LPWAN Wireless Standards Expand Opportunities for Antennas and Connectors

5G has yet to fully arrive, but low-power wide-area network (LPWAN) activity is already influencing design trends in a wide range of connected products.

The number and variety of wireless devices in use across every aspect of society is increasing exponentially, creating new worlds of opportunity for electromechanical component suppliers, not only inside the cellular network but outside of it as well. Analysts project there will be 75 billion connected devices by 2025 and over two-thirds of these will be low-power wide-area networks (LPWAN) or local area networks (LAN) rather than traditional cellular network connections.

While these newer LPWAN network devices have been enabled by the size and volume of the telecom devices that preceded them, it is evident that today’s networked devices are pushing component suppliers and antenna designs in new directions. The advent of the Internet of Things (IoT) has ushered in products that need no human interface. Most LPWAN and LAN network end-products don’t need to fit in your hand and are often kept outdoors where they rely on little power and need to meet tougher temperature and environmental specifications.

LPWAN and LAN products range from meter readers to shipment trackers and building controls to agricultural products. Since they use different bandwidth and frequency specifications than traditional cellular products and their allocated signal spectrums vary by country, they also use different antenna assemblies.

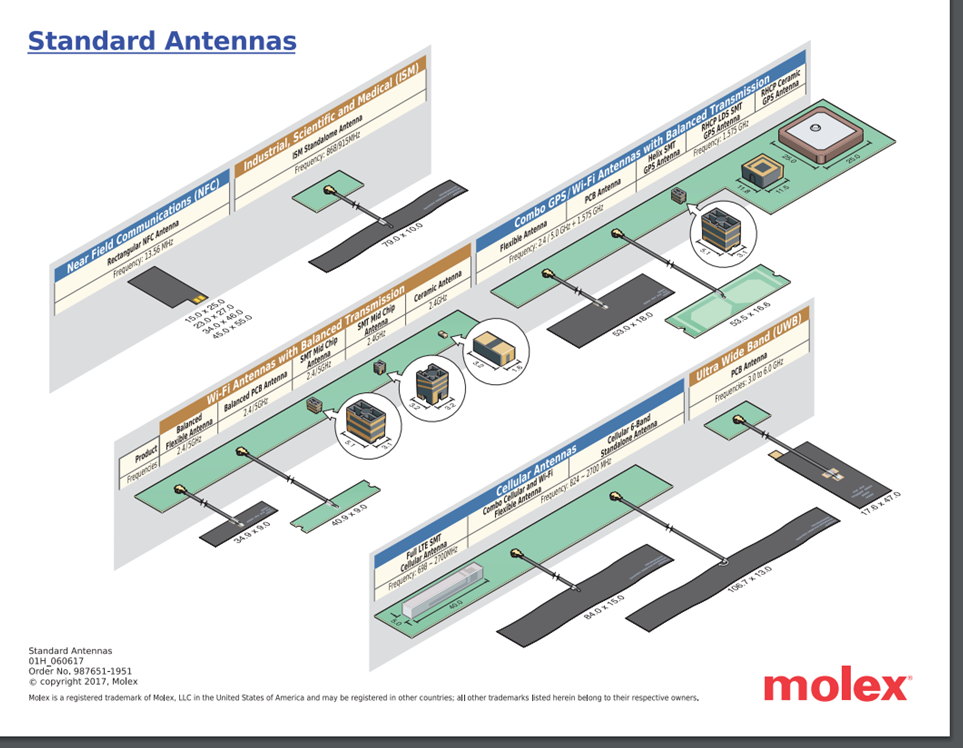

The proliferation of IoT products is creating a surge in the variety of new antenna assemblies coming on the market, which is a trend that will likely continue to grow. In recent years, numerous connector companies have acquired antenna makers or developed their own antenna and antenna-adjacent products. Related connectors, specialty cable assemblies, transceivers, switches, and other RF accessories are evolving rapidly to serve antenna-based systems. Amphenol, Molex, Bulgin, Laird, Phoenix Contact, TE Connectivity, Würth Elektronik, AVX, HARTING, and Radiall are among the electronic component companies that are prioritizing development in the antenna arena.

Internal antenna designs include banner-style antennas with micro-RF cables and connectors.

While traditional standards like Wi-Fi and Bluetooth dominate the LAN space and share a common bandwidth, it is a different story for LPWAN applications. Here, the dominant standards include LoRaWAN, Zigbee, Sigfox, and Weightless, each of which uses bandwidth and frequency differently.

The types of antennas used in mobile devices vary from single-piece plated plastics to assemblies with PCB or thin-film antennas backed by adhesive and tethered by a micro-RF cable to a board-level micro-RF connector. These assemblies offer a level of modularity that is well-suited to the global LPWAN market. More than 90 versions of this basic internal flag-style antenna configuration are now available.

To facilitate multi-sourcing, OEMs have begun standardizing the antenna connector interface. At present, Hirose’s U.FL Series, I-PEX Connector’s MHF Series, and Amphenol RF’s AMC Series connectors (pictured above from left to right) are among the most common RF connectors used in these cabled antenna assemblies. Innovation is occurring very quickly in this area, however.

In the meantime, with a common tape-mounted PCB connector, a high-flex cable, and a very flat antenna that can be bonded to the inside cover of a product, an OEM can easily modify product features or adapt them to country-specific platforms or market-specific standards while maintaining the same assembly process.

