Connector Manufacturers Expand Their Scope Through Diversification

As the Internet of Things continues to expand, connector companies are embracing diversification and establishing new areas of expertise, including antennas, active optical devices, electronic sensors, and packaging services.

Financial advisors like to tell their clients that the path to success is through diversification. The logic being that by spreading their investments over a wide variety of investment categories, portfolio risk will be reduced. Concentrating on a single segment makes an investor susceptible to rapid changes in customer preferences, competitive pressures, as well as disruptive innovation.

Financial advisors like to tell their clients that the path to success is through diversification. The logic being that by spreading their investments over a wide variety of investment categories, portfolio risk will be reduced. Concentrating on a single segment makes an investor susceptible to rapid changes in customer preferences, competitive pressures, as well as disruptive innovation.

A more nuanced iteration of diversification is occurring among manufacturers of electronic connectors. A group of leading suppliers have identified several electronic component markets that are expanding at a much faster rate than general connectors and they are actively investing to become a major participant. Selected products are related to connectors, making their synergy a plus for manufacturers as well as users of these devices.

Years ago, connector manufacturers expanded their connector product lines to include the ability to supply standard and custom cable assembles. This value-added proposition simplified the purchase and manufacturing process for customers while greatly increasing the unit value for the supplier. As the use of fiber optics increased in telecommunications and networking applications, electronic connector manufacturers added optical connectors and assemblies to capture growth.

Component suppliers continue to face a combination of increased competitive pressure, demand for multiple sources, performance limitations, and the commoditization of many connector types. Connector manufacturers are looking for new avenues of revenue growth while maintaining their core commitment to interconnect technology. Several leading connector manufacturers have expanded upon their existing resources or embraced diversification into markets such as electronic sensors, active optical components, antennas, and semiconductor packaging. In order to quickly achieve a dominant position, much of this expansion has been by acquisition of well-regarded suppliers rather than growing the resources internally. Although these new products and connectors may be specified by different people within a customer, a design-in opportunity for one may open the door to the other.

Electronic sensors, for instance, are not an entirely new venture for at least 10 identified connector companies that currently include sensors in their product lines. Many sensors are supplied with wire leads that are terminated with a connector, offering good synergy. Leaders such as TE Connectivity and Amphenol have offered select types of sensors for years. What is new is their aggressive acquisition of large established sensor manufacturers to quickly expand their offerings and increase their share of the total available market.

Electronic sensors, for instance, are not an entirely new venture for at least 10 identified connector companies that currently include sensors in their product lines. Many sensors are supplied with wire leads that are terminated with a connector, offering good synergy. Leaders such as TE Connectivity and Amphenol have offered select types of sensors for years. What is new is their aggressive acquisition of large established sensor manufacturers to quickly expand their offerings and increase their share of the total available market.

With over $13 billion in sales, TE Connectivity has both expanded and refocused their product emphasis over the past 10 years. They continue to offer a huge variety of standard and advanced electronic connectors but are concentrating on introducing new ruggedized connectors and electronic sensors. The $1.7 billion acquisition of Measurement Specialties in 2014 enabled TE to quickly become a major player in the rapidly growing electronic sensor industry. TE product offerings include temperature, humidity, vibration, and force sensors.

In May of 2016, TE announced the acquisition of JAQUET Technology Group, a Swiss leader in the design and manufacture of speed sensors used in automotive, rail, aerospace, and power markets. This addition further cemented TE’s capabilities as a global source of highly engineered interconnect and sensing devices. Additional acquisitions include American Sensor Technologies Inc., whose products complement TE’s concentration on ruggedized interconnects. These sensors are designed for applications in harsh and extreme environments in industrial, marine, energy generation, defense, and aerospace markets. Continuing their aggressive acquisition program resulted in the recent additions of Silicon Microstructures Inc., Alpha Technics, and First Sensor AG. In order to further support their commitment to expanding their sensor products, TE opened a new facility in Andover, Minnesota, dedicated to designing and manufacturing highly engineered temperature sensors. TE now actively promotes an extensive portfolio of sensors to the total range of industry segments, including automotive, industrial, medical, appliance, aerospace, defense, consumer, automotive, and commercial transportation. Other connector manufacturers, including AVX, Yazaki, JAE, and Methode Electronics, are also complementing their lines of connectors with electronic sensors. HUBER+SUHNER, for instance, recently added a new line of 5G small cell antennas to their extensive line of coaxial connectors.

In May of 2016, TE announced the acquisition of JAQUET Technology Group, a Swiss leader in the design and manufacture of speed sensors used in automotive, rail, aerospace, and power markets. This addition further cemented TE’s capabilities as a global source of highly engineered interconnect and sensing devices. Additional acquisitions include American Sensor Technologies Inc., whose products complement TE’s concentration on ruggedized interconnects. These sensors are designed for applications in harsh and extreme environments in industrial, marine, energy generation, defense, and aerospace markets. Continuing their aggressive acquisition program resulted in the recent additions of Silicon Microstructures Inc., Alpha Technics, and First Sensor AG. In order to further support their commitment to expanding their sensor products, TE opened a new facility in Andover, Minnesota, dedicated to designing and manufacturing highly engineered temperature sensors. TE now actively promotes an extensive portfolio of sensors to the total range of industry segments, including automotive, industrial, medical, appliance, aerospace, defense, consumer, automotive, and commercial transportation. Other connector manufacturers, including AVX, Yazaki, JAE, and Methode Electronics, are also complementing their lines of connectors with electronic sensors. HUBER+SUHNER, for instance, recently added a new line of 5G small cell antennas to their extensive line of coaxial connectors.

