In Conversation: The State of the Connector Industry

A conversation between Bishop & Associates’ Ron Bishop and Samtec’s Danny Boesing reviews 2023 sales performance and explores the possibilities 2024 holds for the connector industry.

We are now in a new era for the connector industry. The great disruption of the pandemic has led to the rise of new technologies, a shift out of China for manufacturing, supply chain changes across the electronics industry, and the acceleration of development in AI, electrification, and high-speed technologies. As we move into 2024, we are watching connector prices and lead times closely.

Danny Boesing, product marketing manager at Samtec Inc., and Ron Bishop, president of Bishop & Associates, recently had a conversation about industry sales and the technologies, markets, and world events that shape the outlook for the $84 billion interconnect industry. They review performance for 2023, assess global trends, and look ahead at what could be a tumultuous year in the connector industry.

Danny Boesing: How did the industry perform in 2023?

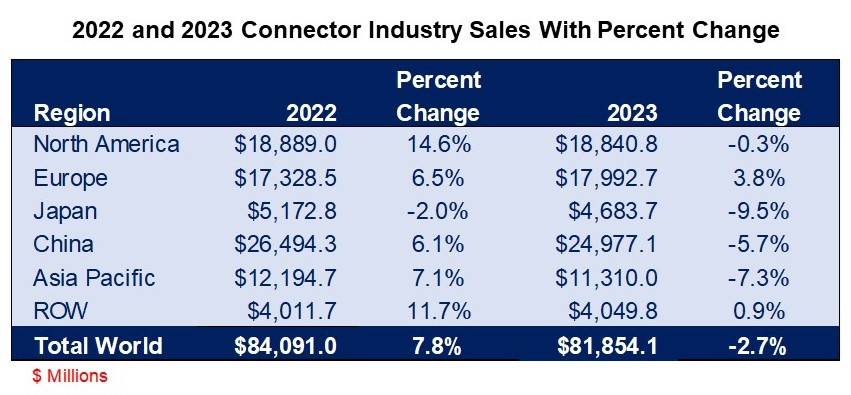

Ron Bishop: The world connector market declined 2.7% in 2023. In 2022 the industry shipped $84.091 billion versus $81.854 billion in 2023.

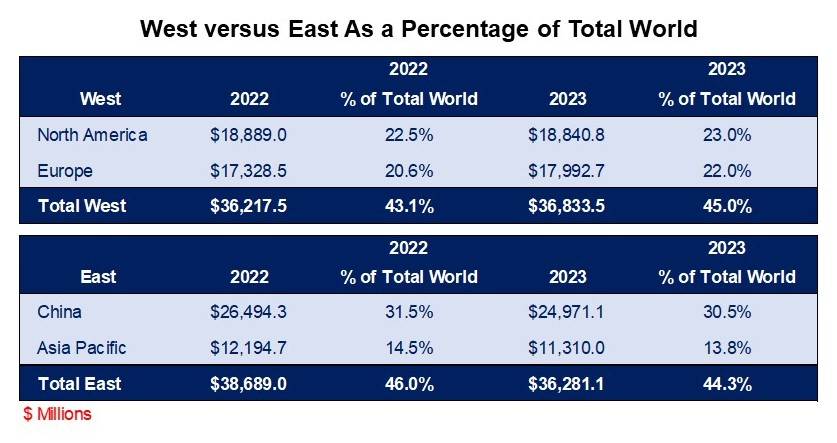

This table identifies how the industry performed by geographic region. “It is interesting to note that North America and Europe combined outperformed the combination of China and Asia Pacific,” said Bishop..

This has happened for the past six years, starting in 2018. It is also interesting to note that in 2023, the West shipped 45% of the world market while China and Asia Pacific shipped 44.3%.

Boesing: How did the industry perform by market/end-use equipment sector?

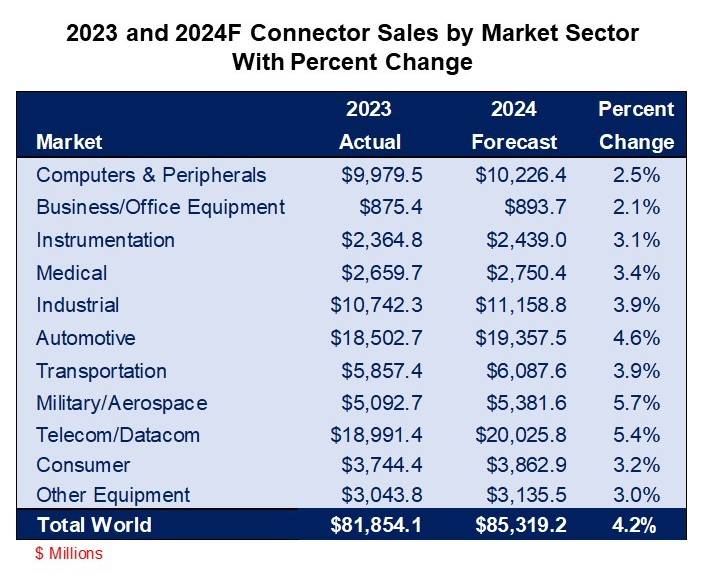

Bishop: The worst-performing market sectors were computers & peripherals, consumer, and telecom/datacom. These were the hot markets during the pandemic. Stay-at-home workers, in the millions, upgraded their equipment, internet access, streaming system capabilities, smartphones, tablets, etc. This created a growth bubble in 2021 and 2022, which is now having an adverse impact on demand.

