Strategic Acquisitions Continued in the Connector Industry in 2019

Connector-adjacent technologies were the key focus of many 2019 acquisitions as companies expanded to a whole-ecosystem approach.

Once again, Amphenol led the industry in acquisitions, completing more acquisitions than any other company in the connector, cable, or cable assembly field in 2019. Amphenol has acquired more than 60 companies in the last decade. In fact, in the last five years, Amphenol has spent 9% of sales on acquisitions. According to Adam Norwitt, president and chief executive officer, Amphenol “look(s) for acquisitions that have great people, great products, and great position, all of which help you to build a platform for that company to perform better as part of Amphenol.”

SSI Technologies, an Amphenol Company

The nine companies Amphenol acquired in 2019 collectively achieved annualized revenues of approximately $350 million in 2019. Amphenol began with the January acquisition of SSI Control Technologies, the sensor manufacturing division of SSI Technologies, Inc. SSI Control Technologies is a leading designer and manufacturer of sensors and sensing solutions for the global automotive and industrial markets, with annual sales of approximately $180 million. Based in Janesville, Wisconsin, SSI operates manufacturing facilities in the US and Czech Republic. The acquisition cost Amphenol approximately $400 million plus a performance-related contingent payment.

Charles Industries, a leading manufacturer of integrated environmental housings and enclosures for wireless, telecom, and broadband service providers based in Schaumburg, Illinois, joined Amphenol’s RF, Optics, and Broadband Group in April. That same month, Amphenol ICC acquired Huizhou, China-based Aorora Technology Co., Ltd. A leading supplier to the consumer and automotive markets, Aorora focuses on fine-pitch FFC/FPC connectors, floating board-to-board, and micro board-to-board connectors.

CONEC’s compact M12x1 PCB socket connectors enable easy in-field assembly and provide both secure data transmission and high-current power transmission in space-constrained, harsh-environment industrial applications.

In June, Amphenol acquired CONEC Elektronische Bauelemente GmbH, a German manufacturer that focuses on interconnects for the industrial market, and Kopek Industries, a China-based supplier of RF passive interconnect components for the broadband market. In July, the company acquired Bernd Richter GmbH, a German manufacturer of high-technology cable assemblies for the medical industry and GJM Group, a Spain-based company of interconnect assemblies for the automotive market.

During the third quarter of 2019, Amphenol acquired UK-based Cablescan, a manufacturer and developer of high-performance cable assemblies and control panels, for the aerospace, defense, and commercial sectors, and China-based XGiga Communication Technology, a designer and manufacturer of active fiber optic interconnect components used primarily in communications infrastructure markets.

TE Connectivity took second place in number of acquisitions in 2019, with four acquisitions. According to John Mitchell, senior vice president and general manager of TE sensors business, the company’s first acquisition of 2019 expanded its leadership position in sensor applications. “The acquisition of Alpha Technics is part of our well-established strategy to expand our leadership position in sensor applications,” he said. “This transaction further establishes TE as a sensor technology leader for the medical market.” Now part of TE’s Transportation Solutions segment, Alpha Technics was a privately held company with annualized sales of approximately $20 million.

The May 2019 acquisition of Alpha was followed by the June acquisition of the Kissling Group. Headquartered in Wildberg, Germany, Kissling is an industry-leading provider of high-power and high-voltage relays and ruggedized switches for the commercial transportation, industrial, military, and aviation industries, as well as other applications.

Silicon Microstructures’ IntraSense biocompatible 1-French pressure sensors with pre-attached wiring and encapsulation won the Innovative Product of the Year Award at Sensors Expo 2019

TE Connectivity’s final two acquisitions of 2019 focused on expanding the company’s presence in the sensor market, particularly in medical, transportation, and industrial applications. In September, Measurement Specialties Inc., a subsidiary of TE Connectivity Ltd., acquired Silicon Microstructures Inc. (SMI), from Elmos Semiconductor AG. SMI is a developer and manufacturer of MEMS-based pressure sensors offering unique solutions for pressure and flow sensing and both the lowest pressure and smallest pressure sensors available today. The company empowers invasive medical devices with ultra-small sensors for in vivo pressure measurement.

