Heavy Industry Drives the Industrial Market

Transportation Market Quarterly Results

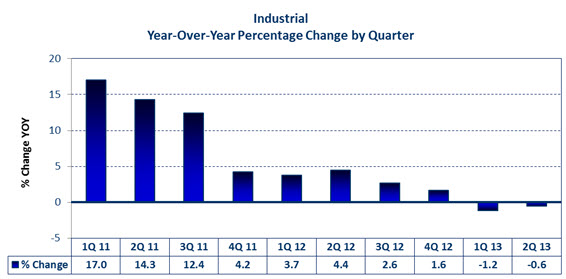

Bishop tracks 13 market sectors for electronic interconnects sales trends. The combined annual revenue of all the market sectors was $4.3 trillion in 2012, an increase of 4.9% over 2011. Of the 13 market sectors, industrial was the sixth-fastest growing market sector in 2012, at 3.1% year-over-year with combined revenues of $567.9 billion. Profitability was $44.6 billion at 7.9% of sales.

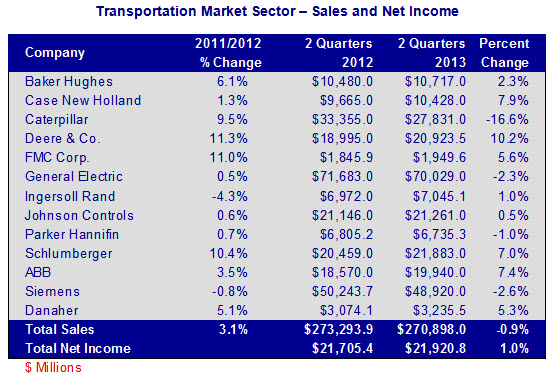

Deere & Company had the most growth in the first half of 2013, at 10.2% year-over-year to $20.9 billion due primarily to increased equipment sales. US/Canada sales are up 5% and Brazil is up 20%. Sales are down 5% in Europe and flat in Asia.

Case New Holland sales are up 7.9% year-to-date. Its agricultural equipment sales are up 11% in the first half and construction equipment sales are down 16% year-to-date. Sales are up 8% in North America and 55% in Latin America. Sales are flat in EAME and CIS.

ABB sales are up 7.4% for the first half of 2013. For Q2, sales were down 1% in discrete automation, up 20% for low voltage products, up 4% for process automation, up 6% for power products, and up 5% for power systems.

Schlumberger sales increased 7% year-to-date to $21.8 billion. With its focus on oil field equipment and services, the company has benefited from the increasing price of oil and gas.

Caterpillar saw its sales decline 16.6% in the first half of the year to $27.8 billion. The company attributes the decline to reductions in dealer machine inventory, which it expects to continue in the second half of the year.

The following table shows the results for the 13 companies we track in this market sector.

As can be seen in the following chart, year-over-year sales growth slowed substantially in 4Q11 and was negative for the last two quarters. Sequentially, second quarter 2013 sales increased 3.8% from the first quarter of 2013.

Trends in the Industrial Industry

- The Industrial market sector tends to do well when medium to heavy industry is doing well, which will drive demand for cable assemblies.

- In a strong automotive market, updating and expansion of production lines means more cable assemblies are required to operate robotic systems and welding equipment. Additional mold and stamping presses are also required to produce parts, and this equipment also uses cable assemblies.

- The strong commercial aircraft market has increased requirements for equipment used in the production of parts and assemblies.

- For energy exploration, cable assemblies are used extensively in seismic exploration equipment, pipe production equipment, and drilling equipment. On the production side, cable assemblies are found in the pumping and monitoring equipment.

- In electrical generation and distribution equipment, smart grid technology is allowing the service providers to do more with existing infrastructure, thus saving them money and improving service. Smart grid is controlled by SCADA (supervisory control and data acquisition) equipment, which is forecast to grow at a 7% CAGR between 2012 and 2020. This equipment includes bay controllers, substation servers, sectionalizer controllers, and other equipment that uses cable assemblies extensively.

- The shift of industrial output from advanced economies to emerging/developing economies is slowing. For the most part, this trend seems to have run its course. Certain industries will always remain local and their subcontract business (as with cable assemblies) will remain with them. Other industries have finished with whatever transfers in business they were going to make between regions.

Bishop & Associates projects the worldwide market for industrial cable assemblies to grow 4.2% in 2013 to $13.4 billion. At 16% year-over-year growth, ROW will be the fastest-growing region in 2013 for this market sector.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019