Enterprise and Mobile Drive the Telecom Market

Enterprise and Mobile Drive the Telecom Market

Bishop & Associates segments the telecommunications sector into the following major equipment segments:

Enterprise Network Equipment– Formerly referred to as Customer Premises Equipment (CPE), enterprise network equipment includes all communication and network equipment used in support of voice, data, video, security, and building automation applications. The equipment is generally owned or leased by the enterprise, such as corporations, call centers, small/home offices, institutions, and governments. Also included in enterprise network equipment is premises-cabling apparatus such as cross-connects, patch panels, and information outlets.

Wireless Network Equipment – Includes wireless infrastructure equipment generally owned or leased by a telecommunications carrier. Examples are microwave repeater equipment, paging apparatus, cell site equipment and apparatus, and similar equipment. Also included is carrier-subsidized wireless subscriber equipment, such as cell phones. Not included are leased copper, optical, or cable (TV) backhaul links.

Wireline Carrier Network Equipment – Wireline carrier equipment includes copper and fiber-optic based network equipment typically employed by traditional wireline carriers. The equipment is further divided into access, metro, and core networks. The mobile backhaul network is the access network for the mobile carriers.

Cable/MSO Network Equipment – This segment includes land-based network equipment generally owned by a cable (TV) operator or multi-system operator (MSO) used for the origination and distribution of IP voice, data, and video services to residential and business customers.

Other Network Equipment – Includes all telecom/datacom equipment not covered in the above segments.

It should be noted that as a consequence of widespread acceptance of Internet Protocol (IP), Multi-Protocol Label Switching (MPLS), and similar protocols, deployment of very similar equipment might occur within each of the above segments. IP media gateways and signaling gateways are common examples. Also, the names for similar equipment may differ by segment. To remedy potential confusion and double counting, we use the equipment name most commonly used within the segment for values of connector shipments within that segment.

There are three areas of the telecom market that stand out with more growth opportunities than the rest: data communications equipment within the enterprise segment, mobile backhaul within the wireline carrier equipment segment, and smartphones within the wireless subscriber equipment sub-segment of the wireless network equipment segment. These will be the focus of this article.

How Consumer Behavior Drives the Mobile Network

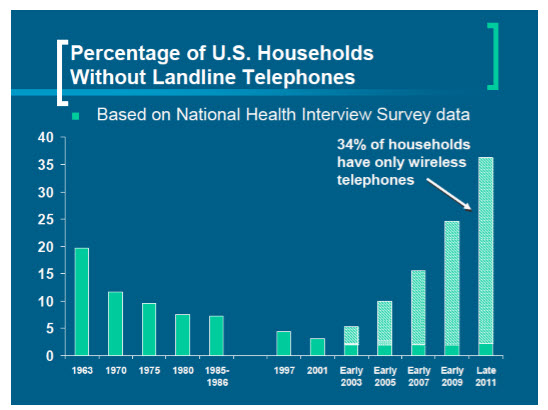

According to a recent study by the US National Health Information Survey (NHIS) conducted by the Centers for Disease Control (CDC), more than 30% of all US households no longer have landlines. In addition, several studies have shown that nearly 90% of US adults now own cell phones. And, as generation Z (those born in the early 2000s) matures, this statistic will only increase.

Figure 1: US Households without Landline Telephones (Source: CDC NHIS)

In China, the fastest growing mobile market, the percentage of mobile-phone-only households is even higher – close to 50%. In fact, the number of mobile lines sold in China surpassed landlines nearly 10 years ago in 2004. In 2012, more than 1.1 billion people in China had mobile phones and almost a quarter of them are smartphones, according to data released by the Chinese Ministry of Industry and Information Technology. Its mobile phone industry brought in more than $1.3 trillion in revenue, half of which came from outside of China.

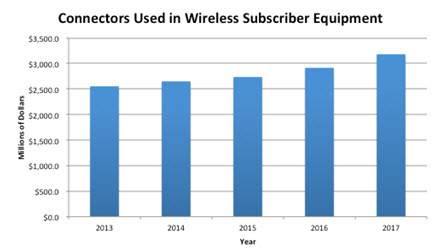

According to a different study conducted by research firm IDC, by 2015, mobile devices will surpass computers in Internet transactions. All of these trends show how consumers will drive the need for updated mobile networks, particularly upgraded mobile connection technology — 4G LTE and beyond — as well as increasing innovation of mobile subscriber equipment (better smartphones). Figure 2 shows our connector forecast for wireless subscriber equipment.

Figure 2

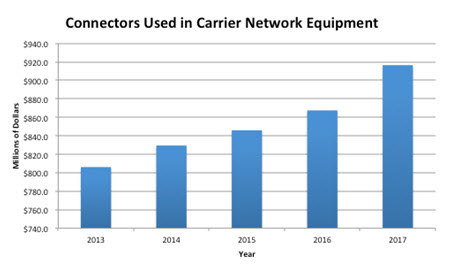

Figure 3, below, shows the revenue from connectors sold into the carrier network over the next five years. If not for mobile backhaul enhancements and data-rate expansion in the enterprise network driving increases in the carrier networks, this segment would show a decline in revenue.

Figure 3

Next Generation Ethernet Drives Growth in the Enterprise Networks

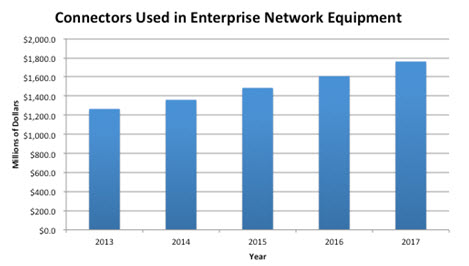

These trying economic times have taken their toll on most industries, but the local area network seems to have come through it unscathed. Because most businesses now rely on their computer systems for their livelihood, not upgrading them is not an option, even in a down economy. While growth slowed in the late 2000s, it did not turn negative for the enterprise segment like it did in other parts of the telecom market.

Over the next five years, we see an overall CAGR of more than 8%, the highest of all the telecom segments. This growth is fueled by pent-up demand from putting off upgrades in data centers and LANs for new Ethernet equipment. Our forecast for connectors sold into the enterprise segment is shown below.

The bright spots for the Ethernet market are with 10G and beyond products and copper giving way to fiber for longer distances, both in the data center and the LAN. Though copper still rules for lengths shorter than about 50m, once 40G and 100G start to take hold, this distance will shorten to within a rack of equipment. So it appears that long-term opportunities for connector companies lie in short-reach copper and optical products.

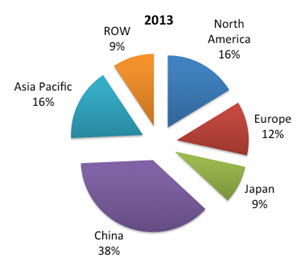

Telecom Market by Region of the World

China has dominated world connector sales for quite some time and this is not expected to change in the next five years. Below is the regional breakdown of expected connector sales into the telecom market in 2013.

Details behind all of these forecasts are found in several of our recent reports as well as an upcoming update on the entire telecommunications market that will be released later this year.