Top 10: Mil/Aero Market by the Numbers

Which country leads the world in mil/aero expenditures? Which connector manufacturer is the military market’s leading supplier? Which OEM leads the market in sales? Bishop & Associates crunched the numbers to find out.

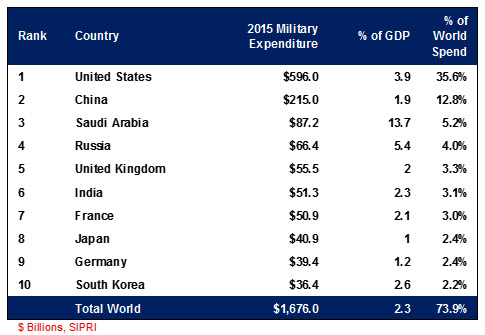

In 2015, the top 10 countries for military expenditures represented 74% of the total worldwide outlay according to SIPRI (Stockholm International Peace Research Institute). The United States leads the list at $596 billion, outspending China (#2) by almost three times and South Korea (#10) by 16 times. Out of the top 10 countries, Saudi Arabia spends the largest percentage of GDP at 13.7%. The total world expends $1.7 trillion, representing 2.3% of the world GDP.

2015 Top 10 Countries

for Military Expenditures

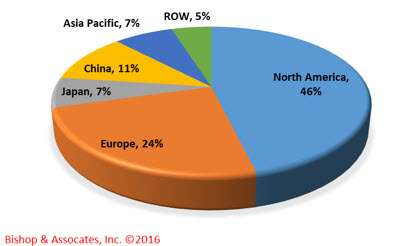

The worldwide demand for connectors in the military/aerospace market was $3.1 billion in 2015, down 9% from 2014. Not surprisingly, North America consumed 46% of those connectors by dollar volume.

2015 Military/Aerospace Market for Connectors

Sales by Region of the World

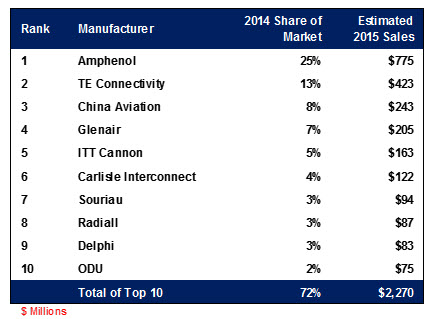

Out of the top 100 connector companies, the top 10 companies that supply connectors to the military/aerospace market provide 72% of the worldwide demand for that market (based on 2014 sales). Amphenol has the largest market share at 25% of the military/aerospace market, followed by TE at 14%.

Military/Aerospace Market for Connectors

Market Share for Top 10 Suppliers

The top 10 largest OEMs in the military/aerospace market supply $226 billion of hardware and services. The largest is Lockheed Martin at $46 billion. The company employs 116,000 people worldwide and receives approximately 10% of the Pentagon’s funds. Programs it manages include C-130 Hercules, C-5 Galaxy, F-16 Falcon, F-22 Raptor, F-35 Lightening, the Aegis combat system, and advanced ballistic missile defense systems.

2015 Military/Aerospace Market

Top 10 OEMs

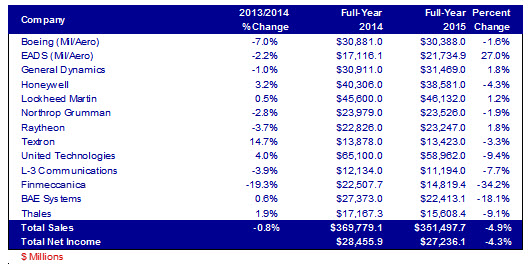

Bishop follows 13 public companies in the military/aerospace market on a quarterly basis. In 2015, sales for these companies declined 4.9% over their 2014 sales. Profitability decreased 4.3% year over year.

Of the 13 companies, EADS had the largest increase in sales in 2015 at 27%. Lockheed Martin was the largest company in 2015 at $46.1 billion.

2015 Military/Aerospace Market

14 OEMs’ Results

Military/aerospace connector sales decreased 9% in 2015. Combined sales of the 14 mil/aero OEMs that Bishop tracks declined 4.9% in 2015.

Sales information for these companies and others can be found in Bishop & Associates’ Top 100 Connector Manufacturers report. Profiles of more than 700 connector companies can be found on Bishop & Associates’ subscribers-only World’s Connector Companies website (www.worldsconnectorcompanies.com). For more information, contact [email protected] or call 630-443-2702.

No part of this article may be used without the permission of Bishop & Associates Inc.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019