Accelerating into the Future of Mobility as a Service

In the years to come, it is projected that consumers worldwide will pivot from owning private cars, that they only use a fraction of the time to instead accessing mobility as a service (MaaS).

With the breathless coverage of electric vehicles (EVs), it would be easy to believe that they represent a significant disruption to the automotive market. Yet the reality is that they serve as just a step-change on the path to a new future of mobility. In the years to come, it is projected that consumers worldwide will pivot from owning private cars that they only use a fraction of the time to instead accessing mobility as a service (MaaS).

Understanding Mobility as a Service – and Why It Matters

But first, what is MaaS, and why is mobility changing?

The World Bank defines Mobility as a Service (MaaS) as “a single interface where users can plan, book, and pay for a wide range of mobility services to meet any travel need.” Users can seamlessly plan journeys, integrate public and private transportation modes flexibly, and access on-demand transportation. Providers benefit by increasing public consumption of travel services, improving equity of access to all users, and solving last-mile transportation challenges.

Global Trends Contributing to the Development of MaaS

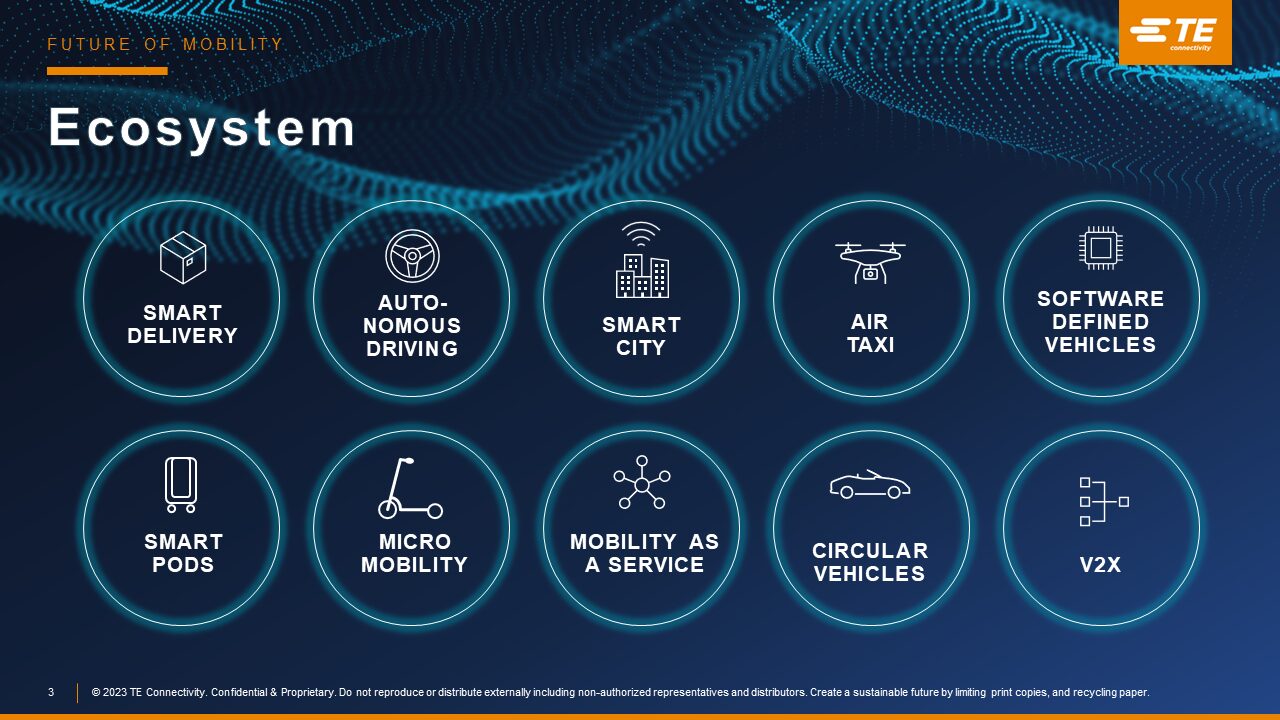

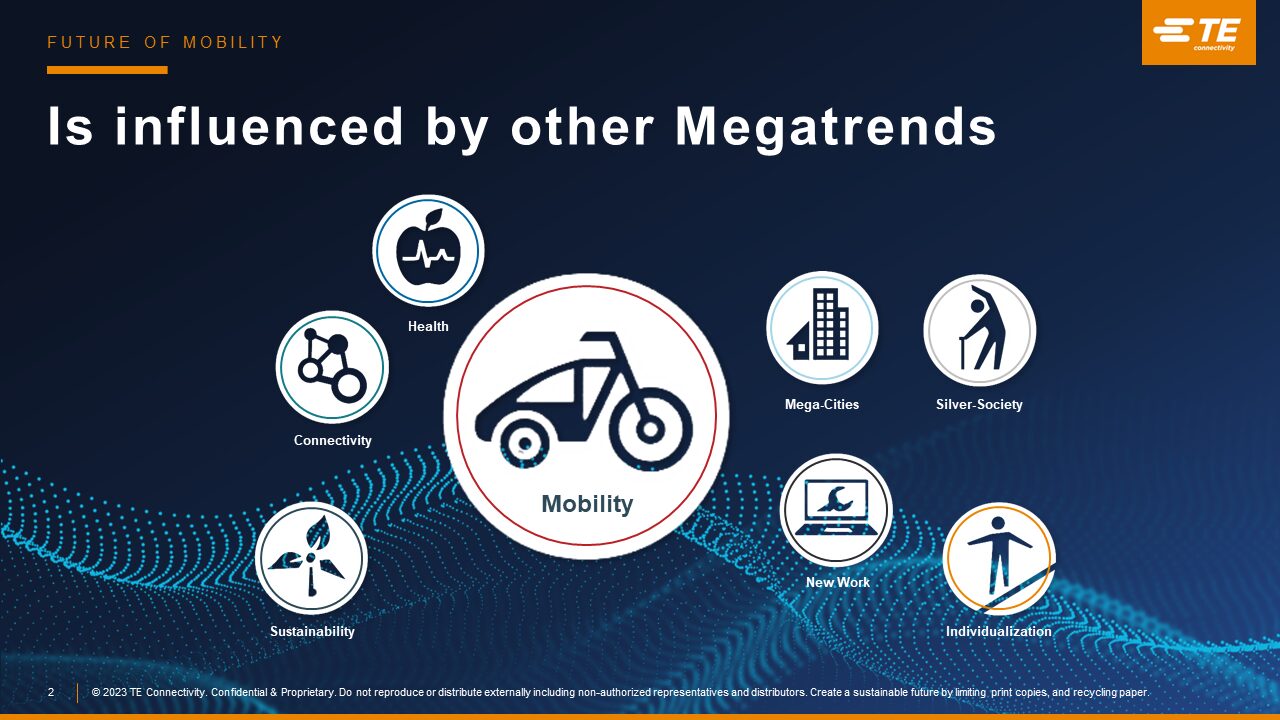

Multiple megatrends are driving the potential pivot from individual car ownership to shared transportation resources. These trends include sustainability, connectivity, the growth of megacities, and the development of smart cities.