Following the acquisition of SMI, TE undertook a voluntary public takeover offer for all shares of First Sensor AG, a provider of sensing solutions based in Germany. Listed on the Frankfurt Stock Exchange, First Sensor is a global player in sensor technology that develops and produces standard products and customer-specific solutions for the ever-increasing number of applications in the industrial, medical, and mobility target markets. According to TE, “Completion of the offer will be subject to customary closing conditions, including regulatory approvals, and the offer will not be subject to reaching a minimum acceptance threshold. TE expects to complete this acquisition by mid-2020 at the latest.”

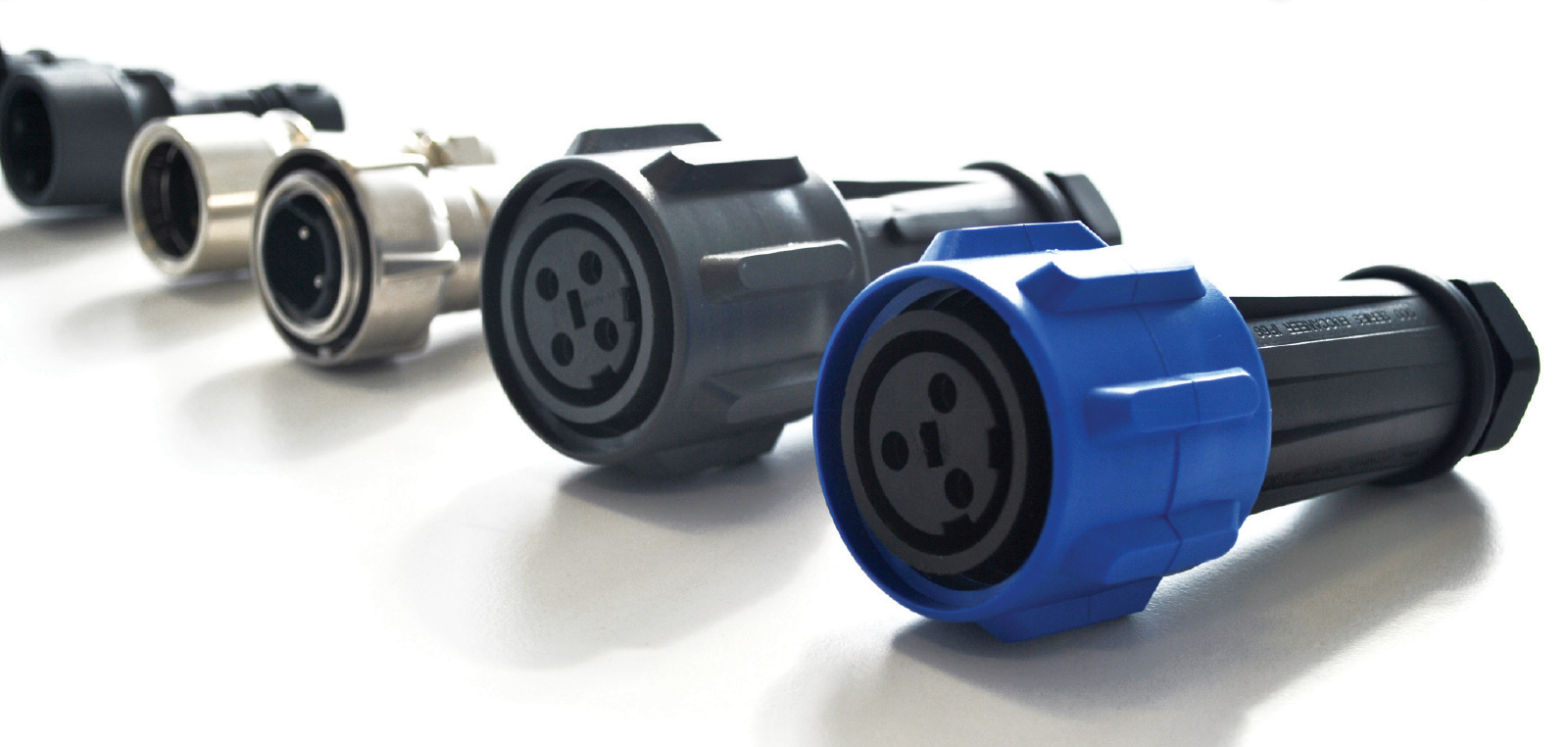

SOURIAU’s UTG Series metal and plastic connectors are engineered for use in heavy-duty applications including industrial robotics, rail transportation systems, and fiber-to-the-home and fiber-to-the-antenna (FTTH and FTTA) architectures.

Probably the largest acquisition of 2019 involved two separate, but very “connected” acquisitions. In March of 2019, TransDigm Group acquired Esterline Technologies Corporation for approximately $4.0 billion in total consideration, including the assumption of debt. Esterline is a supplier of products to the global aerospace and defense industry, including interconnect solutions marketed under SOURIAU and Sunbank. Following the July acquisition, Eaton announced a commitment to acquire the SOURIAU-SUNBANK Connection Technologies business of TransDigm Group for $920 million, which represents a trailing 12-month EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple of approximately 12x. With a workforce of approximately 3,200 people, SOURIAU-SUNBANK is a global leader in highly engineered electrical, electronic, and fiber optic interconnect solutions for applications in the aerospace, defense, industrial, and transportation markets. The company, which is headquartered in France, has manufacturing facilities in France, the Dominican Republic, India, Morocco, Mexico, and the United States.

