The Next Industrial Revolution – Driven by a Changing World

The Next Industrial Revolution will be Driven by a Changing World

The industrial automation and process control market is characterized by the supply of industry-grade analog and digital (distributed) control (DCS) and automation control (ACS) systems, networks, and components. In recent decades, the differences between the programmable logic controllers traditionally used on the factory floor for discrete manufacturing and distributed control systems traditionally used for continuous process control have narrowed. In addition, these systems, software, and components are similar to systems now being utilized in other markets, such as building automation and management and energy network management and control systems.

Significant growth is expected in the coming years as smart grid energy (power) networks are made more efficient and improvements are seen in the control mechanisms that manage the power and energy distribution from substation to end user (smart meter). China has invested huge sums in their smart grid power networks and in less than five years may overtake the US as the leader in total electric power generation capacity. With the explosive growth of both its energy needs and its smart grid power networks, China is poised to lead the way in energy distribution automation.

The energy distribution automation system market will therefore become a major growth market around the globe and will bring higher levels of reliability and efficiency to end users and operators. By adding greater intelligence and control capabilities to their distribution infrastructure, the utility operators will be able to generate a higher ROI on their networks while improving the service level to their customers. While there are many and diverse suppliers active in this market, the top 10 vendors account for more than 70% of the 2011 worldwide distribution automation systems market.

Suppliers to this market include companies such as:

- ABB

- BPL Global

- CG Power Systems

- Echelon Corporation

- G&W Electric

- GE Energy

- Landis+Gyr

- Motorola Solutions

- Netcontrol Oy

- Schneider Electric

- Siemens

There are, however, other industries besides smart grid automation that seem to converge with industrial automation and process control markets. Frost & Sullivan, a research company, predicts that the following industries will also converge with industrial automation: the automotive industry, as it responds to demand for electric vehicles that will require charging station automation; the water and waste treatment industry, especially the desalination and reuse of fresh water, which will gain importance as natural disasters due to climate change spur demand for automated systems and pumps; and the aerospace industry, which, while looking for ways to reduce weight (and fuel consumption) by switching to carbon fiber and fiber glass products, is driving demand for new production methods and material handling processes.

As a result of these converging industries, a large variety of system and component manufacturers that service these markets have also expanded their product portfolios to supply related market segments. It is therefore not surprising that many connector manufacturers have introduced their version of electric vehicle charging plugs.

Leading suppliers of automation technology and process control products have a global reach and typically operate in a wide range of industries. Emerging markets for industrial and factory automation include high growth industries in Brazil, India, and China, as well as other developing countries. Wages in these countries are on the rise, so it becomes cost-effective, even in these countries, to use machines instead of hand labor. The so-called BRICI countries (Brazil, Russia, India, China, and Indonesia) and other emerging markets are likely to continue to drive high growth in industrial automation markets.

Leading suppliers of automation technology and process control products have a global reach and typically operate in a wide range of industries. Emerging markets for industrial and factory automation include high growth industries in Brazil, India, and China, as well as other developing countries. Wages in these countries are on the rise, so it becomes cost-effective, even in these countries, to use machines instead of hand labor. The so-called BRICI countries (Brazil, Russia, India, China, and Indonesia) and other emerging markets are likely to continue to drive high growth in industrial automation markets.

In short, converging industries and markets are driven by high-level technology trends and their growing global demand, including:

- Energy efficiency in production and manufacturing;

- Sustainability and environmentally friendly production methods;

- Easy integration of machines, plants, and other production attributes;

- Use of Internet and wireless technology for (remote) management and control;

- Increased reliability and minimal downtime;

- Production and manufacturing flexibility to react quickly to changing demands;

- Cloud computing on the factory floor;

- Improved (cyber) security.

As discrete automation, process, and energy markets converge, those companies that offer integrated solutions across these segments may be best positioned for the years ahead. This may benefit large European players such as Siemens, Schneider, and ABB, but also the US-based General Electric.

Industrial Ethernet

While these industrial automation markets develop and grow, automation networks and technologies have also evolved. Over the years, Ethernet industrial protocols have become a de facto standard on the factory floor. Most of these protocols, however, were developed with a specific application in mind, and are optimized when serving that particular purpose. Currently, the most widely used Industrial Ethernet protocols are Ethernet/IP, EtherCAT, Ethernet Powerlink, ProfiNet, and SERCOS III.

Wireless Communication on the Factory Floor

Another major trend in industrial networking has been the use of wireless technology on the factory floor, which demands reliability, robustness, and deterministic communication. These are offered by the WirelessHART and ISA100.11a protocols that are mostly used for factory floor applications.

Another major trend in industrial networking has been the use of wireless technology on the factory floor, which demands reliability, robustness, and deterministic communication. These are offered by the WirelessHART and ISA100.11a protocols that are mostly used for factory floor applications.

Wireless communication on the factory floor allows for lower maintenance and installation costs, increased mobility and flexibility through remote control, and cost-savings on wiring and cables.

