Is the Gold Rush Over for China Connector Sales?

Bishop & Associates has been tracking the connector industry since 1980 by product type, by end-use market sector, and by major geographic region. When we initially starting reporting on the industry, China’s connector sales were so insignificant we included China’s numbers as part of the Asia Pacific region.

Bishop & Associates began reporting China connector sales as a separate region in 1994 as we began to see the potential of this huge untapped market. In 1994 China’s connector sales were only $38 million, or just 0.19% of a $20.2 billion global connector market.

Then European and North American based companies started investing billions to move manufacturing to China. The objectives were twofold, to capitalize on cheap labor, allowing manufacturers to lower prices to consumers in the West and to capture more of the growing consumer market in China.

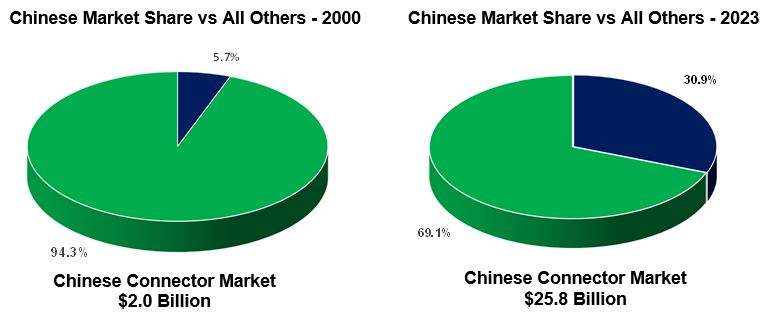

From a meager $38 million in connector sales in 1994, by the year 2000 China connector sales accounted for $2.0 billion annually or 5.7% of the total connector market and was still growing.

Since 2000, China has been the growth engine for the connector industry and the overall electronics industry. As noted, China accounted only for 5.7% of the global connector market in 2000. By 2023 China accounted for 30.9% of the global connector market.

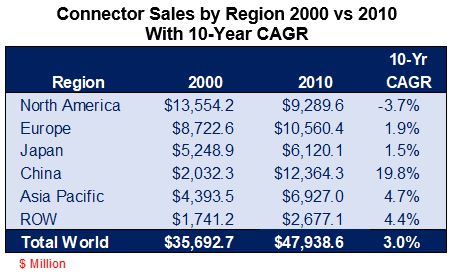

China has outperformed all other regions since the beginning of the 21st century. This is clearly shown in the table below.

China Connector Sales by Region 2000 vs 2010

During the 2000 to 2010 period China achieved growth of 19.8% versus industry growth of 3.0%. This is in sharp contrast to the other regions which were negative or exhibiting low single-digit growth. Clearly China was the source of sales growth for the connector industry.

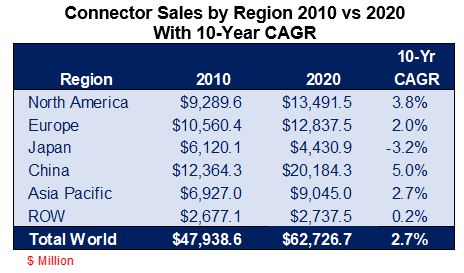

During the next decade, 2010 to 2020, China, still outperformed the other regions in sales growth but the slowdown was dramatic. China went from a 19.8% CAGR to 5.0% CAGR.

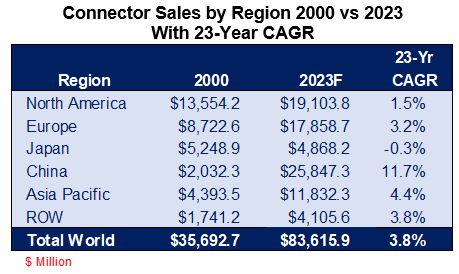

China Connector Sales by Region 2000 vs 2023

When analyzing connector sales by region over the past 23 years (2000 through 2023), it is obvious that China has been the growth engine in the 21st century. China’s CAGR is 11.7% compared to the industry CAGR of 3.8%.

Analysis of connector sales by region over various timelines results in several conclusions.

- The transfer of manufacturing from West to East occurred mainly in the first decade of the 21st century with China achieving connector growth of 19.8% while the total industry only achieved 3.0% growth.

- The flow of Western capital to China slowed significantly during the second decade of the century. China’s growth more closely resembled overall industry growth.

- The transfer of wealth from West to East has slowed appreciably in recent years. Thus we conclude that the gold rush from West to East is over, or at a minimum, has slowed dramatically.

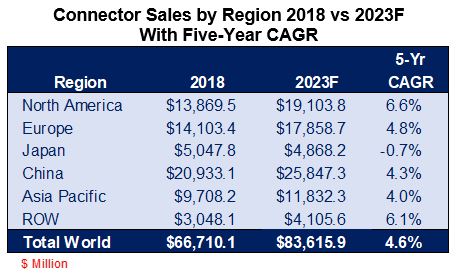

China Connector Sales by Region 2018 vs 2023F

Further evidence that China’s largest growth years are behind it is shown in the analysis below. During the last five-year period (2018-2023F), China, and even the Asia Pacific area, has performed below North America, Europe, and the ROW region. When you include Japan, the West significantly outperformed the East.

Bishop Comments:

- It is our opinion that Western leadership will be very cautious in deploying new capital to China. It fact we believe the West will re-shore some manufacturing,

- New capital into China will be mostly to support existing manufacturing.

- China’s economy is probably facing some lean years. Already we are noticing a gradual drop in GDP. Some are projecting a 2% GDP for China by 2030.

- China’s aggressive posture regarding Taiwan has the entire Asia Pacific region very concerned. This will further reduce Western capital movement to China.

Subscribe to the Bishop Report, a publication by Bishop & Associates, to receive monthly updates on the performance of the connector industry.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Is the Gold Rush Over for China Connector Sales? - October 17, 2023

- The Top Five European Connector Suppliers for Product Quality and Price Competitiveness - October 10, 2023

- 2023 Top Five European Connector Suppliers - September 26, 2023