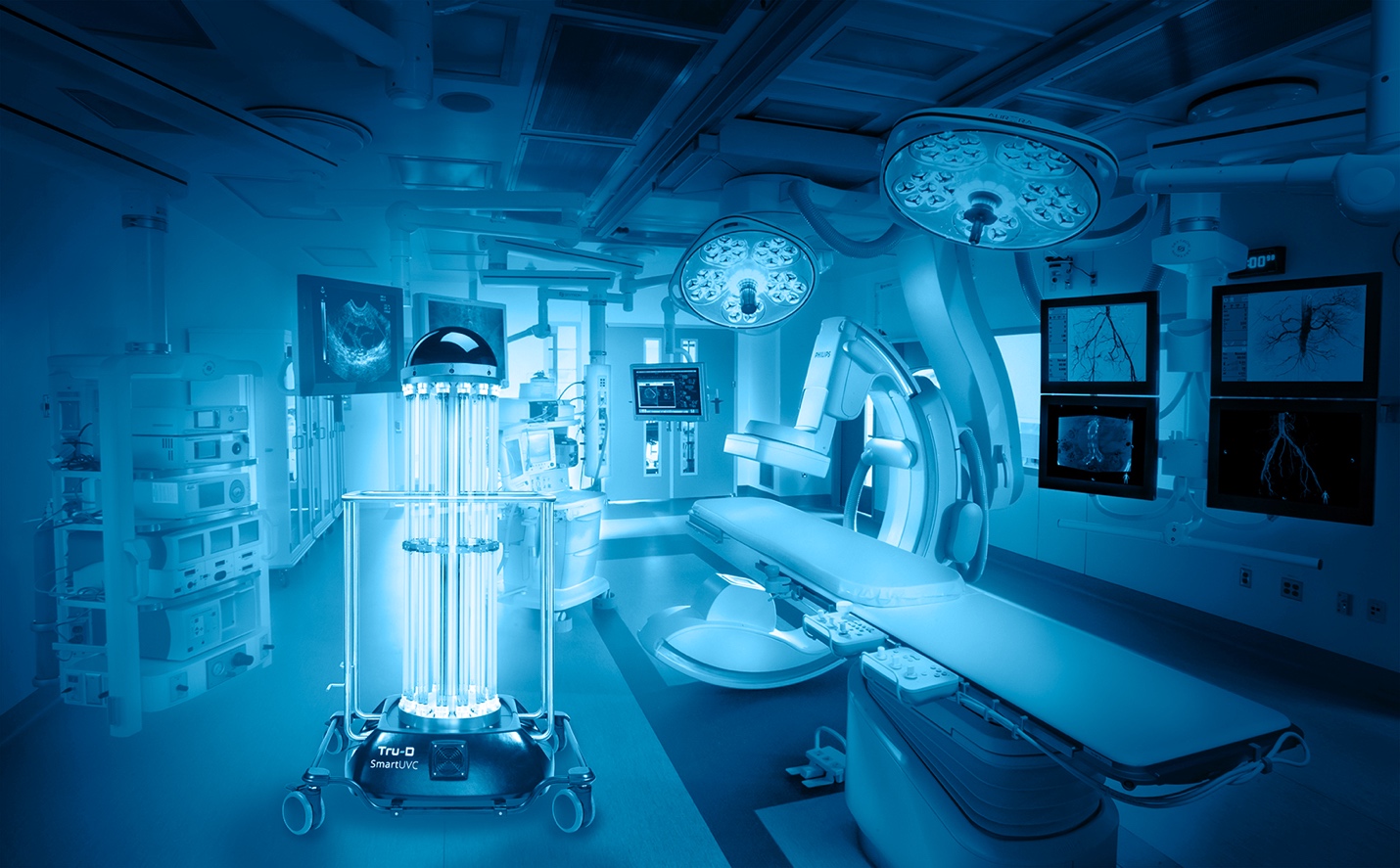

SmartUVC’s Tru-D UVC disinfection robot (pictured here) uses UVC light (ultraviolet C radiation with 200–280nm wavelengths) to safely, efficiently, and effectively disinfect patient rooms, intensive care units, operating rooms, emergency rooms, and long-term care facilities. The medical robot deconstructs the DNA of even deadly pathogens that could compromise patient outcomes, allowing hospital staff to disinfect with ease and confidence. (Image courtesy of TRU-D SmartUVC.)

Robotic Disinfection Equipment

To eliminate harmful bacteria and viruses, one of the most common germ-zapping technologies available for hospitals is ultraviolent light, specifically UVC, which utilizes the C frequency of the electromagnetic family of light frequencies. Offering 99.9% effectiveness at killing the DNA and RNA in viral pathogens, these light-based processes use wavelengths from 200–280 nanometers, delivered via handheld wands or robots designed to illuminate targeted areas with UVC light, effectively damaging viruses beyond recovery and stopping them from replicating and spreading infection. UVC has been recognized by the U.S. Center for Disease Control (CDC) and the U.S. Food & Drug Administration (FDA) as an approved method for disinfecting N95 face masks, medical supplies, and other personal protective equipment (PPE) during the pandemic.

