COVID-19 Spreads, Demand for Ventilators Skyrockets

Automotive and engineering companies have reworked their production lines to produce ventilators and other critical medical supplies needed to fight the virus. The medical technology companies that originally designed these devices have led the way by sharing their designs.

According to the World Health Organization (WHO), the COVID-19 coronavirus is an infectious disease that has become a worldwide pandemic, affecting people in 210 countries. Most people infected with COVID-19 will experience mild to moderate respiratory illness and recover without requiring special treatment. Older people, and those with underlying medical problems like cardiovascular disease, diabetes, respiratory disease, and cancer, are more likely to develop serious illness and require a ventilator to breathe.

According to the Centers for Disease Control and Prevention, the best way to prevent and slow down transmission of the disease is to wash your hands and avoid exposure to people who may be sick. It is therefore critical to abide by local stay-at-home orders and social distancing protocols. People can protect themselves and others from infection by using personal protective equipment (PPE) such as N95 medical face masks, when available. PPE is in short supply and the priority is to reserve it for healthcare workers on the front lines treating patients.

As of April 13, 2020, there are more than 1,773,084 confirmed cases and more than 111,652 deaths worldwide, according to WHO data. At this time, there are no cures and a vaccine is many months away. However, many clinical trials are in progress to evaluate potential treatments. The most effective and critical treatment at this time is the use of ventilators to aid critically affected patients with basic lung function until they recover sufficiently to resume breathing on their own. As COVID-19 spreads throughout the world, tensions are high over the lack of ventilators needed to treat patients. The American Heart Association (AHA) estimates that 960,000 ventilators will be needed in the United States alone to treat people with the coronavirus. There are 170,000 ventilators in the U.S., some of which are in dire need of service, repair, and maintenance to be put into use. The Public Interest Research Group (PIRG) submitted a petition to medical ventilator manufacturers to immediately release service manuals, schematics, and service keys, because lives are at stake.

In addition, on April 2, President Trump and the White House invoked the Defense Protection Act (DPA), ordering GE Healthcare, Hill-Rom Holdings, Medtronic, ResMed, Phillips, and Vyaire Medical to produce ventilators and other supplies needed during the crisis.

The Emergency Use Authorization (EUA) authority allows the FDA to help strengthen and protect the nation’s public health and safety by facilitating the availability and use of unapproved medical products or unapproved uses of approved medical products to be used in an emergency to diagnose, treat, or prevent serious or life-threatening diseases or conditions caused by chemical, biological, radiological, and nuclear (CBRN) threat agents when there are no adequate, approved, and available alternatives. The CDC has granted a right of reference to the performance data contained in the CDC’s EUA request to any entity seeking an FDA EUA for a COVID-19 diagnostic or treatment device. On March 24, 2020, and based on the February 4, 2020, HHS EUA determination, the HHS Secretary declared that circumstances exist that justify the authorization of emergency use of medical devices, including alternative products used as medical devices, due to shortages during the COVID-19 outbreak.

- Letter of Authorization (PDF, 359 KB)

- Appendix B: Authorized Ventilators, Ventilator Tubing Connectors, and Ventilator Accessories (PDF, 129 KB)

The EUA grants companies the ability to produce and supply ventilators without being subject to FDA 510(k) pre-market notification or other medical regulatory requirements that would otherwise slow them down from responding to the crisis.

At the request of the president and White House officials, several large automotive companies — Tesla, Ford Motors, and General Motors — have licensed technology to form partnerships that enable them to support the increased ventilator demands created by the global pandemic. In the UK and EU, more than 60 military engineering companies, automakers, and aerospace firms, including Fiat, Vauxhall, Airbus, and Rolls-Royce, have also switched production to manufacturer ventilators and other medical supplies.

In addition to doubling production, Medtronic has shared its ventilator specifications with automaker Tesla and is offering an unrestricted, free license online for businesses to download specifications in order to manufacture the company’s Puritan Bennett (PB560) ventilator system.

