Ethernet Networks Progress to 400 Gb/s

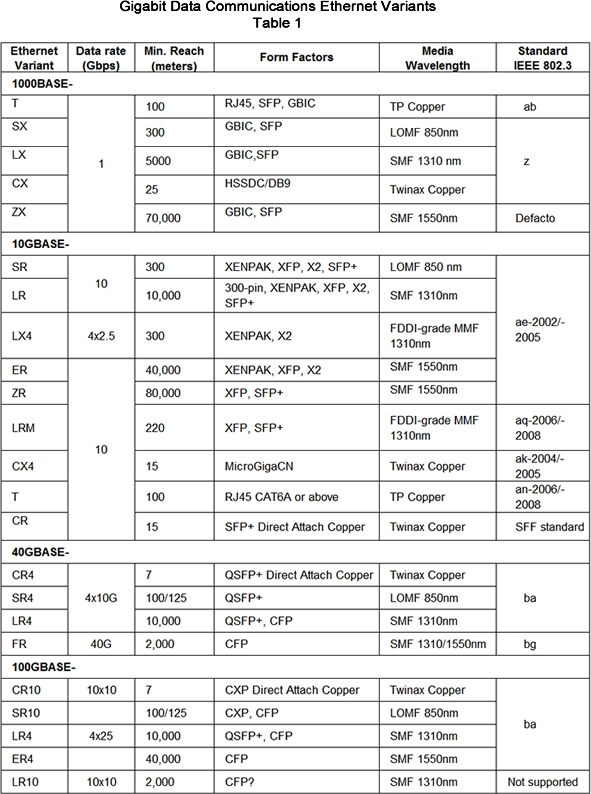

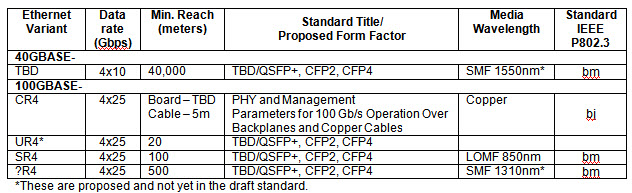

Ethernet Networks Progress to 400 Gb/sEthernet’s success has been unmatched in the networking industry. While telecom networks have progressed through TDM, SONET/SDH, DWDM, and Carrier Ethernet, local area networks continue to thrive just with faster data rates of Ethernet. And Ethernet has already started to overtake SONET/SDH in the public networks as well. This article explains the variants of Ethernet and its connectivity solutions. The Ethernet StandardTypically, towards the end of the development of one data rate of Ethernet, its champions start to confer about the next generation. The motivator here is that as Generation N Ethernet begins to be deployed in some quantity, there is an immediate need in some parts of the network for generation N+1 Ethernet to aggregate it. With this in mind, we note that before 40/100G has really become a successful commercial product, 400G and Terabit Ethernet are being debated. The process for standardizing the next Ethernet is the responsibility of the IEEE’s 802.3 Working Group. Specifically, 40G and 100G were standardized through the IEEE 802.3ba Higher Speed Ethernet Task Group (HSTG). The standard was published in June of 2010. Follow-on projects quickly materialized and the resultant variants are summarized in the table below, along with all the other Gigabit datacom variants.

There are several observations that can be seen by looking at the Ethernet variants in this fashion:

|

Product Gallery |

- Parallel optics and wave division multiplexing (WDM) are used for 40/100G Ethernet.

- For 40/100G, the IEEE did not want to make the mistake of allowing too many variants and form factors again, so it consciously limited them. But in our opinion, they may have restricted them too much. By reducing the LOMF optical reach to 100m over OM3 and 125m for OM4, the IEEE left a huge gap in distance covered for data center applications — in fact, a two orders of magnitude gap — from 100m to 10,000m. This results in an enormous difference in cost as well. For example, a 40GBASE-SR4 QSFP+ module cost is about $600, while the 40GBASE-LR4 costs about $4,000. So it is cost-prohibitive to design a data center with connections longer than 100m. This is not realistic. In order to address this shortcoming, the top transceiver manufacturers are working on SR4 products that have the potential to reach to 300m. The IEEE 40 Gb/s and 100 Gb/s Fiber Optic Task Force is exploring lower-cost solutions to cover reaches perhaps up to one kilometer for both data rates.

- There is no 40G twisted pair variant yet, but that does not mean it will not materialize. Both Gigabit and 10-Gigabit TP standards were done after the initial short-reach copper and fiber ones were done. And, late in 2012, the IEEE established the NGBASE-T study group to gauge interest and develop criteria for a possible TP variant.

- Any 100G variant using 25G signaling is still under development. While the optical devices are almost ready to go, there are long-term projects to ascertain how 25G is going to run on a printed-circuit board or on twinax cable. The IEEE P802.3bj 100 Gb/s Backplane and Copper Cable Task Force is working on this. However, there are pre-standard products available. There are chip sets available to run 25G signals over PCBs that will be available in the coming months. Texas Instruments was demonstrating this at SC11 and Altera, Amphenol, Semtech/Gennum, IBM, Inphi, TE Connectivity, and Xilinx showed 25G products in the OIF booth at OFC/NFOEC 2012.