UVC devices contain a broad variety of signal and power connectors, sensors, and cable harnesses. (Image courtesy of Skytron, a healthcare efficiency specialist that offers three different UVC robots to meet a range of needs and budgets.)

UVC disinfection devices can be stationary or portable and are frequently operated by healthcare workers, who take on some exposure risk in the process. However, a new generation of robotic UVC disinfection equipment requires no human presence in infected areas. Autonomous robots can be programmed to disinfect entire rooms or specific areas and can be programmed to operate at preset times in routes within surgical suites, ICUs, COVID-19 suites, and other hospital environments. Sophisticated robotic systems may include lasers and passive infrared (PIR) motion sensors to detect and avoid obstacles in hospital rooms, hallways, elevators, and automated door vestibules. When autonomous UVC systems detect the presence of human beings, they turn off the emission of UVC light to ensure hospital staff and patient safety.

A growing number of companies is emerging in the specialized robotic disinfection market, including Akara Robotics, Finson Technologies, HELIOS, Keenon Robotics, LG, Omron,R-Zero, Sherpa Mobile Robotics, Siemens/Aucma, Skytron, TMI Robotics, TRU-D SmartUVC, UVD Robots, a subsidiary of Blue Ocean Robotics, XD Bot, and Xenex Disinfection Services. Based on UVC’s proven safety and effectiveness, experts predict that the use of this technology will become a widespread standard disinfection protocol used throughout hospitals and other medical facilities.

The global robotic disinfection market reached $343 million in 2019 and is expected to reach $2.3 billion by 2025 with a CAGR exceeding 36%, which could well be a conservative estimate. This growing demand for robotic equipment is pushing the electronics industry to provide connectors, cable assemblies, and sensor solutions that can endure the harsh operating conditions of both medical environments and sterilization processes.

TE Connectivity’s wire-to-board and wire-to-wire connectivity solutions include signal and power connectors that enable connectivity between circuits and are well-suited for use in robotic disinfection equipment. TE’s wire-to-board connectors are designed for low-profile mating and secure terminations and are available with friction lock and full lock mechanisms. Its LCEDI connectors support both low-voltage differential signaling (LVDS) and embedded DisplayPort (eDP) applications, which are commonly used in medical imaging, surgical, and therapeutic applications.

Mill-Max offers hybrid power and signal connectors designed to streamline device architectures and deliver reliable performance, including a compact, five-pin cable-to-board header and socket and a 40-pin board-to-board header and socket combination. The five-pin connectors have two contacts for power and three for signal, while the 40-pin connectors have 30 signal contacts and 10 power contacts, and both connectors are well-suited for critical applications in harsh environments.

Innovation Fuels Growth and Investments in Surgical Robotics

Newer robotic assisted devices include more unique features than earlier iterations and are trending smaller, more portable, and more affordable. The rising use of AI, automation, enhanced connectivity, haptic sensor technology, and other advanced technologies is enabling surgical robots to achieve higher levels of precision and putting more control in the hands of surgeons. New entrants have taken notice and are investing heavily in specialty surgical robotic companies and technologies to get in on the action.

Robot-assisted surgery enables surgeons to perform many types of complex procedures with more precision, flexibility, and control than is possible with conventional techniques. Surgeons who use robotic systems find that this technology minimizes potential hand tremors or shakiness, provides more control, and allows for a better line of sight compared to traditional techniques. Some of the most notable patient benefits of minimally invasive robotic surgery include fewer complications, reduced likelihood of infection, less overall pain and blood loss, smaller incisions, less noticeable scaring, and quicker recovery.

Mako Surgical, a Stryker company, launched the Mako SmartRobotics platform (left) in 2017. This device combines 3-D imaging, AccuStop haptic technology, and insightful data analytics into a portable platform to improve patient outcomes for total knee, total hip, and partial knee replacements. In January 2021, Stryker announced the acquisition of OrthoSensor and its VERASENSE Sensor-Assisted Total Knee Arthroplasty technology (center and right), which enables surgeons to quantify ligament balance and customize knee implant position using a disposable wireless smart device.

When market-leader Intuitive Surgical introduced its da Vinci robotic surgical system more than 20 years ago, it was initially used for cardiology, urology, and gynecology procedures. Since then, robotic-assisted surgical procedures have expanded to include general surgeries, gallbladder removals, hernia repairs, orthopedic hip and knee replacements, spinal surgeries, laparoscopic and endoscopic visualization procedures, lung cancer treatments, and more.

In 2020, TransEnterix obtained FDA 510k clearance for its Senhance digital robotic surgery system, which is challenging the market-leading Intuitive da Vinci surgical system with features including haptic force feedback that heightens surgeons’ sense of pressure and tension, an eye-tracking camera that senses surgeons’ eye activity for greater camera control, and high-definition 3-D visualization for intelligent depth perception and enhanced visual recognition.

Many market-leading companies are making significant investments in surgical robotics, including Abbott, Becton Dickinson/BARD, Boston Scientific, CMR Surgical, Curexo Technologies, Hanson Medical, Intuitive Surgical, Johnson & Johnson, Medrobotics, Medtronic, Qiagen N.V., Siemens/Corindus, Stryker, Tecan Group, THINK Surgical/Robodoc, Titan Medical, and TransEnterix.