Boesing: What is your 2024 outlook for the industry?

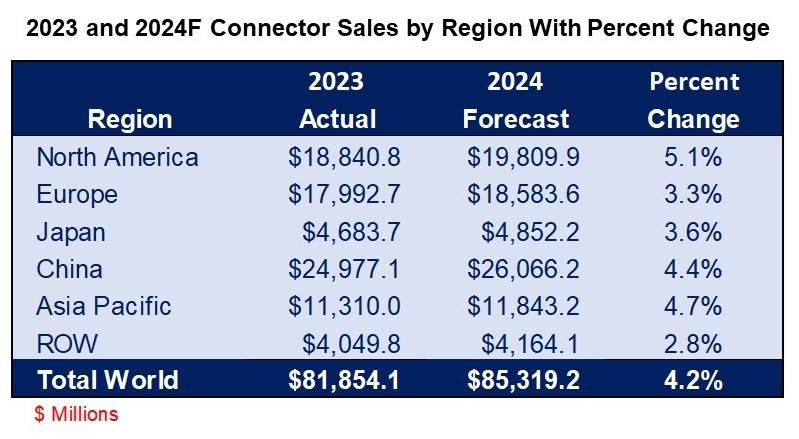

Bishop: It is an election year in the U.S. and for the European Parliament, so we anticipate several things. In the U.S., we believe the Federal Reserve will hold interest rates steady or reduce them. Although inflation has come down, it is still north of 3% in the U.S., and just slightly below that in the Euro area. Worldwide gross domestic product (GDP) is at a reasonable level and is forecast to rise slightly going into 2025. With these factors in mind, we are reasonably optimistic and are forecasting the worldwide connector market to grow in the +4% range.

The following table shows our forecast by region for 2024.

We believe that North America will slightly outperform Europe, China, and Asia Pacific.

Once again, it is anticipated that North America and Europe combined (West) will out-ship China and Asia Pacific (East) in 2024.

Boesing: What market sectors will perform better than others?

Bishop: We believe automotive and transportation will do well. We are concerned about the electric vehicle (EV) market because of slower consumer demand. As more people own an EV, we learn more about the downsides of electric vehicle ownership. The biggest is the lack of an adequate infrastructure to support its use, i.e., enough charging stations appropriately placed. Other issues include the ability of the battery to maintain a charge in cold weather climates and the risk of battery exposure to salt water in warmer coastal climates.

We also expect a good year for telecom/datacom. The internet and the increasing demand for speed, bandwidth, etc. will fuel this demand. Here’s our 2024 forecast by market sector:

However, significant uncertainties come from global conflict areas. The black swans are Russia and Ukraine, Iran, the Red Sea turmoil, China and Taiwan, America’s southern border, and the increased potential for terrorism.

Boesing: Yeah, those are some VERY black swans. Anyway, what are your thoughts on connector prices, lead times, the industry backlog, and raw material costs?

Bishop: We believe connector prices will remain stable in 2024. In 2023, customers pushed for price reductions because demand was lethargic (sales down 2.7% in 2023), inflation slowed down, and the cost of raw materials used in connectors stabilized. Customers will push for price concessions in 2024, but we believe manufacturers will be able to hold the line. We do not believe manufacturers will be able to increase prices.

As for lead times, we see stable lead times in the 8–12-week range. Of course, military/aero and some of your custom connectors are running higher, averaging 12 to 16 weeks. Overall, however, Bishop anticipates lead times to remain stable throughout 2024.

Bishop predicts raw material costs will also remain stable in 2024. We measure and report on these costs each quarter. We don’t expect any surprises.

The connector industry backlog currently stands at 13.4 weeks. World connector backlog has been in the $21 to $22 billion range for all of 2023. We need to achieve a significant increase in order demand before the backlog grows. Unfortunately, we do not anticipate that happening in 2024.

Learn more about the Bishop Report and the roughly 40 news briefs that subscribers receive. For a complimentary copy, e-mail Ron Bishop at [email protected].

This conversation originally appeared on the Samtec Blog. Samtec is ranked #1 in Bishop and Associate’s Customer Service Survey of both North America and Europe. Visit Samtec to learn more about its products and services.

Like this article? Check out our other Connectors, and Facts and Figures articles, our Sensors & Antennas Market Page, and our 2023 and 2024 Article Archives.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- State of the Industry: 2022-2023 Connector Sales - April 16, 2024

- Amphenol is On a Roll - April 2, 2024

- Nicomatic Proves That Two Heads are Better Than One - March 26, 2024