Should Manufacturers Be Optimistic About Europe?

Economic growth is slowing down in Germany and the economy in France is contracting, highlighting the euro area’s struggle to sustain its recovery. Still, should manufacturers be optimistic about Europe?

With the “political earthquake” caused by the European elections in May and the difficult task of choosing the new leader of the European Commission in mind, it is easy to think the European Union is losing its credibility. In addition, economic growth in Germany is slowing down and the economy in France is contracting, highlighting the euro area’s struggle to sustain its recovery. In an attempt to avoid much-dreaded deflation, the European Central Bank introduced a negative deposit rate for overnight deposits by commercial banks to lower the value of the euro and combat low inflation in the EU, and is contemplating further actions (quantitative easing). To lower the value of the euro is no easy task if, at the same time, the Chinese Central bank is trying to diversify its reserves by selling US dollars and buying euros. A lower value of the euro would help boost European exports.

With the “political earthquake” caused by the European elections in May and the difficult task of choosing the new leader of the European Commission in mind, it is easy to think the European Union is losing its credibility. In addition, economic growth in Germany is slowing down and the economy in France is contracting, highlighting the euro area’s struggle to sustain its recovery. In an attempt to avoid much-dreaded deflation, the European Central Bank introduced a negative deposit rate for overnight deposits by commercial banks to lower the value of the euro and combat low inflation in the EU, and is contemplating further actions (quantitative easing). To lower the value of the euro is no easy task if, at the same time, the Chinese Central bank is trying to diversify its reserves by selling US dollars and buying euros. A lower value of the euro would help boost European exports.

Unemployment rates are also (too) high in various European countries and the sovereign debt crisis is not easily resolved until the European Union can show some larger growth figures.

To make things worse, the trouble in the Ukraine painfully illustrates the energy dependency, and thus vulnerability, of Europe on fossil energy imports (from Russia), at a time when economic recovery is of utmost importance.

So why do many connector manufacturers appear optimistic about Europe?

Of course it is easy to be optimistic about the (near) past when billings are good and about the (near) future when bookings are good. The real issue for most industry leaders is to judge what the not-so-near future will have in store. In a recent Bishop Report, we read that through May 2014, year-to-date billings in Europe were up by 10.7% and year-to-date bookings were up by 8.9%.

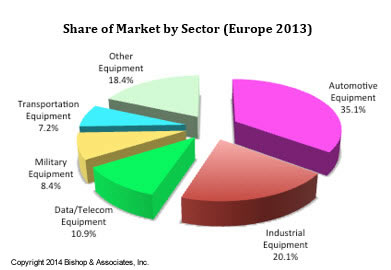

End-use equipment sectors show a more diverse picture. While the automotive sector shows strong performance, revenue growth for equipment manufacturers in the industrial and telecom equipment markets appeared to slow and are slightly below 2013 levels in the first quarter of 2014.

The automotive end-use equipment market has shown strong growth, and industry leaders we spoke to recently all confirmed that this end-use equipment market has been very good for them.

The automotive end-use equipment market has shown strong growth, and industry leaders we spoke to recently all confirmed that this end-use equipment market has been very good for them.

The performance of the industrial market is also good so far. HARTING, a European leader in the industrial market space, posted nearly 10% growth for its European business for the first six-month period ending March 31.

The telecom/datacom market shows a mixed picture with telecom generally in positive territory and datacom in more negative territory.

These three market sectors combined (automotive, industrial, and telecom/datacom) represent 66% (or two-thirds) of the European connector market. So with good growth in two out of three sectors at the start of 2014, we can confirm that the European connector market is in good shape.

Also, our regular industry confidence survey among connector industry professionals shows that industry personnel consider the present business conditions positive, and they expect that the business conditions remain positive six months from now, only mildly slowing. Indeed, the European connector market is in a “sweet spot” with:

- Rising demand in selected industry sectors driving the total market

- Stable prices

- Lower (than before) raw material costs

Apparently there are plenty of reasons to be optimistic about the European connector market. While the European economies are slowly getting back on their feet, there is reason for optimism about the near future for growth, while, at the same time, there are plenty of reasons to believe that the crisis is far from over, and that there are still many underlying problems that need (urgent) fixing.

Apparently there are plenty of reasons to be optimistic about the European connector market. While the European economies are slowly getting back on their feet, there is reason for optimism about the near future for growth, while, at the same time, there are plenty of reasons to believe that the crisis is far from over, and that there are still many underlying problems that need (urgent) fixing.

The fragile growth that Europe currently enjoys can easily be undone, pushing the region back into recession. Therefore the outlook for Europe is most likely a classic case of a division between “bulls” and “bears.” Taking the optimistic approach, at Bishop & Associates we have tried to “price in” all these elements in our forecast for Europe, by country, until 2018. This includes the latest GDP growth forecast released by the IMF and forecasts by industry associations for specific markets and industries where available. In addition we spoke with connector industry leaders and asked their opinions on what lies ahead. The result is summarized in the table show here.

Arthur Visser, VP, Bishop & Associates, Inc.

[hr]

More details about European connector market sales and forecasts by country, market, and product are available in our report European Connector Market Handbook.

[related_posts limit=”10″]

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019