Amphenol is On a Roll

With its ambitious acquisition strategy, the company has skyrocketed into the connector industry’s second largest position. CEO Adam Norwitt shares his insights on the big portfolio, product strategy, China, and what it’s like to manage a company that is actually many dozens of companies.

Since January 2000, Amphenol has acquired over 70 companies, with 10 of them joining the company in 2023 alone. To kick off 2024, the company has also acquired Carlisle’s CIT business. With the 2023 newcomers adding $600 million in sales and CIT bringing in another $900 million, Amphenol Corporation has outperformed the connector industry and the S&P 500 in the 21st century. Clearly, the company’s voracious acquisition strategy has contributed significantly to this success, but so has solid internal growth.

Amphenol’s leadership has maintained a clear vision centered on developing a large and diverse portfolio of interconnect products that serve both emerging technologies such as AI and quantum computing as well as established electronic markets such as industrial equipment, automotive, transportation, military, telecom/datacom, computers & peripherals, medical, and consumer products. In addition to connectors and cable assembly manufacturers, Amphenol is acquiring companies that manufacture antennas, sensors, microwave components, fiber optics, and broadband-related products. Collectively, Amphenol’s companies also hold the number one or two position from an interconnect product standpoint in the heavy duty/harsh environment, power/high voltage, fiber optic, circular, PCB, and RF interconnect markets. In other words, Amphenol does it all.

This era of phenomenal growth has occurred under the guidance of Director and Chief Executive Officer R. Adam Norwitt, who joined the company as an intern in 1998, working in Taiwan and China in mergers and acquisitions. He went on to hold a variety of executive roles, becoming president of Amphenol Corporation in 2007 and director and chief executive officer in 2009. Norwitt received a B.S. in international politics from Georgetown University’s School of Foreign Service, an MBA from INSEAD in France, and has a Juris Doctor degree from the University of Michigan. He shared a few insights into Amphenol’s success.

This era of phenomenal growth has occurred under the guidance of Director and Chief Executive Officer R. Adam Norwitt, who joined the company as an intern in 1998, working in Taiwan and China in mergers and acquisitions. He went on to hold a variety of executive roles, becoming president of Amphenol Corporation in 2007 and director and chief executive officer in 2009. Norwitt received a B.S. in international politics from Georgetown University’s School of Foreign Service, an MBA from INSEAD in France, and has a Juris Doctor degree from the University of Michigan. He shared a few insights into Amphenol’s success.

Bishop & Associates expected to see some slippage in Amphenol’s 2023 financial performance because of all the acquisitions. However, Amphenol actually outperformed the industry. How did you do that?

Our companies perform well because we give the management team complete authority to run their operating unit. The team on the ground, those closest to the customer, have total flexibility. We do not micro-manage from headquarters (HQ). However, as a matter of common sense, the operating units take advantage of the benefits of Amphenol’s size. Amphenol’s operating units are encouraged to work collaboratively to take advantage of the company’s breadth of technologies and market position.

For example, many of our units produce cable assemblies. We do not insist the connector on the assembly be an Amphenol product. If they can acquire a connector for less, they will use a competitor’s product. This is a good illustration of our commitment to management autonomy and flexibility in running their business.

How do you incorporate the newly acquired companies into the mix?

We have three divisions, 14 groups, and 135 operating units. The new companies are not integrated into Amphenol; they have total operating autonomy. The divisions are Harsh Environment Solutions, Communications Solutions, and Interconnects and Sensor Systems. We establish high standards of achievement and reward our teams accordingly. For example, our managers can earn 100% of their target bonuses for sales growth of 7% and income growth of 11%. We want our teams working for shared goals with high spirits. Coupling achievement and compensation has worked well for us.

Besides connectors and cable assemblies, Amphenol is acquiring sensors and antennas. What other products are in Amphenol’s future?

We are fortunate to be in the fast-growing and profitable electronics industry. We plan on sticking with our current strategy and do not expect to add non-interconnect related products. After all, in 2022, the connector industry was valued at $84 billion, the cable assembly market at $214 billion, and the sensor and antenna industry are north of $100 billion. These large and growing markets offer us a lot of opportunities.

You must be optimistic about the future. Where do you see Amphenol in 10 years? At your current CAGR of 10.8%, Amphenol would have annual sales of approximately $28 billion in 2033.

I am reluctant to predict the future, but I am optimistic. We are well positioned in the growing electronics industry. We have broad enabling products and a great entrepreneurial attitude. We anticipate that Amphenol’s culture will remain vibrant, and we will be able to continue our past success well into the future.

And now, for the numbers.

