In Comparison: The 2012 Downturn Has Been Mild

The 2012 Downturn

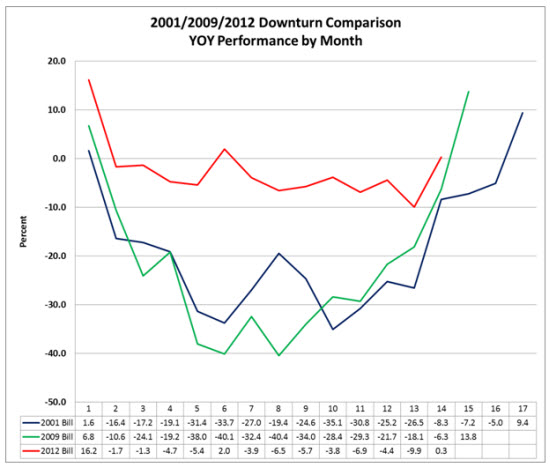

What are the comparisons between the downturns of 2001/2002, 2008/2009, and 2011/2012? The following chart compares the monthly year-over-year performance of the billings for each period.

What do these numbers illustrate?

The length of the downturns has varied slightly, but they all lasted just over one year. 2001/02 was the longest, with a duration of 15 months; 2008/09 lasted 13 months; and 2011/12 lasted 12 months. For this comparison, the downturn ends when there are at least two consecutive months of positive YOY billings performance.

The severity of the downturns has also varied. The 2008/09 downturn was the most severe, with YOY declines between -18% to -40% for nine consecutive months. The 2001/02 downturn was not as severe but was longer in duration. During that downturn, there were 12 consecutive months where YOY performance declines were between -19% and -35%.

The 2011/12 downturn, by comparison, has been very mild. Over the 12-month duration, the YOY declines were predominantly between -1% to -7%, with one month at -9.9%. The loss in total industry market value was only approximately $1.2 billion. By comparison, the loss in 2009 was $9.6 billion and in 2001/02 losses reached $9.4 billion.

In the three industry declines prior to 2001, the years of growth in between the downturns were four, six, and eight years. There were 75 months (6.3 years) between the end of the 2001/02 downturn to the beginning of the 2008/09 downturn, but just 23 months (1.9 years) from the end of the 2008/09 downturn to the beginning of the 2011/12 downturn. The decreasing cycle rate may be the result of the increasing inter-dependencies of the world’s economies and our 24/7 processing of news of all types.

In the 2001/02 downturn, the YOY booking decline preceded the billing downturn by two months. In 2008/09, the booking YOY decline started one month prior to the billing decline. In 2011/12, they started simultaneously. This again may be from increasing inter-dependencies and quick processing of the events as they unfolded.

Although nothing is certain, it is likely that the next downturn is three or more years down the road, given no unforeseen major calamities. The economies of the world and their governments have gone (and are going) through a correction, which should lead to relatively stable times where the growth rates will, in all likelihood, be more modest than they have been after past industry downturns.

Industry Profitability During Downturns

A number of factors influence the profitability of individual companies and the overall connector industry. Certainly, management decisions regarding spending and cost control will contribute to improved results, or at least mitigate losses during bad economic conditions. Other management-controlled, profit-influencing decisions are manufacturing footprint, marketing, sales, product innovation, customer service, etc.

The three largest contributors to income statements, however — global economic health, price erosion, and commodity prices — are not controlled by management. Company leadership can only react in an attempt to reduce the downturn in company profits.

A good example of this is the 2008/09 downturn, which was caused by the housing bubble and the ensuing financial crisis.

Industry Profitability by Quarter

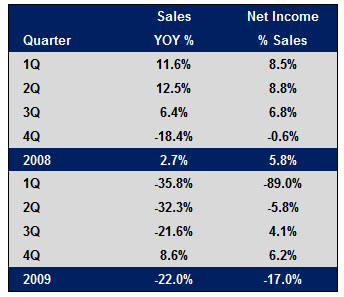

2008 & 2009

The downturn started in 4Q08 and industry profits plummeted for the next three quarters until management adjusted capacity to more closely match demand. As sales improved in 4Q09, profitability returned modestly and then soared in 2010 to a net income of 9.5% of sales on a year-over-year increase of 28.4% in sales.

The 2008/09 downturn had the three profitability killers working against the industry: plummeting demand, high raw material cost, and price erosion.

The current downturn started in October 2011 and continued through September 2012, for 12 months. October and November saw year-over-year increases in sales, hopefully signaling the end of the downturn cycle.

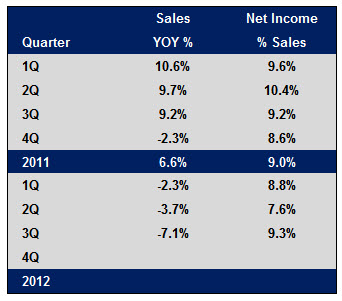

As you will note in the next table, profitability has remained strong. First, this is because the sales decline has been modest compared to 2008/09. Second, connector prices have been stable. Third, raw material prices have remained flat.

Industry Profitability by Quarter

2011 & 2012

To date, this downturn has only caused single-digit declines in sales, requiring management to make only modest adjustments to cost structures. These adjustments were easy compared to the decisions required in the last downturn, which included plant closings and massive layoffs.

We are hopeful that this downturn ended in September after 12 months of year-over-year declines in sales and that the fourth quarter of 2012 will show growth of 3.5%.

Connector Industry Forecast

2012 Projection

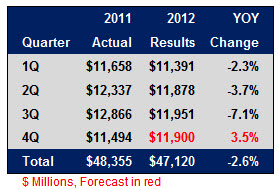

We currently project industry sales to end the year at $47.1 million for a year-over-year change of -2.6%. This result is unchanged from last month. We expect fourth quarter sales to be essentially flat to the third quarter. Although fourth quarter sales are historically the highest of the year, we do not believe 4Q12 will beat the higher than expected 3Q12 sales, due to the general economic softness worldwide.

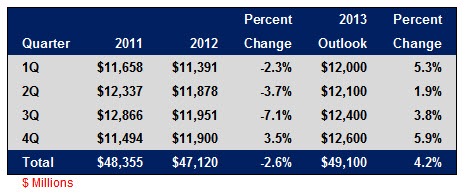

The following table depicts the projected quarterly results for the last quarter of the year.

Connector Industry Quarterly Sales

2013 Forecast

Given the stated finish to 2012, Bishop currently projects 2013 will see growth of 4.2% to $49.1 million, with each quarter seeing slight sequential increases. This forecast is unchanged from last month. The following tables show the projected quarterly sales for 2013.

Connector Industry Quarterly Sales

This forecast assumes the following:

- The European economies begin to stabilize and modest growth is achieved in their GDPs.

- The United States avoids a political stalemate on the budget to escape triggering the automatic budget cuts/tax increases and modest growth is achieved in the GDP.

- With improving economic conditions in the Western economies, China will see their GDP growth stabilize and begin to improve modestly.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to subscribe to the ConnectorIndustry Forecast, go to connectorindustry.com and select “Research Reports.” You may also contact us at [email protected], or by calling 630.443.2702.

- Is the Gold Rush Over for China Connector Sales? - October 17, 2023

- The Top Five European Connector Suppliers for Product Quality and Price Competitiveness - October 10, 2023

- 2023 Top Five European Connector Suppliers - September 26, 2023