Phoenix Contact Group took over both SKS Kontakttechnik GmbH and Pulsotronic GmbH & Co KG in January of 2019. Based in Niederdorf, Germany, SKS Kontakttechnik offers electrical engineering components and systems, while Pulsotronic manufactures sensor solutions. In March, RF Industries acquired C Enterprises. In May, Belden Brand PPC acquired OPTERNA, a provider of innovative, scalable fiber solutions.

Carlisle Interconnect Technologies announced its acquisition of MicroConnex, a privately held manufacturer of highly engineered microminiature flex circuits for the medical and test and measurement markets, in May. Carlisle also acquired Providien, a global supplier of solutions to the medical industry, in November.

Bulgin’s Buccaneer range of ruggedized power and data connectors for harsh environments.

In July, private equity investor, Equistone Partners Europe purchased the majority stake in Bulgin from parent company Elektron Technology. Winchester Electronics, a subsidiary of Aptiv, acquired Falmat Inc., a worldwide leader in the engineering and manufacturing of high-performance, mission-critical custom cable solutions.

In August, Radiall strengthened its technology portfolio and enhanced its selection of power interconnect solutions with the acquisition of Solyneo’s assets. Solyneo, a French startup company based in France, specializes in producing prototypes of highly efficient and reliable free-space power transmissions for demanding environments. In December, FDH, a portfolio company of Audax Private Equity, acquired BTC Electronic Components, a distributor of high-performance connectors and accessories.

