Automotive Wiring Undergoes an Architectural Revolution

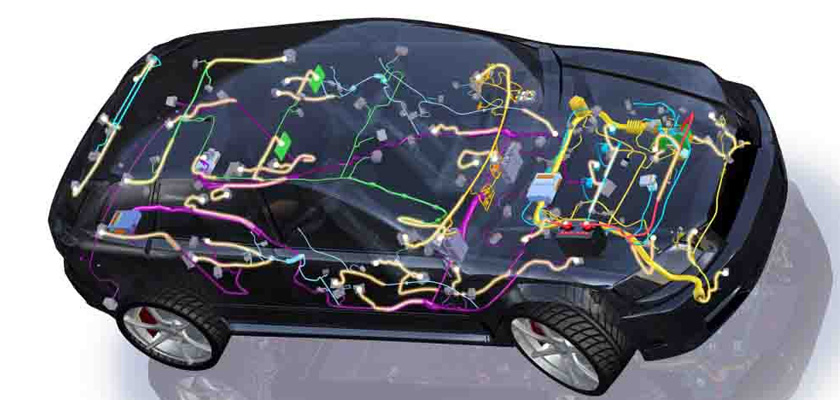

The electronic content in cars has exponentially expanded, leading to more than 150 pounds of wiring in a single vehicle, all assembled by hand — for now. As vehicles increase in complexity, a new wiring paradigm is needed.

Automotive wiring is experiencing a revolution. From the explosive growth of electronic content in vehicles to the arrival of electrification and autonomous systems, how companies design, engineer, manufacture, and deliver vehicle wiring harnesses has completely changed. Doug Burcicki, director of the automotive and transportation business in Siemen’s integrated electrical systems group, has been a close observer of the changes that have reshaped automotive systems over the past three decades. Burcicki was with the design software company Mentor Graphics when it was acquired by Siemens of Germany a year ago and, prior to that, spent 25 years with Japanese automotive electronic harness giant Yazaki and 17 of those 25 supporting GM and Chrysler. We talked to him about the changes that have occurred and the many more that are coming soon.

The automotive industry is evolving at a breakneck pace, and car makers have made some drastic portfolio changes to keep pace with changing electronics requirements. What does that mean for electronics designers working in this market?

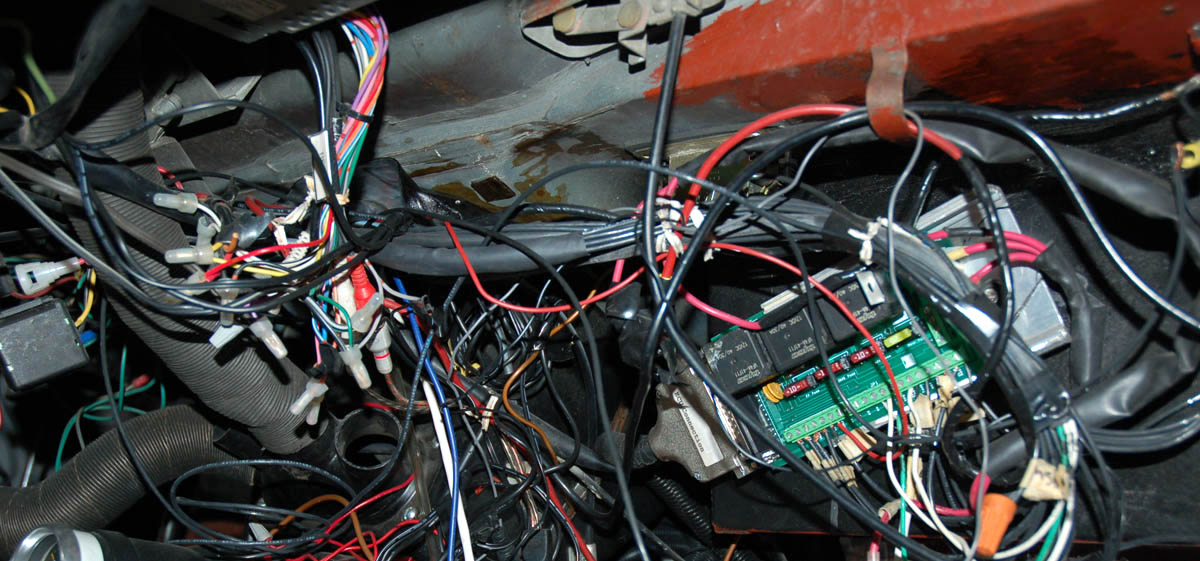

Automotive OEMs are looking at new electrical architectures to simplify harness designs so they can minimize wiring complexity and cost. They have simply had to: The wiring industry is no different than it was 80 years ago. Automotive wiring harnesses are still manually built by people who individually attach thousands of components. The architecture of the design has a huge impact on OEM business models. For the Tier One OEMs, wiring harnesses are a very labor-intensive product, so they utilize the lowest-cost labor around the world. A couple of thousand part numbers go into making each vehicle’s wiring harness and the finished product weighs 150 pounds or more. So, they have to coordinate all the materials and components for these products and ship them all around the world. This creates an incredibly long, complex supply chain with hundreds of design changes occurring along the way — all of which need to be individually tracked, implemented, and validated.

Simplified automotive wiring harness designs will lend themselves to more automated assembly and delivery processes and allow OEMs to implement changes more quickly, which will reduce costs across the entire chain. In addition to the raw materials required to build wiring harnesses — including connectors, terminals, wire, tape, and various other components — OEMs have to store a certain amount of inventory to prevent potential supply disruptions. There are a lot of hidden costs that go into the current operating model. If OEMs can automate a percentage of their manufacturing by designing new wire harness architectures, they stand to achieve huge gains.