For the successful implementation of WirelessHART and ISA100.11a in the process automation and manufacturing industries, it is imperative that both technologies work flawlessly and reliably with other wireless systems that operate in the 2.4-GHz band. Examples of such systems are IEEE Standard 802.11-based wireless local area (Ethernet) networks (WLANs), Bluetooth (IEEE 802.15.1), and Trusted Wireless technology. GSM and 3G networks are also used on the factory floor and can be used for SMS-based control systems and/or systems that require worldwide access.

With the deployment of 4G and Cloud computing, the speed and bandwidth allow the transport of larger amounts of data over longer distances at higher speeds while enabling access to this data from virtually anywhere in the world. Cloud computing on the factory floor is widely recognized as one of the drivers of industrial automation in the coming years.

As a result of these technology trends, a shift in the connector mix used on the factory floor is emerging. There is more demand for robust and sealed RJ45 and USB-style connectors, an increased use of fiber optic connections, wireless antennas, and coaxial/RF connectors, but also for M12 X-coded connectors. This means that there are similar shifts in the connector space in order to meet this demand for high reliability, high throughput/high speed, and robustness.

Connector Technology and Application Trends

Improvements have been achieved in a number of areas of design, primarily those illustrated below.

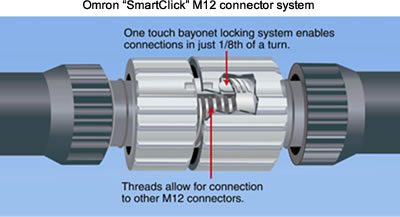

- Connector latching mechanisms–Locking in 1/8 of a turn

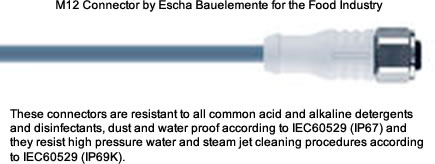

- Sealing and corrosion resistance–

- Higher data rates to 500 Mb and higher to 1GB /10GB–

Besides RJ45, M12-style connectors are also used for industrial Ethernet connections. The M12-style connector is available as a 4- or 8-pole connector and can offer IP67/IP69K protection. They are available as molded or field-terminated connections.

Most recently the M12 X-Code connector appeared on the market. X-Code connectors are distinguishable by the way in which the eight wires in the Ethernet cable are segmented into four shielded pairs. This connector type has been developed to keep pace with the increasing use of Gigabit Ethernet on the factory floor from 1GB to 10GB Ethernet. HARTING, Phoenix Contact, CONEC, Metz/RIA, Belden/Lumberg, Turck and Escha have released this type of connector.

- Robust USB/RJ45 interfaces on the factory floor for Industrial Ethernet applications–

- Application-specific connector designs–

The specific harsh environment in which the connectors often have to perform in industrial applications implies critical design specifications, which have to be met by the connector manufacturers. Connectors used in the industrial markets are built to meet all the requirements for use in a harsh environment and in addition meet the electrical specifications to transmit signals in a safe and deterministic way. The margin for error is usually very small.

The critical connector performance attributes required for today’s factory floor include:

- Sealing from water/dust to IP 67 and higher;

- Extended ambient temperature range of -40° C to +125° C;

- Multiple keying positions;

- Positive latching to prevent accidental disconnect under extreme vibrations;

- Termination to shielded cable;

- Resistant to long-term shock and vibration;

- Standard connector configurations M8, M12, M23, 7/8”, RJ45, USB, D-subminiature;

- Long service life;

- Terminal block termination for tool-less installation.

The industrial automation market is a very diverse market with many niche applications that have their own specific requirements. Another section of the industrial market, AC drives/motion control, is poised to grow in light of the need for more energy efficiency. Likewise, the total inverter market size of almost $44 billion in 2011 is expected to reach about $57 billion in 2016, with a high double-digit compound average growth rate for applications such as electric vehicles and hybrid electric vehicles and renewable energy. The overall shipments of inverters for every power range should reach almost 28 million units. This means the need for passive components and connectivity solutions such as power connectors and bus bars will also represent a huge market in coming years.

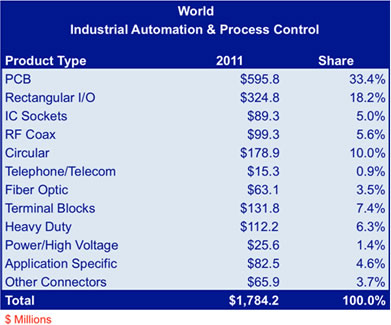

In the wide range of equipment that falls into the industrial automation segment — including robotics, vision systems, RFID systems, process controls, motion control, programmable logic controllers, and many more — an equally wide range of connectors is used for control equipment (PCB connectors), I/O signals, and man-machine interfaces (I/O connectors and terminal blocks), machine connections (heavy-duty and circular connectors), networking modules (RJ45, USB, M12 connectors) and so forth. Bishop & Associates estimated the total potential for connectors used in industrial automation applications at almost $1.8 billion in 2011 (see next table).

Connector Potential Industrial Automation 2011

Conclusion

While many technologies in industrial automation and process control have been developed, we expect the market will be driven by high-level trends in energy efficiency, smart grid automation, EV rollout, sustainability, and environmental technologies. These will drive the use and implementation of “smart” technologies such as wireless communication, advanced networking, cyber-security, and cloud computing.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019