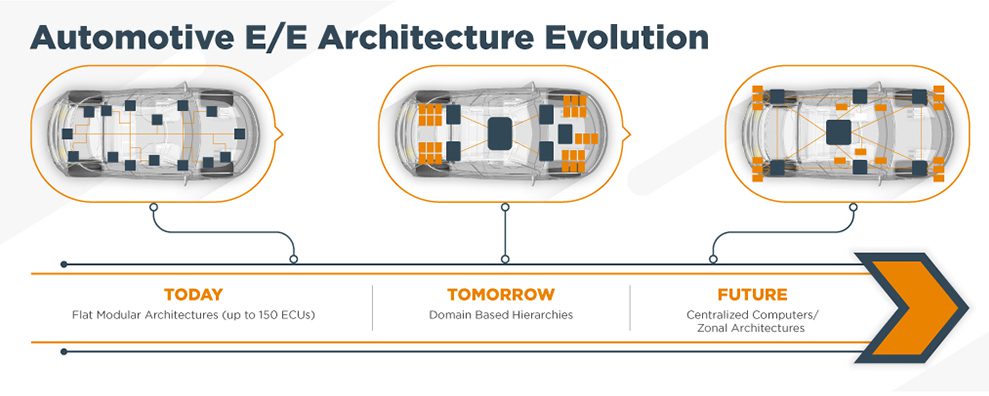

Today, many consumers own a car, 1.474 billion of them to be exact, and those vehicles are typically only operated 5% of the time. Tomorrow, however, cars will be dramatically different, leading automotive manufacturers are making fast strides to achieve the vision of fully autonomous cars, which provide leap-ahead advantages in delivering safety, comfort, and entertainment. They’re deploying software-defined vehicles (SDVs) with servers, 5G connectivity, and artificial intelligence (AI)-powered self-learning capabilities to enable ever-more powerful systems. SDV architectures used in EVs and hybrid electric vehicles (HEVs) decrease hundreds of electronic control units to 2-5 servers and reduce harness weights by 30%. They also enable software and hardware innovation to be done in parallel and auto manufacturers to update vehicles continuously.

Those advancements are enabling the viability of MaaS and they can’t come soon enough. In 1950, there were only two megacities with more than 10 million residents; today there are 45. Residents in these cities must commute and travel, yet they can’t all park cars on city streets or in lots. For those areas in particular, a more efficient and sustainable solution is needed.

At the same time, governments, technology providers, and suppliers are working hard to make those and other cities smarter, using systems of intelligence to automate processes such as streamlining public transportation and optimizing stoplights to ensure better vehicular flow.

Together, these trends will create a significant global market for MaaS, which is expected to reach $774.93 billion by 2029, with annual growth rates of 18.5% until it evolves to be the new normal.

Different MaaS models include a wide array of vehicles, including:

- Autonomous passenger vehicles: Currently, Level 2 autonomous vehicles, with safety features like advanced driver assistance systems (ADAS), are sold worldwide. Many manufacturers are testing Level 3 and Level 4 autonomous cars to ensure they are safe for deployment. They’ll likely be mass-commercialized within a year or two. While Level 5 autonomous cars are expected by 2035, widespread consumer adoption is even further out. However, it has been estimated that private car prices could likely increase by as much as 50% to cover the cost of the sensors, sensor fusion, AI, and real-time computing needed to enable a safe Level 4/5 fully autonomous car, putting these vehicles out of reach for most consumers.

- Robo-taxis and robo-shuttles: The business case for Level 5 fully autonomous driving, however, is entirely different for these types of vehicles. Driver shortages and the cost of human labor could motivate mobility companies to invest in robo-taxis and robo-shuttles and cover the higher costs of sensors, AI, and computing. Thanks in part to more efficient vehicle usage, it’s estimated that the cost of a robo-taxi trip could ultimately be 50-60% less than a driver-based trip. Robo-taxis are already starting to pop up in limited testing. Baidu is operating them in Beijing, Cruise in San Francisco, and Tesla is planning mass production of a robo-taxi fleet in 2024. Overall, they are expected to gain significant traction later this decade, with the global market for robo-taxis expected to reach $38.64 billion by 2030, with annual growth rates of 67.84%.

- Micro-mobility solutions: While at the moment Robo-taxis may be rare, Micro-mobility solutions, such as e-bikes, scooters, and self-balancing boards, are much more prevalent. Major cities offer docking stations for consumer-owned or vendor-provided e-bikes and this market is slated to grow at a CAGR of 17.4% to $214 billion globally by 2030.