Airon Corporation pNeuton Model A ventilator

Airon Corporation, a pneumatic ventilator specialist, has licensed its pNeuton Model A ventilator design to GE Healthcare, and automaker Ford Motors will provide its manufacturing scalability expertise to produce 50,000 ventilators in 100 days, with the ability to produce 30,000 a month thereafter as needed. The new model, designated the pNeuton Model A-E ventilator, which is powered by Airon’s pneumatic technology, does not require electricity or batteries and provides oxygen with pressure to keep the lungs open and assist breathing for critically ill patients. GE will continue to produce its CARESCAPE ventilators at double the normal capacity.

Dave Shepard, managing director and co-founder of MedWorld Advisors, who facilitated the strategic relationship between Airon, GE Healthcare, and Ford, said, “It was really impressive to watch Airon, GE Healthcare, and Ford collaboratively team up to develop a strategic plan to modify the design, secure the supply chain, and create a manufacturing strategy to produce a large volume of ventilators to save lives during this crisis.” At full production, Ford plans to produce 7,200 ventilators per week.

Ventec VOCSN ventilator

Ventec Life Systems has licensed its VOCSN critical care ventilator design to General Motors. This model is designed for hospital, institutional, transport, and home environments. The advanced unified respiratory system combines responsive leak and circuit compensation as well as precision flow trigger controls to enable breathing and accurate therapy.

A senior spokesperson from Ventec said the company has been working around the clock to transfer design, manufacturing, and supply chain knowledge to GM in order to build product in half the time it normally takes. The company is confident in its supply chain with vendors ranging from the US, India, Malaysia, Thailand, China, Switzerland, Germany, and other locations to keep up with GM’s expected production levels. General Motors expects to produce the first ventilators at a converted Indiana factory in a matter of days and officials say the safety measures being used there could become the model that enables the Fort Wayne plant to reopen. GM plans to produce an estimated 80,000 of the Ventec VOCSN ventilators.

The Advanced Medical Technology Association (AdvaMed) is the largest medical device association in the world. Its members produce close to 90% of annual health care technology purchases in the United States and more than 40% globally. AdvaMed members that are ventilator manufacturers include Draeger, GE Healthcare, Hill-Rom, Medtronic, Philips, ResMed, and Vyaire Medical. These companies are adding new manufacturing lines, repurposing existing manufacturing lines, training and reorienting engineers, and adding new employees to meet the demand. Respiratory device companies that belong to AdvaMed have boosted ventilator production to 2,000–3,000 units per week and expect to soon produce 5,000–7,000 ventilators per week. To put this in perspective, most of these companies were making only about 700 ventilators per week for distribution in the U.S. last year. According to Scott Whitaker, AdvaMed CEO, its members have increased production by more than 285% to support the crisis.

The coronavirus pandemic has put existing ventilator manufacturers under increased pressure to produce large numbers of medical ventilators and the sophisticated breathing circuits required by many critically ill patients. With demand for ventilator devices at an all-time high, companies are working around the clock to increase production and build these life-saving machines as quickly as possible.

There are 25 known ventilator equipment suppliers.

- The top seven ventilator manufacturers in the world are Draeger, Hamilton Medical, Fisher & Paykel Healthcare, GE Healthcare, Medtronic, Philips, and Vyaire Medical.

- Additional ventilator manufacturers include Airon Corporation, AliMed, Allied Healthcare Product, ALung Technologies, Bio-Med Devices, BNOS Meditech, Coeur Scientific, CWE, Harvard Apparatus, Instrumentation Industries, Joshua’s Respiratory Care, Kent Scientific Corporation, Medline Industries, New Trend Environmental Services, Norco, Passy-Muir, ResMed, and Smiths Medical.

| Connector content, including the quantity and type of connector employed in each ventilator, varies greatly based on manufacturer and type/model of ventilator. Common connector types include two-position terminal blocks — such as those made by METZ CONNECT, Molex, Phoenix Contact, TE Connectivity, WAGO, and Weidmuller — which are used to bring power to the processor board, to control the main valves for the ventilator applications, and to power up the compressor. |