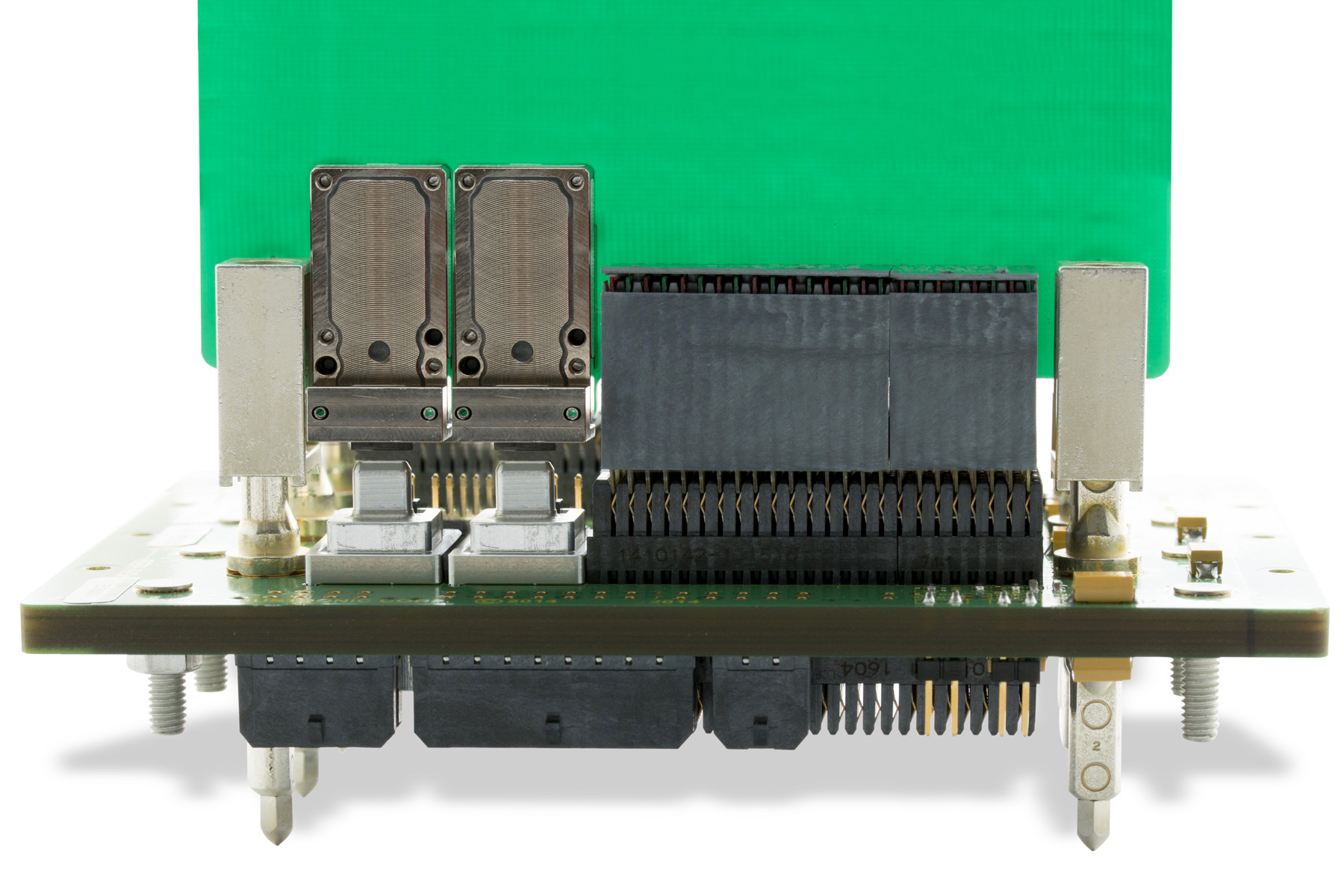

Reflex Photonics’ LightCONEX Active Optical Blind-Mate Interconnects

Finishing out Bishop’s list of 31 acquisitions in 2019: Sager Electronics’ acquisition of Technical Power Systems in July, TPC Wire and Cable’s acquisition of EZ Form Cable in June and Cicoil LLC in September, Samtec’s acquisition of Precision Connector in October, Smiths Interconnect’s acquisition of Reflex Photonics in November, Volex’s acquisition of GTK Ltd., Beijer Tech’s acquisition of Encitech in March, and Avnet’s acquisition of French software company Witekio in December.

To see how 2019 connector industry acquisitions compared to the previous year, revisit our 2018 acquisitions roundup.

Like this article? Check out our other Industry News and Industry Facts and Figures articles and our 2019 Article Archive.

- Wire & cable cutting services - March 3, 2024

- Belden – REVConnect RJ45 Connectors | First Look - March 3, 2024

- Molex, LLC – 5G25 Series 5G mmWave RF Flex -to-Board Connectors | First Look - March 3, 2024