- Mobility pods: Futuristic-sounding mobility pods are individual self-contained units that slide into subways, buses, or rail cars and carry two or more passengers. Fully automated mobility pods can pick travelers up from home, take them to a centralized location to be loaded onto a primary vehicle, and then transported on existing infrastructure. They then slide out of a central vehicle when the passengers’ destination is reached. They have moved from concept in 2022 to pilot deployment in Saudi Arabia, but are likely years away from commercialization. Going a step further, mobility pods could also be pulled by robo-taxis or even picked up by flying taxis to take consumers to more far-flung locations or speed up travel in congested areas.

Delivering on the Promise of MaaS

While the future looks bright, the following challenges need to be overcome:

- Improving utilization rates: To be financially viable and deliver the sustainability benefits, a business case is crucial to drive MaaS forward. Autonomous vehicles that do not need any driver and can be utilized 24/7 could potentially reduce the total cost of ownership by 45%. This is a good estimation for robo-taxis or robo-shuttles as well. Operating a robo-taxi or a robo-shuttle in a megacity 24/7 could increase the utilization rate up to 70% or higher, depending on the time waiting for the next customer and charging/service time.

- Addressing mixed traffic: Nonautonomous vehicles will share the road with autonomous vehicles for years, creating mixed traffic. This creates technical challenges, such as optimizing traffic flows, and risks, where non-autonomous vehicles or pedestrians do unexpected things, such as stopping suddenly or walking into traffic. One approach to solving this problem is to allocate dedicated routes, such as the inner circle of megacities, to autonomous vehicles, such as robo-taxis and robo-shuttles.

- Planning for the future: Automotive manufacturers will navigate constant transformation for the next few years. They will work closely with original equipment manufacturers (OEMs) to forecast megatrends, technology developments, and customer needs. They’ll also want to determine the data rate they need to enable smart cameras used for autonomous driving features, ethernet capabilities to power intelligent systems, and latency requirements to ensure safe operation and zero fatalities. These rates will be increasing every year.

- Connecting more systems: The content and software-driven features in cars is increasing, demanding reliable high-speed connectivity. MaaS vehicles rely on this connectivity more than others, so V2X infrastructure – including rapid data transfer rates within the vehicle itself – is imperative for MaaS to become mainstream.

- Changing architecture models: Today, auto manufacturers use domain-based architectures that centralize functions such as powertrain, advanced driver assistance systems (ADAS), and infotainment. These architectures merge ECU lightweight harnesses by 10-20% and require 1-10 Gb/s Ethernet and 200-300 million lines of code to provide connectivity and upgrades.Solutions for domain architectures include point-to-point harnesses and sub-harnesses to enable greater automation, miniaturized terminals; green connectors; and modularized, standardized terminal blocks and connectors.

Zonal architectures are already here. These application-server-based architectures will use 2-5 servers to provide cloud V2X communications. They will leverage only virtual ECUs to power functions, have 20-30% lighter-weight harnesses, rely on 10-100 Gb/s Ethernet, and enable collaborative applications and self-learning.

New solutions for zonal architectures include single PCB headers that support signaling, data connectivity, and miniaturization applications; and hybrid power, data, and backplane connectors that enable new centralized server architecture approaches.

Getting Ready for the Future of Mobility

MaaS models will enable a new era of mobility that reduces traffic congestion, pollution, and roadblocks to travel. Governments will gain scalable transportation solutions. Consumers will gain simplified access to end-to-end transportation services and enjoy the benefits – including increased safety and comfort – of autonomous driving. And auto manufacturers and OEMs will create new markets, deploy new service-based business models, and unlock subscription revenue streams. Truly, MaaS offers something for everyone.

To learn about about solutions for e-mobility and Maas, visit TE Connectivity.

Like this article? Check out our other articles on Smart Cities and Ev’s and HEV’s, our Automotive Market Page, and our 2023 Article Archive.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Accelerating into the Future of Mobility as a Service - January 16, 2024