Since many network operators believe that they will only be able to connect 10–15% of the predicted volume of IoT devices with classic (i.e., licensed band) cellular technologies, there is a strong market for antenna assemblies outside the telecom network. LPWAN plays a significant part in the expanding market here. Unlike Wi-Fi and similar LAN technologies, LPWAN products are well-suited for long-distance applications like moisture sensors for agriculture, heat sensors in forests, or animal herd management products, where battery power that can last months or years is needed.

LPWAN Standards are Creating Multiple New Markets

A number of global standards organizations are actively defining the LPWAN market and many of them are being led by major OEMs. A few of the most prevalent groups include LoRaWAN, Zigbee Alliance, SigFox, and Weightless.

LoRaWAN, managed by the LoRa Alliance, enables low-power devices to communicate with internet-connected applications wirelessly over long distances. The standards group has more than 500 members, including Cisco, HP, Foxconn, and Schneider. The LoRa Alliance believes that 50% of the predicted IoT volume will be handled by LPWANs. Since LPWAN standards like LoRaWAN work off of the Open-Source Interconnect (OSI) model, they take stress off of network providers by creating bandwidth for other applications. “The Things Network,” a European member of the LoRa Alliance that calls itself “the first open-source, decentralized infrastructure for the Internet of Things,” claims to have over 8,632 gateways running to supporting over 83,000 developers in building industrial grade LoRaWAN solutions.

Similarly, the Zigbee Alliance calls itself the standard bearer of the open IoT. Membership is promoted by end-users like Amazon, Comcast, and Landis & Gyr. The more than 3,000 certified Zigbee products range from the Amazon Echo products to Samsung smart-door controls to Landys & Gyr electricity metering devices. The Alliance has three focus groups: Zigbee, Dotdot, and the Smart Energy initiative.

Sigfox, a French global network operator founded in 2009, has built wireless networks for low-power objects that need to be continuously on and emit small amounts of data. Sigfox has partnered with Texas Instruments, Silicon Labs, and ON Semiconductor, as well as Alps/Alpine and Google. Sigfox has reported that it is now possible to push any data generated by Sigfox-enabled devices to the Google Cloud Platform.

Weightless is a set of open wireless LPWAN technology standards for exchanging data between a base station and the thousands of machines around it. Again, the purpose is to allow developers to build low-power wide-area networks. The Weightless SIG recently renamed the technology Weightless, based on the strength of its Weightless P standard. First released in July 2017 by Ubiik Inc., a Taiwan-based company, the Weightless ecosystem has grown to more than 100 companies spread over 40 countries.

This groundswell of activity will increase in the years ahead. Yet, while the importance of the IoT and the LPWAN networks is huge in terms of volume and the way it has expanded the application base for networked products, it needs to be underscored that the massive home and office Wi-Fi markets will be two of the areas immediately impacted as 5G functionality rolls out around the world. With 5G, the peak signal speed jumps to 10 gigabits per second (Gb/s). Even if we assume that real world speeds will only average 10% of 5G’s potential, 5G speeds will still be 100 times faster than current speeds. New modems and routers will be needed to realize these speeds.

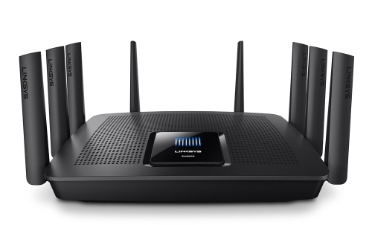

Wi-Fi uses two frequencies, 2.4GHz and 5.0GHz. Wi-Fi standards are governed by IEEE 802.11 a/b/g/n/ac specifications. The new IEEE 802.11ac modems and routers that accommodate 5G use multiple-in multiple-out (MIMO) protocols. These routers can accept parallel signal streams and use up to eight antennas simultaneously to capture 5–10G/s of data. As 5G rolls into the LAN market, there will be incremental demand and the units delivered will feature more antenna and more cable connectors than were previously needed.

The Linksys AC5400 MU-MIMO Gigabit Wi-Fi Router uses eight external adjustable high-performance antennas featuring a paddle-shaped design for increased surface area to transmit and receive multiple data streams simultaneously.

This same MIMO functionality will be evident in other applications. For example, shark fin car antennas accept GPS, 4G LTE, Wi-Fi, and WiMAX signals and have eight SMA output cables. Manufacturers such as TE Connectivity are making automotive antennas that are 5G ready now.

Full 5G implementation is still some years off. 5G cellphone towers are being installed around the world, but implementation is uneven, with some countries and telecom providers making a bigger push to get their networks ready first. During the final stage of implementation, after the infrastructure is in place, it is expected that a range of new products and services will be released to utilize this new bandwidth. Some companies already have 5G products, such as 5G-ready phones, available now. With these changes will come more new products and applications.

Like this article? Check out our other New Technology, wireless, networking, and standards articles, our Datacom/Telecom market page, and our 2019 Article Archive.

- Cell Towers Become Less Cluttered - January 10, 2023

- Market for Smaller LC Duplex Fiber Connectors Makes Big Gains - November 1, 2022

- Twinax Cable is Replacing PCBs Inside Server and Switch Applications - October 4, 2022