The Transportation Market for Cable Assemblies – The Bullet Train of Markets

The Transportation Market for Cable Assemblies Grows worldwide

The transportation industry has experienced strong growth over the last two years. The growth has been fueled by the (relatively) improving economies of the world since the recession, and the need for new equipment brought on by two years of austerity by service companies, particularly the airlines, and by industrial companies.

Bishop tracks 13 market sectors for electronic interconnects. The combined annual revenues of all the market sectors was $4 trillion in 2011, and grew by 9.7% over 2010. Of the 13 market sectors, transportation was the fastest-growing sector in 2011 at 19.5% year-over-year, with combined revenues of $291.4 billion. Profitability was up 49.2% year-over-year to $18.6 billion and sales growth was well above 2010 levels, growing 12.6% year-over-year.

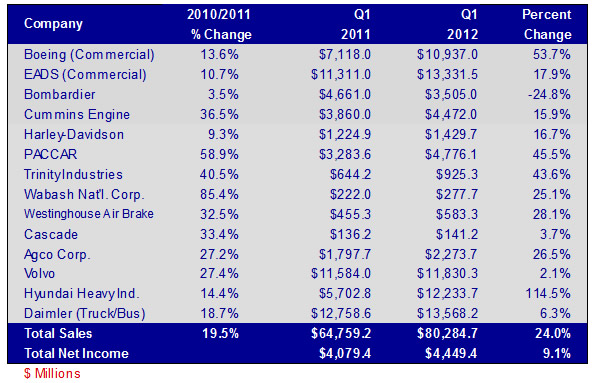

Hyundai Heavy Industries had the most growth in this sector for the first quarter 2012 at 114.5% year-over-year. Hyundai is the largest builder of ships in the world, and is prospering on the increasing freight between the Far East, Europe, and North America. Boeing grew 53.7% year-over-year in the first quarter on revenues of $10.9 billion. Boeing shipped 137 planes in the first quarter, 99 of which were the 737 MAX (next-generation) models. Boeing and Airbus have both been ramping up their production lines for their narrow-body jet airliners as worldwide demand is expected to continue increasing for these models over the next 10 years. Airbus revenues were up a strong 17.9% in the first quarter. PACCAR’s first-quarter revenues grew 45.5%. They build large, Class 8 commercial trucks, and attribute their growth to increased freight tonnage and higher fleet utilization, driving their customers to replace aging equipment. As a side note, Volvo and Daimler saw much lower growth rates in the first quarter, due in great part to the weaker European market for their products. Trinity Industries grew 43.6% year-over-year in the first quarter. Trinity reported higher revenues from an increase in railcar shipments and from the Inland Barge Group.

Cascade Corp., a manufacturer of forklift trucks, saw a small increase in sales of 3.7% in the first quarter. Bombardier is the only company in our transportation market sector that saw a decrease in sales. The manufacturer of commercial aircrafts, trains, and rail systems saw a first-quarter drop in revenues of 24.8% year-over-year. The company attributes the drop in sales to a slow business jet market, but it also had a significant drop in commercial aircraft. Bombardier also experienced a contraction in its rail business in China. Commercial aviation and rail were down approximately $700 million and $500 million, respectively.

Transportation Equipment Sector – Sales and Net Income

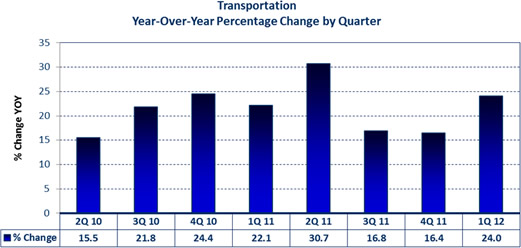

As you can see in the following chart, year-over-year sales have been growing in the double digits each quarter for the transportation sector since the second quarter of 2010. Sequentially, first-quarter 2012 sales declined 2.6% from the fourth quarter of 2011.

As you can see in the following chart, year-over-year sales have been growing in the double digits each quarter for the transportation sector since the second quarter of 2010. Sequentially, first-quarter 2012 sales declined 2.6% from the fourth quarter of 2011.

Impact on the Cable Assembly Industry

Bishop projects the worldwide market for transportation cable assemblies to grow 3.2% for 2012. What happens in 2012 and beyond will depend on social, economic, and political factors worldwide. Some observations:

- Although Europe narrowly averted a recession in the fourth quarter of 2011, their economies have stagnated. Europe’s GDP contracted 0.1% in the first quarter of 2012. Year-to-date, the interconnect industry is down double digits in Europe and expected to get slightly worse through the second half. The transportation market will have to look to Asia Pacific and North America for growth.

- There is high demand for the narrow-body jet aircraft such as the Boeing 737 and Airbus 320. Boeing is forecasting worldwide airplane sales of 34,000 jets, worth $4.5 trillion, over the next 20 years. Approximately 60% of these planes will be narrow-body. The biggest market will be Asia Pacific. The value of the cable assemblies in these planes will exceed $100 billion.

- The ocean freight market is expected to grow 4.5% in 2012 and 7% in 2013 to 2015. This should help continued growth in the shipbuilding market.

- Asia Pacific and Europe have the greatest potential for growth in high-speed rail. According to Frost & Sullivan, there are more than 14,000Km of track already installed in both areas, with construction either under way or planned for over another 20,000Km.

- With the slowing of the world economies in 2012, the commercial trucking market is also expected to slow.

Bishop & Associates projects the worldwide market for transportation cable assemblies to grow to $5.8 billion in 2012. The majority of the growth will be in China and Asia Pacific, where the expansion will be between 8%-12% year-over-year.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019