The Telecom Market Takes a Breather

Bishop & Associates’ tracking of the cable assembly industry in the telecom market shows cell/smartphone revenues in decline while unit sales climb.

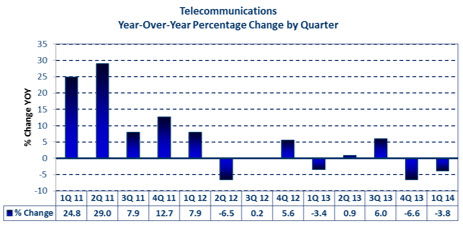

Bishop tracks 11 companies in the telecom market sector. This market has been in contraction, as measured by these 11 companies’ revenues, in three of the last five quarters since 1Q13. In comparison to these companies, the cable assembly market for the worldwide telecom/datacom market sector contracted 3.7% year over year in 2012 and grew 5.7% in 2013. Global mobile phone unit shipments declined 1.7% in 2012 and grew 3.5% in 2013. Price erosion on smartphone sales is the most significant factor negatively impacting revenue growth.

Bishop tracks 11 companies in the telecom market sector. This market has been in contraction, as measured by these 11 companies’ revenues, in three of the last five quarters since 1Q13. In comparison to these companies, the cable assembly market for the worldwide telecom/datacom market sector contracted 3.7% year over year in 2012 and grew 5.7% in 2013. Global mobile phone unit shipments declined 1.7% in 2012 and grew 3.5% in 2013. Price erosion on smartphone sales is the most significant factor negatively impacting revenue growth.

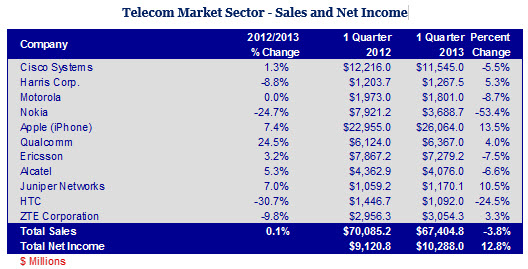

Bishop follows electronic interconnects sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.24 trillion in 2013 and grew 0.8% over 2012. Of the 13 market sectors, telecom was tied for the eighth fastest growing market sector in 2013 at 0.1%, with combined revenues of $285.7 billion. Profitability was $36.1 billion at 12.6% of sales.

Apple (iPhone) had the most growth of the telecom companies at 13.5% year over year in CY 1Q14 sales of $26,064 million. Although Apple’s share of the smartphone market declined in 2013, its CY 4Q13 sales were still a record for the company, according to Gartner, at 50.2 million units with the iPhone 5S and 4S leading the way. This was a 15.4% increase from a unit volume standpoint. CY 1Q14 sales were bolstered by sales to NTT DOCOMO in Japan, although sales dropped 19.8% sequentially from CY 4Q13. Apple is currently the second largest smartphone manufacturer behind Samsung.

Juniper Networks had the second largest increase in sales in 1Q14 at 10.5% year over year. Juniper Networks primarily sells products used in the telecom infrastructure and products needed to expand the capacity and speed of mobile networks.

Harris grew 5.3% year over year in 1Q14 to $1,268 million. “Revenue and earnings were higher than the prior year as a result of strong performance in government communications systems and RF communications’ international tactical radio business,” according to William Brown, the Harris chairman.

Qualcomm grew 4% year over year in 1Q14 to $6,367 million. Qualcomm’s performance was “driven by demand for our leading multimode 3G/LTE chipset solutions and record licensing revenues,” according to Steve Mollenkopf, CEO.

Nokia and HTC both had terrible results with year over year sales declines of 53.4% and 24.5%, respectively. Both have lost significant sales to their competitors in mobile phones.

The following table shows the results for the 11 companies we track in the telecom market sector.

As shown in the following chart, year-over-year sales have been in the low single-digit range or negative over the last eight quarters. Sequentially, first quarter 2014 sales declined 16.1% from the fourth quarter of 2013.

Trends in the Telecom/Datacom Markets

- According to Gartner, smartphone unit sales were 968 million in 2013. This was an increase of 42.3% from 2012. Smartphones accounted for 53.6% of the mobile phone sales in 2013, the first time that smartphone sales have exceeded half the total sales.

- Smartphone usage and 4G/LTE upgrades are still driving the sales for companies which sell the infrastructure equipment.

- Competition in the mobile phone market is intense and is changing the competitive landscape.

Bishop & Associates projects the worldwide market for telecom/datacom cable assemblies to grow 8.6% in 2014 to $19.4 billion. At 14.0% year-over-year growth, North America will be the fastest-growing region in 2014 for this market sector.

Dave Pheteplace, VP, Bishop & Associates, Inc.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019