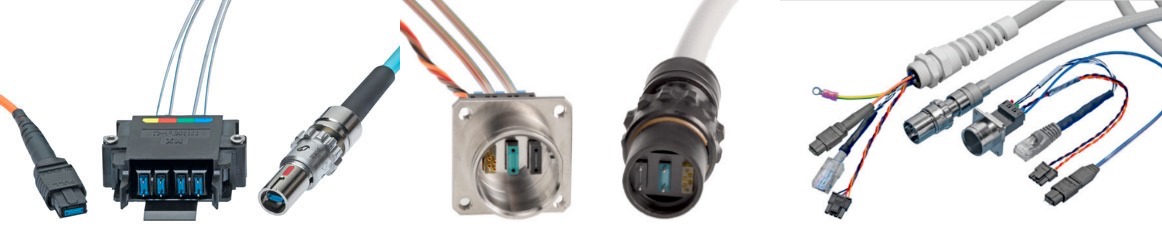

Hybrid and modular interconnect solutions that have the ability to combine signal, power, fiber, and other mediums are widely preferred by designers of surgical robotic systems. User-friendly mating and the ability to withstand rigorous cleaning, disinfection, and sterilization is the norm for interconnect solutions used in surgical and other medical equipment.

Enabling Connectivity Components

Caton’s QL Series quick-locking, modular connectors and cable assemblies support hybrid contact layouts, including power, signal, pneumatic, fluidic, and fiber optic contacts, and have an automatic locking mechanism that that provides positive confirmation of connector engagement. They are used in a variety of industry-standard therapeutic and surgical applications and can also be customized to address more unique medical device designs.

Intuitive Surgical acquired Schölly, a leading global manufacturer of optical visualization systems, in 2019. Based in Germany, Schölly is the world’s leading OEM for 3-D endoscopes and endoscope systems, as well as a vertically integrated manufacturer of technologies including 3-D HD and micro borescopes, microlenses and lens assemblies, 2-D and 3-D chip-in-tip systems, fiberscopes, micromechanics, multi-optical systems, videoscopes, probes, LED light sources, fiber optic cable, ruggedized and ergonomic product housings, custom visualization solutions, and even specialized video processing algorithms.

In December 2020, Molex acquired optical fiber solutions company Fiberguide Industries. Fiberguide will merge with Molex’s Polymicro business. Combined, the two will serve the unique optical requirements of medical applications, including high-power laser surgery, DNA sequencing, and flow cytometry with optical fibers, optical interconnects, analytical probes, and assemblies to support minimally invasive medical procedures.

Molex’s VersaBeam MT Interconnects (left) provide high-density optical connectivity solutions ideal for use in robotic surgery systems. Designed for high reliability and ease of use, the series employs recessed micro lenses and a controlled gap to prevent contact between mating interfaces and ensure repeatable optical performance after even thousands of mating cycles. Molex’s MediSpec Hybrid Circular MT Cable Assemblies and Receptacles (center and right) provide high-performance, mixed optical and electrical signaling to streamline the number of connectors required in medical systems. The series offers EMI-shielded metal and lightweight medical-grade polymer connector housings, an optical MT ferrule equipped with up to 24 fibers, and two to eight copper electrical contacts.

Amphenol LTW metal push-pull connectors, which are intermateable with push-pull connector series from Fischer Connectors, LEMO, and ODU. These connectors offer reliable power, signal, and data connectivity for reusable medical equipment, including robotic and electrosurgical systems and video endoscopy.

LEMO B Series circular, metal, push-pull connectors are modular, ergonomic, durable, and reliable and ideal for use in demanding medical applications including surgical and endoscopy equipment. The modular inserts offer a wide range of high-density multi-pole and hybrid electrical contacts and can be vertically integrated into complete medical cable assemblies.

Forecast

The surgical robotics market was $6.7 billion in 2019 and is expected to exceed $13.5 billion by 2025. This rapid acceleration of new technologies will increase safety and effectiveness in the surgical suite and give providers new tools to deliver better outcomes.

Wayne Shockloss is the author of the Bishop & Associates 2020 Medical Interconnect Solutions report, which provides an in-depth review of the political, economic, sociocultural, technological, environmental, and legal (PESTEL) factors that impact healthcare, medical device providers, and medical interconnect solution suppliers.

Wayne Shockloss is the author of the Bishop & Associates 2020 Medical Interconnect Solutions report, which provides an in-depth review of the political, economic, sociocultural, technological, environmental, and legal (PESTEL) factors that impact healthcare, medical device providers, and medical interconnect solution suppliers.

Shockloss is also author of Top 50 Medical Interconnect Solutions Companies. This 2020 report provides company profiles and summarizes the products, technologies, capabilities, and unique value propositions that each of the top 50 offers the medical market. Tables detail sales, worldwide rankings, and five-year medical market forecast by subsector, as well as updated medical market expectation narratives, including the COVID-19 impacts on the medical connector market.