- Notice in the table above that there are different signaling schemes and form factors between 100GBASE-CR10, SR10, and 100GBASE-LR4. The CXP that was chosen for short-reach copper and LOMF is not suitable for longer-reach SMF operation. Even though most of them were involved in the IEEE process, equipment manufacturers are not happy about this because that means their products must support two different form factors at the same time. It may doom CXP to only the initial products until another, more suitable form factor can be developed that will cover both cost effectively — maybe a CFP2 or CFP4? Or 25G signaling matures and the SR4 and CR4 variants created in the QSFP28 (now being worked on in the SFF committee) are used?

- The LR10 variant is not standardized, but a consortium of vendors and end users that includes Google and Facebook backs it. Whether this will take hold in the industry at large remains to be seen, but some industry leaders are boasting that it is actually selling very well, with over 10,000 units already shipped. And, since it is substantially less expensive (currently by an order of magnitude) than the LR4 variant, it may really take hold instead of LR4, especially for data center and LAN applications.

The following table summarizes the current relevant projects in the IEEE 802.3 Working Group.

So, while we talk about Terabit Ethernet being on the horizon and there have been multi-vendor demonstrations of 25G signaling for 100G-operation, plenty of work remains to be done in order to bring 100G to fruition prior to the next speed bump.

Ethernet Connectivity Products

Throughout its history, Ethernet has been serviced by a number of connectivity products, but for Gigabit Ethernet and above, there are really two types that have been widely adopted:

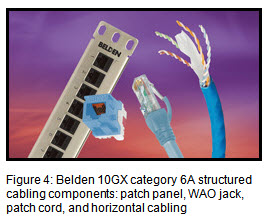

- Structured Cabling: governed by a set of TIA standards starting with TIA-568. This includes standardized products such as the RJ45, patch panels, patch cords, horizontal cabling (both copper and fiber), and some pre-terminated cable assemblies.

- Interconnect: can be proprietary, but typically governed by SFF standards. Includes products like SFP+ Direct-attach copper (DAC), direct-connect LC fiber cable assemblies and pre-terminated fiber assemblies.

Before 10G systems were defined, the vast majority of Ethernet connections were variations of structured cabling components. At higher data rates (i.e. 10G), there is a more equal mix, because the Ethernet “BASE-T” technology just seems to take much longer to develop than its interconnect rivals.

Ethernet Connectivity Vendors

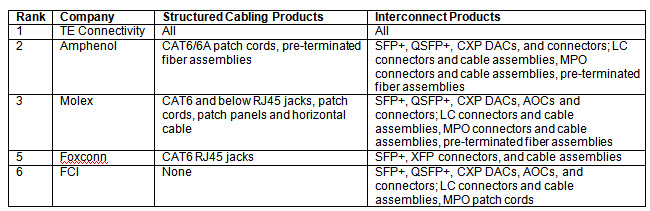

Five of Bishop’s top six connector suppliers (worldwide by revenue) offer some type of Ethernet product. A summary of their wares is shown below.

The Market for Ethernet Products

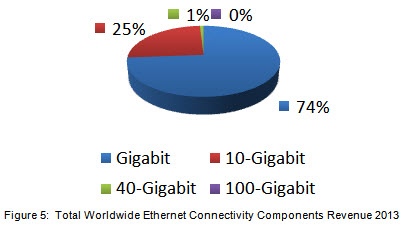

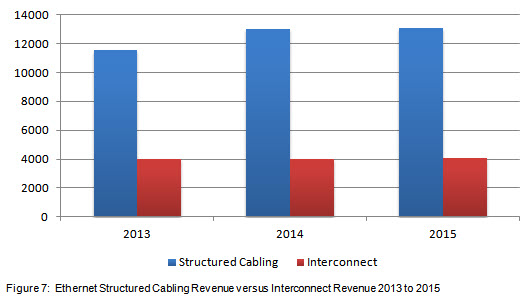

Because Ethernet is used for virtually every local area network (LAN) in the world, the market for connectivity products used in Ethernet networks is substantial — almost $16 billion in 2013. Below are some figures detailing the market.

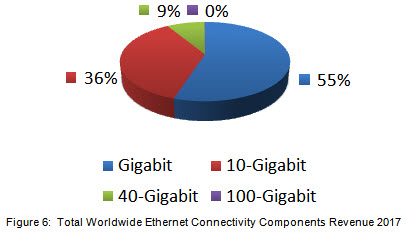

Over the next five years, 10-Gigabit components will grow from 25% to 36% of the total Ethernet market, which will in turn drive the growth of 40G.

As mentioned above, structured cabling components far outpace interconnect products in the market, and this is not expected to change very much over the next few years. Interconnect products remain flat, while structured cabling systems are expected to grow, particularly for 10-Gigabit applications.

More detailed forecasts can be found in two recent Bishop & Associates market research reports: “Multi-Gigabit Datacom Network Connectors and Cable Assemblies” and “Structured Cabling and Connectivity Market.”