Facts & Figures: First Half 2015 Connector Industry Performance

In the first half of 2015, the connector industry is down almost 5% in US dollars, yet up in foreign currencies. Why?

The connector industry contracted -4.6% in the first six months of 2015 when measured in US dollars. After the strong performance in 2014, it is reasonable to believe that year-over-year growth would be harder to achieve in 2015, but that is a small part of this result. The main culprit for this contraction is exchange rates of the weaker euro and yen, in particular, when compared to the US dollar.

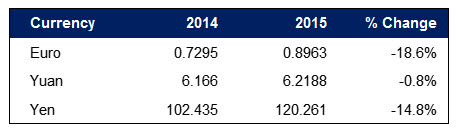

The following table measures the decline of these currencies for the first six months of 2015 versus the same period in 2014.

One Local Currency to One US Dollar

YTD June 2015 versus YTD June 2014

Europe, China, and Japan account for 60% of world connector sales. As a result, currency fluctuation to the US dollar is having a significant impact on our reporting of sales performance in US dollars.

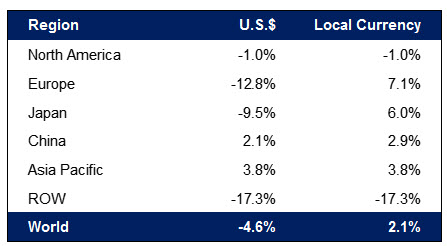

The following table shows year-to-date June sales performance by region in US dollars and local currencies.

Industry Sales Performance

YTD June 2015

US Dollar versus Local Currencies

As seen in the table, European sales have declined -12.8% when measured in US dollars, but have grown +7.1% when measured in euros. Japan’s contraction of -9.5% when measured in US dollars becomes +6.0% when measured in yen.

These currencies have both weakened in comparison to the US dollar for different reasons. The euro decline has been precipitated by the European Central Bank’s quantitative easing program, looming rate hikes by the US Federal Reserve, record low interest rates in Europe, and the Greece crisis adding volatility to the euro. The yen decline has been engineered by the Japanese through monetary easing which drives up inflation and weakens the currency. The weaker currency makes Japanese exports cheaper (driving growth) and should stimulate wage growth.

By far, this has not been a good year for connector industry growth. Weakness in the North American and Chinese markets is troubling as these are bellwether markets for the world economy.

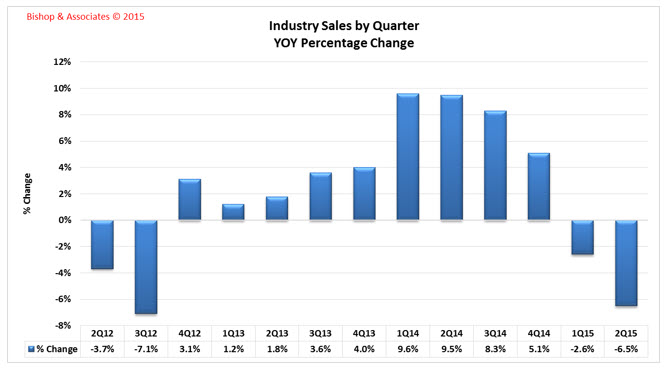

The following graph shows the quarterly connector industry performance for the last 13 quarters.

Bishop is forecasting that in 3Q15, the connector market will contract -4.5% year over year and that 4Q15 will result in modest growth of +1.1% over prior year. For the year, we see a small contraction of -3.2% measured in US dollars.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019