Connector Trends and Challenges in the Automotive Wire Harness Industry

Space and weight constraints, environmental regulations, and increasingly complex system requirements are inspiring new wire harness products and versatile interconnect alternatives.

Automotive wire harnesses come in thousands of varieties. Some modern vehicles contain close to 40 different harnesses, with up to 700 connectors and more than 3,000 wires. Additional variation is required for wire harnesses made for heavy-duty vehicles and equipment used in construction, agriculture, and other off-road environments.

In addition to keeping down weight, cost, and space while serving an ever-growing array of auxiliary components, harness makers for heavy-duty applications have unique challenges. Heavy-duty vehicles are subject to higher amounts of stress and strain than consumer vehicles and require extra-durable wiring and connectors. Regulations continue to change in the U.S. and worldwide. And as data and signal-driven applications grow more prevalent, their thin wiring — though beneficial for reduced weight — presents a challenge in terms of durability.

Top Challenge: Component Availability

It’s no surprise that product availability is the biggest issue faced by wire harness manufacturers today. Like so many other industries, wire harness makers are struggling with ongoing pandemic-related shortages and shipping bottlenecks, compounded by uncertainties stemming from world events.

The availability of connectors has eased somewhat since the early days of the pandemic but continues to be strained. “Connector manufacturers have had trouble getting the resins and other materials they needed from Asia,” says Tim Buhler, director of engineering services at Electrex, one of the nation’s premier manufacturers of wire harnesses for utility, construction, and agricultural vehicles. “And now there’s a concern about nickel prices, which could further cut into the availability of terminals, relays and other components.”

Increasing Acceptance of Connector Equivalents

One thing that’s helped the connector squeeze is an accelerated market acceptance of replacements for in-demand connectors such as TE Connectivity’s DEUTSCH, Murrelectronik, and others. Popular replacements for DEUTSCH-type connectors, for example, include Amphenol’s A Series of connectors, which are fully compatible with their industry-standard counterparts.

“Proven equivalents have been out there for a while, but our customers were reluctant for us to use them,” explains Forrest Hett, supply chain director at Electrex. “Now, when the choice is to wait six months or find a replacement, our customers say get the replacement. No hesitation.”

An Amphenol A Series panel mount connector with plug-in receptacle, one of the many popular replacement options for hard-to-find standard connectors.

The Decline of Pull-to-Seat Connectors and Soldering

Pull-to-seat connectors, once a mainstay of the industry, have been largely phased out in favor of push-to-seat connectors at companies like Electrex. “The thinking once was, pull-to-seat would be a reliable way to lock in your wire and terminal,” says Buhler. “The reality is, they’re difficult to use in harness manufacturing. You have to hand-crimp a lot of them — so you can’t use automation like Komax tooling — and they’re harder to field service than push-to seat connectors.”

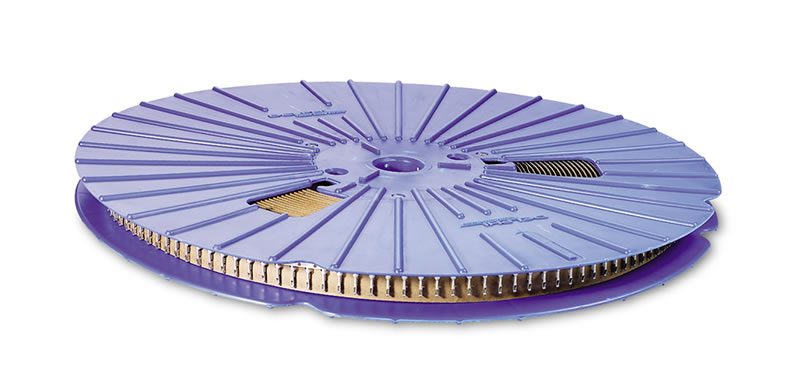

Terminals from Aptiv packaged in a reel, making them ideal for pneumatic or hydraulic automation tooling in wire harness manufacturing.

Another change in wire harness manufacturing is the steady movement away from use of solder and tin-based components such as connectors with solder tabs. As regulatory bodies in the U.S. and many other countries have enacted tightened restrictions on lead-based materials, wire harness manufacturers have followed suit and are phasing out use of tin-plated terminals and components that require soldering.

Components such as these fully insulated quick disconnects from 3M eliminate the need to use solder connections in many wire harness applications.

Maintaining Wire Strength in Signal Applications

An ongoing challenge for wire harness manufacturers comes from industry pressure to reduce the size and weight of wiring. With the increasing use of data-driven applications and components in modern vehicles comes a corresponding expectation to use thinner-gauge, lighter-weight wiring in harnesses. Communication lines can run efficiently over wire as thin as 22 or even 26 gauge. However, this presents a problem for heavy-duty vehicles due to vibration concerns and the potential for wire breakage.

Electrex has asked several vendors to design their components using 18- or 20-gauge wire, even though signals can effectively travel through thinner wire. “We need stronger wire for the physical integrity of the system,” says Buhler. “Thicker wires also have better manufacturability — you can do things like sonic welding instead of a mechanical splice that creates a fatigue spot on the harness.”

Reliability and Flexibility in Product Sourcing

As mentioned previously, sourcing products in for wire harnesses is a challenge in today’s market. Many wire harness manufacturers have been turning to distributors who are able to provide more flexibility with order quantities and scheduling and frequently have alternative manufacturers’ parts to evaluate when product lead times don’t fit the production schedule. “A good distributor should be able to recommend and ship a wide array of connectors, including drop-in replacements for standard connectors that are becoming hard to find,” says Hett.

As wire harness manufacturers continue to adapt to changing market conditions and regulatory requirements, so will the connector marketplace. To see a full line of connectors, wire and electrical components used in heavy-duty vehicle wire harness manufacturing, visit the Waytek website.

Like this article? Check out our other articles on Cable, Cable Assemblies, our Wire and Cable Assemblies Market Page, and our 2022 Article Archive.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.