Amphenol, the world’s second largest connector manufacturer, acquired nine businesses in 2019, including XGiga Communication Technology Ltd., a leading Chinese manufacturer of optical transceivers. They have also been adding to their roster of electronic sensor manufacturers. Their product line diversification into the world of sensors began in 2013 with the acquisition of the Advanced Sensors business from General Electric Measurement and Control Solutions. Many of the sensing devices acquired from this purchase target transportation, medical, pharmaceutical, and industrial rather than consumer applications, which complements Amphenol’s reputation for high-reliability, ruggedized connectors and cable assemblies. Amphenol Advanced Sensors now features five brands of sensing devices designed to measure temperature, humidity, pressure, dust, CO², and moisture as well as validation and monitoring equipment. Amphenol also offers an extensive line of base station and Wi-Fi antennas as well as antennas created using laser direct structuring (LDS) technology.

Amphenol, the world’s second largest connector manufacturer, acquired nine businesses in 2019, including XGiga Communication Technology Ltd., a leading Chinese manufacturer of optical transceivers. They have also been adding to their roster of electronic sensor manufacturers. Their product line diversification into the world of sensors began in 2013 with the acquisition of the Advanced Sensors business from General Electric Measurement and Control Solutions. Many of the sensing devices acquired from this purchase target transportation, medical, pharmaceutical, and industrial rather than consumer applications, which complements Amphenol’s reputation for high-reliability, ruggedized connectors and cable assemblies. Amphenol Advanced Sensors now features five brands of sensing devices designed to measure temperature, humidity, pressure, dust, CO², and moisture as well as validation and monitoring equipment. Amphenol also offers an extensive line of base station and Wi-Fi antennas as well as antennas created using laser direct structuring (LDS) technology.

Molex is in a relatively early stage of diversification in terms of the market for electronic sensors. To date, they have made a limited number of strategic acquisitions that complement and expand upon their extensive lines of connectors and cable assemblies. The acquisition of Sensorcon added the manufacturer of portable carbon monoxide and hydrogen sulfide gas detectors. In 2015, Molex acquired Soligie Inc., which produces custom electronic sensors fabricated on flex circuitry. Molex sensors are often sold as application-specific assemblies that feature integrated sensors and pluggable connectors, which is particularly attractive in automotive applications.

Molex is in a relatively early stage of diversification in terms of the market for electronic sensors. To date, they have made a limited number of strategic acquisitions that complement and expand upon their extensive lines of connectors and cable assemblies. The acquisition of Sensorcon added the manufacturer of portable carbon monoxide and hydrogen sulfide gas detectors. In 2015, Molex acquired Soligie Inc., which produces custom electronic sensors fabricated on flex circuitry. Molex sensors are often sold as application-specific assemblies that feature integrated sensors and pluggable connectors, which is particularly attractive in automotive applications.

Molex continues to branch out into other related products as well. The Molex Antenna Group produces a wide variety of standard and custom antennas, including Wi-Fi, Bluetooth, Zigbee, GPS, LTE, and near-field configurations. In addition to an extensive array of fiber optic interconnects, they produce EMI shielding material and flex circuits and are investing in silicon photonic devices. The recent acquisition of Bittware and Nallatech put Molex into the fast-growing market for FPGA accelerators. Molex recently celebrated the opening of their new state-of-the-art optical R&D facility in New Jersey, which will concentrate on the development of wavelength selective switches used in high-performance networks.

Molex continues to branch out into other related products as well. The Molex Antenna Group produces a wide variety of standard and custom antennas, including Wi-Fi, Bluetooth, Zigbee, GPS, LTE, and near-field configurations. In addition to an extensive array of fiber optic interconnects, they produce EMI shielding material and flex circuits and are investing in silicon photonic devices. The recent acquisition of Bittware and Nallatech put Molex into the fast-growing market for FPGA accelerators. Molex recently celebrated the opening of their new state-of-the-art optical R&D facility in New Jersey, which will concentrate on the development of wavelength selective switches used in high-performance networks.

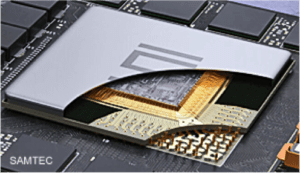

Samtec is primarily known as a leading supplier of high-performance micro-pitch board-to-board connectors. They acquired nMode Solutions and Triton Microtechnologies in 2016 to expand their ability to support both ends of a high-speed channel. The Samtec Microelectronics Group has become the technology focal point for enabling their silicon-to-silicon interconnect concept. This group specializes in chip-level packaging, which includes micro wire bonding, IC packaging, microfluidic devices, MEMS assembly, stacked die, and high-performance redistribution layers using their proprietary Glass Core Technology, as well as signal integrity, modeling, and simulation support. They also offer custom semiconductor assembly and testing, as well as packaging of electronic sensors.

Embracing diversification and branching out into components that offer synergy with their primary interconnect business makes good sense for connector manufacturers. Given the incredible market forecasts for Internet of Everything devices, adding small RF antennas, active optical devices, and electronic sensors, along with increased semiconductor packaging expertise, to the portfolios of connector companies offers an excellent path to long-term sales growth.

Like this article? Check out our other Facts & Figures and Industry News articles, our 2019 Article Archive, and our Sensors and Antennas Market Page.

- Digital Lighting Enhances your Theatrical Experience - March 5, 2024

- DesignCon 2024 in Review - February 13, 2024

- Chip Technology Struggles to Keep Pace with Moore’s Law - January 30, 2024