Phoenix Contact two-Position, 2.54mm Fixed Terminal Blocks |

| Friction-lock wire-to-board headers like TE Connectivity’s MTA-100 Series and AMPMODU IV and V connectors are also common in ventilators and are used to send the main instructions and power to the LCD board. Two-position friction lock headers are often used as button connections to control the ventilator via the user interface. |

TE Connectivity MTA-100 connectors provide connections to LCD screens |

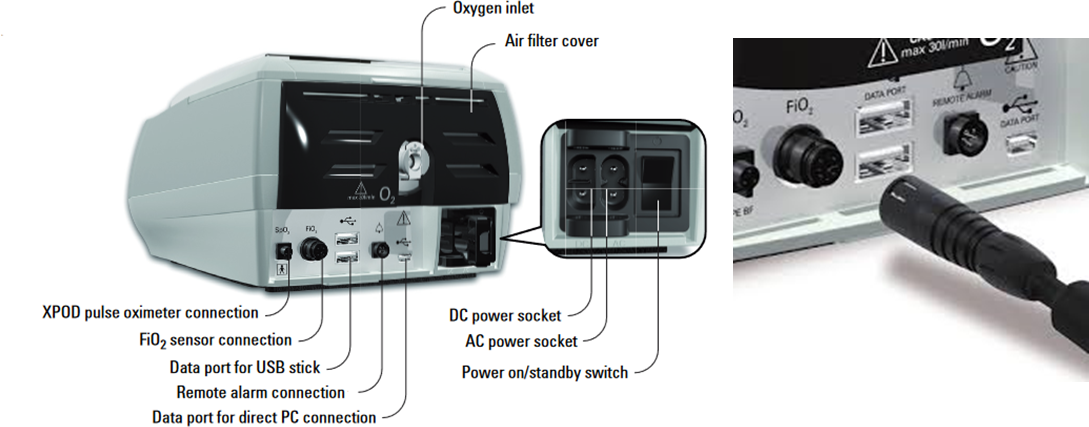

| I/O connectors used in ventilators include standard and miniature USB connectors, SD card connectors, and D-subminiatures and are generally used to interface with other microcontroller units (MCUs) or directly with a computer interface. Many of these connectors do not affect the actual functionality of the ventilator. Connectors are also used for communication connections, including remote alarms. These include Ethernet, RJ45 modular jacks, circular all-plastic, and BNC connectors. |

Hirose USB 2.0 connectors work as an application interface with other MCUs or directly with a computer interface. |

Other connectors found on ventilators include DC and AC power connectors and external connections for XPOD pulse oximeter and FiO2 sensors.

ResMed Stellar™ Non-invasive/Invasive Ventilator

The pneumatic ventilators being produced by automakers may have limited connector content, but the higher-end ventilator systems produced by the 25 existing medical ventilator manufacturers have more electromechanical content that will generate increased connector demand.

The sales price of the pneumatic systems produced by the auto manufacturers ranges from $7,500 to $15,000, with an average sales price of approximately $10,000. The ventilators produced by the medical technology companies have more features and prices range from $20,000 to $30,000, with an average sales price in the $25,000 range. In this instance, where lives are at stake, the average sale price is not the greatest concern. The most important thing is the speed at which the ventilators can be produced and distributed to those who desperately need them to breathe.

The worldwide ventilator market was $4.5 billion in 2019 with a compound average growth rate (CAGR) of 6.6%. The COVID-19 pandemic will create an unprecedented short-term spike in demand, increasing the total market value by up to $4 billion over the next 12 months. Of that sum, connector content will account for approximately $6 million. Expect the market in the U.S. and other countries to create an inventory of ventilators to prevent these shortages from happening again. Ultimately, the ventilator market may reach $7.5–8.5 billion by 2021 or 2022, depending how quickly manufacturers can respond.