Which standards are relevant to wiring harness designs?

Standardization has always been the holy grail, but certain regions do that better than others. Germany does a pretty good job of engineering platforms for their vehicles, while the North American auto industry has really struggled.

The variation in automotive wiring harnesses is extremely vast; it’s not just the low cost, the heavy duty, or the luxury platforms. There are certainly optimized architectures, and especially for cost and weight. The sheer physical limitation of packaging space and volume demands the latter. But many different architectures have arisen to meet the needs of individual vehicle designs and are going to continue to evolve as automobiles continue to leverage new, next-generation technologies. For example, autonomous vehicles will have to implement centralized data storage and scalable, modular system architectures, and the wiring and networking components will have to evolve to support them. The question is whether the solution to next-generation wiring challenges is optical or wireless instead of just copper. There are a huge variety of parameters that will factor into these decisions, extending from vehicle’s network and software considerations to their physical wiring and electrical performance specifications.

Right now, there is a big push toward automotive Ethernet. Ethernet solves a lot of problems in terms of speed and reliability, but it hasn’t kept up with vehicle’s high-speed network needs. In addition, the Ethernet route also won’t offer standardized products that OEMs can employ as one-size-fits-all solutions. There are sure to be some standard CAN, LIN, and Ethernet approaches, but on top of that there are always going to be proprietary and application-specific protocols because they are technically required. So, there is still no real standardized answer for OEMs to fall back on there.

How is industry consolidation impacting these developments?

There has been lots of investment and mergers and acquisitions. The systems integrators — Bosch, Conti, Magna — have been acquiring pieces that interest them. Among the component suppliers, standalone companies like Rosenberger are expected to stay on the leading edge for high-speed components. For companies like Delphi [now Aptiv] or Yazaki, development programs tend to be much more integrated and complex. These companies have focused on things like miniaturization and secondary locking features and have also had an ergonomic focus. In addition, Molex recently bought the antenna company Laird, which makes shark fin antennas designed to replace the traditional mast or rear-window grid antennas. We are going to see more of this type of consolidation and integration throughout the automotive supply chain.

Are we going to need roadmaps that matrix to these new architectural approaches?

Yes. In the past, if you added a feature like power windows to a vehicle, you also added a power window module to its wiring harness. When you look at the current architectural approach, engineers now have to implement functions such as “window up.” Today’s automotive engineers have to account for features that can be implemented with a soft switch on the center console, a hard switch on the door, or even voice activation. This means that more features have to be implemented using software solutions, which should support more standardized automotive architectures for individual OEMs. This approach to automotive architectures will also result in more component reuse, which will mean fewer but larger component applications with redundant software modules and even more diagnostics.

As vehicles become more software-driven, there will be a greater need for diagnostics that can help ensure the functional performance of critical systems. Connector and header products will require finer-pitch data and power communications, back-up or fail-safe mechanisms, and robust diagnostic capabilities, in addition to an ever-expanding suite of core functionality.

Are the car companies prepared for all of this?

The last six or seven years has been a relative free-for-all. We were in that over-hyped period where everyone gets all excited and overly optimistic, and the banks and investment houses are throwing money around. They saw a market, but they had no idea who was going to make it.

Now, there are fewer deals, but they are bigger and more strategic. With the Rivian deal [Rivian received a $500 million investment from General Motors and a $700 million investment by Amazon in spring of 2019], Ford is saying, ‘I want to electrify a huge portion of my portfolio now,’ and, in doing so, just saved themselves two years of R&D. If you believe in the technology, it’s a wise play, but it’s a different business model and a big change for the automotive industry.

For 20 or 30 years, there have been studies and activities around different automotive architectures. Back in the 1950s and 1960s, there may have been a few dozen circuits. Horn, exterior lights, AM radios, speakers, etc. Then there were power seats, power windows, air conditioning, stereo and navigation systems, and rear-seat entertainment. Cars went from having a dozen or a couple dozen to a couple thousand plugs in a relatively short span, which has had a significant effect in terms of wiring harness component count and complexity and has made a huge task of complexity management.

What does complexity management involve today?

Due to both varying consumer tastes and individual brand identities, there are thousands of automotive wiring harness variants. Each vehicle has a wiring harness with thousands of part variants and thousands of potential feature combinations. This results in millions of possible combinations of parts coming together at the vehicle assembly plant. Around 90% of these combinations are rarely, if ever ordered, but suppliers still have to create all that data, just in case, and manage the changes that impact each of those possible variants. In addition to the product design, all the enterprise resource planning (ERP) systems, the manufacturing execution systems (MES), the logistics, and IT costs are huge. There are also payment and contract implications. So, as it currently stands, you could easily have a manufacturer and its equipment supplier investing in tooling on a part number that will never ship. OEMs spend a lot of time and resources chasing this issue down.

Something had to give.

Yes. The automotive wiring industry is in the midst of a huge disruption with regard to both the architecture and the physical structure and harness type, which will have a direct impact on vehicle’s automation potential and the regions in which they can be manufactured. It will happen in waves and around certain platforms before others — and it will take decades in some cases, but it’s going to happen. It already is.

Like this article? Check out our other New Technology, Wire and Cable News, and 2019 articles, and our Automotive market page.

- Automotive Wiring Undergoes an Architectural Revolution - August 27, 2019