Connector Distributors are Feeling Price Pressure

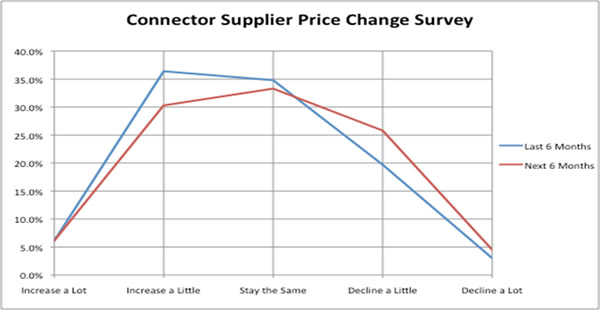

The connector industry is experiencing its highest level of downside price pressure since the 2008-09 recession. As shown in the chart below, 36.4% of industry respondents believe prices have increased a little bit in the past six months. Only 30.3%, however, believe that they will see a similar trend in the next six months. Conversely, 19.7% have seen a slight decrease in the past six months, but 25.8% expect to see a small decrease going forward. In total, 30.3% of those responding believe that prices will decrease to some degree in the next six months.

Weak sales have certainly exerted downside pressure on prices. Another significant factor, however, is the stabilization and actual decrease in the prices of some raw materials used in the manufacture of connectors. The two largest of these are oil-based resins and precious metals. Both have decreased by more than 10% in the last six months. The costs of goods sold (COGS) by manufacturers have more than offset the market-generated pricing pressure, and supplier margins have actually increased slightly.

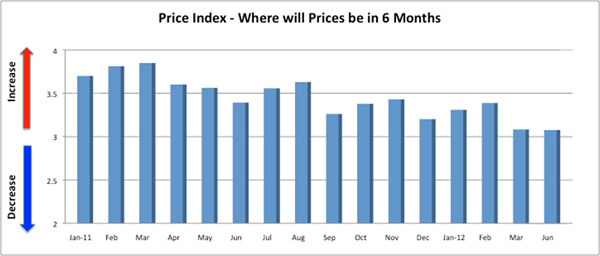

Bishop & Associates also tracks the Connector Industry Price Index, in which industry personnel indicate their opinion of where prices are today and where they will be in six months. A score of 3 or higher indicates that prices are increasing, while anything less than 3 means prices are decreasing. Once again, the outlook stays in the slightly positive range at 3.1%, but it has trended lower since August 2011 and is now considerably lower than its high of 3.9 in March of that year.

The industry is clearly concerned about future price trends and is moving quickly toward a negative outlook. What, then, is happening to pricing in distribution? And just as important, what effect is the price trend having on distributor margins?

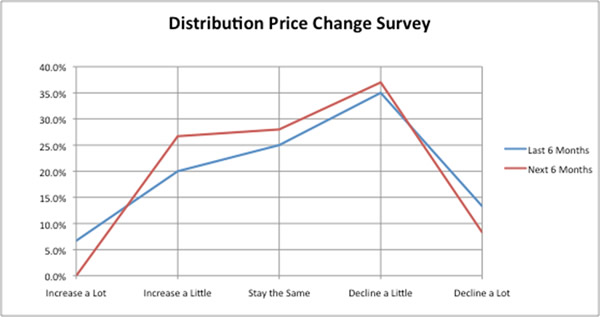

Unlike the direct sales channels ― where, in spite of a negative trend, the consensus of opinion is that prices are relatively stable ― the outlook in distribution is decidedly more negative.

While 42.5% of suppliers and direct customers indicated that they have seen prices increase during the past six months, only 26.7% of distributors agreed. Going forward, the number of distributors anticipating a price increase is also 10 percentage points below the rest of the industry.

On the downside, 48.3% of distributors indicate that they have seen prices decrease somewhat in the past six months, and 45.3% expect this trend to continue. While only 20.7% of suppliers and direct customers have seen decreases in the past six months, the trend going forward matches that seen in distribution, with 30.3% of these responders looking for some sort of decrease.

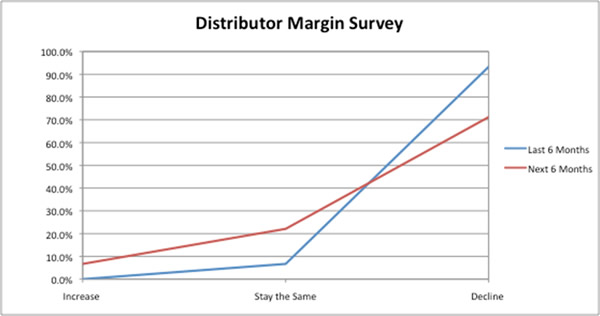

The disparity of the pricing survey results is partially explained by looking at the results from a similar survey focused on distributor margins.

93.3% of distributor respondents indicated that margins had declined during the past six months. None felt that margins had increased. Going forward, an optimistic 7% see margins increasing, but an overwhelming majority of 71.2% believes that margin levels will continue to worsen.

According to several distributor sources, competition is the primary cause for the decrease in both prices and margins. Distribution industry sales fell 5.5% in 1Q2011 versus the same period last year and 7.4% consecutively from 4Q2011. Most distributors reported positive book-to-bill results in that quarter, but soft bookings in April and May reversed that trend. All in all, the business climate is not that good, and as in most downturns, price competition heats up and the cannibalization of each other’s margins begins.

The transfer of direct business into the distribution channel, typically referred to as TAM to DTAM, is also driving down both prices and margins. Several large connector suppliers, such as TE, have implemented programs to move significant amounts of previously direct sales into the distribution channel. Doing so allows the supplier to utilize the superior logistics and supply-chain tools provided by distributors. It also shifts the responsibility for inventory support and accounts receivable to the distributor. The obvious upside for the distributor is an increase in sales volume. The obvious downside is the extra costs incurred. The perhaps not-so-obvious impact is the effect on both prices and margins.

Suppliers benefit from the transfer of costs to distributors. Distributors benefit from an increase in business. End customers can benefit from the superior level of service provided by distributors. The customers, however, are rarely, if ever, willing to pay for the improved service. So where does the distributor margin come from? Typically, suppliers offer a small initial discount to the distributors and then allow them to negotiate directly with the customers in future years. The discount rarely provides margins commensurate with legacy distribution business. And it usually takes several years of negotiation to boost the margin to an acceptable level.

On a positive note, for the same reasons cited above (weaker sales and reduced costs for raw materials), connector suppliers have not raised the distributors’ book costs, so there has been no pressure on margins for ongoing business.

As the TAM to DTAM programs ― which, as explained above, do also have an upside in increased sales for the distributors ― are completed, their impact on prices and margins will diminish. Only time will tell how what effect the uncertainty in direct pricing will have on distribution, but the impact of any decreases is greatest at the large direct customers, and will not affect distributors prices or margins to a great degree.

The negative impact of competition-based price-cutting will, however, continue until the distributors decide to discipline themselves. Not every distributor is equally guilty, but all suffer to varying degrees. Once again, the words of the comic strip character Pogo apply: Distributors can only look at themselves and lament, “We have met the enemy and he is us!”

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.