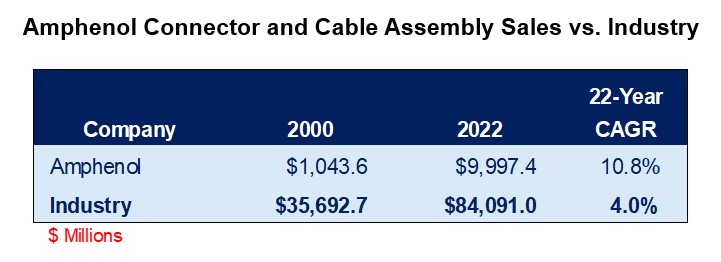

Amphenol’s acquisition strategy, coupled with internal growth, has increased Amphenol’s market capitalization from $1.3 billion on January 1, 2000, to approximately $65 billion today. That is a compound annual growth rate (CAGR) of 17.7% compared to the S&P 500 CAGR of 5.0% — almost triple the overall industry. Their connector and cable assembly sales achieved a 10.8% CAGR versus the industry CAGR of 4.0%.

Amphenol’s total sales are approximately $12.5 billion, of which over $2.5 billion are non-connector or cable assembly products. Bishop reports on connector and cable assembly sales by connector companies.

The connector industry’s second-largest company

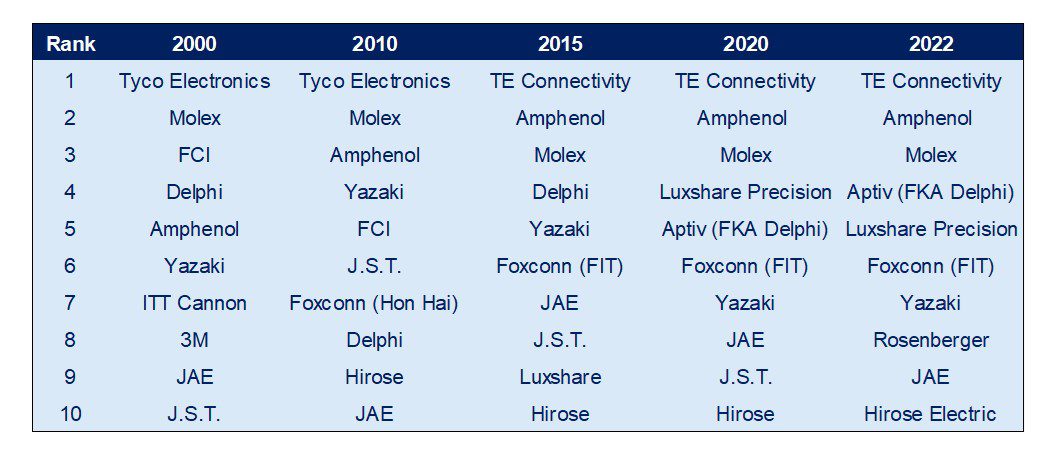

In 2000, Amphenol was ranked the fifth largest connector company in the world. Amphenol is now ranked number two in size behind TE Connectivity. The following table ranks the top 10 companies and shows how the ranking has changed since 2000.

In 2000, Tyco Electronics’ connector business was 6.7 times larger than Amphenol. Now TE Connectivity is 0.8 times larger with approximately $2.5 billion more connector and cable assembly sales. In 2000, TE had about $7.0 billion more connector sales than Amphenol. Clearly, the acquisition strategy, if continued at the current pace, would eventually make Amphenol a challenger for the number one ranking.

China drives growth

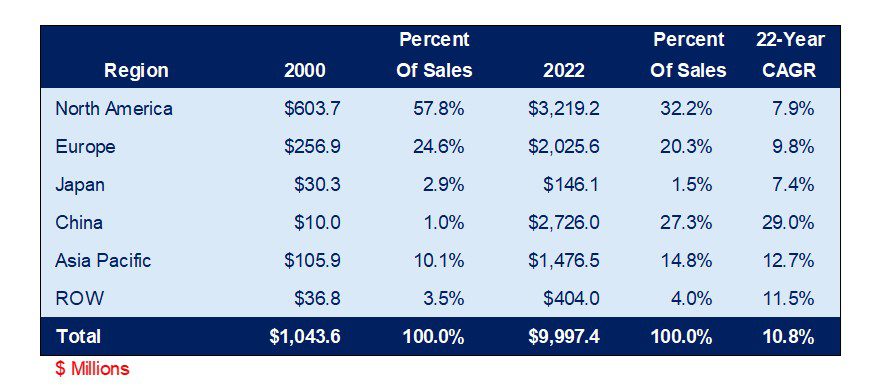

The following table shows Amphenol sales by region of the world along with the 22-year growth rate.

Amphenol Regional Sales

Key takeaways

- China drives Amphenol sales with a 29% CAGR.

- China grows to 27.3% of Amphenol’s total sales from minimal China sales in 2000.

- Amphenol now has approximately 250 manufacturing plants, with approximately 50 in China.

Amphenol’s market share quadruples

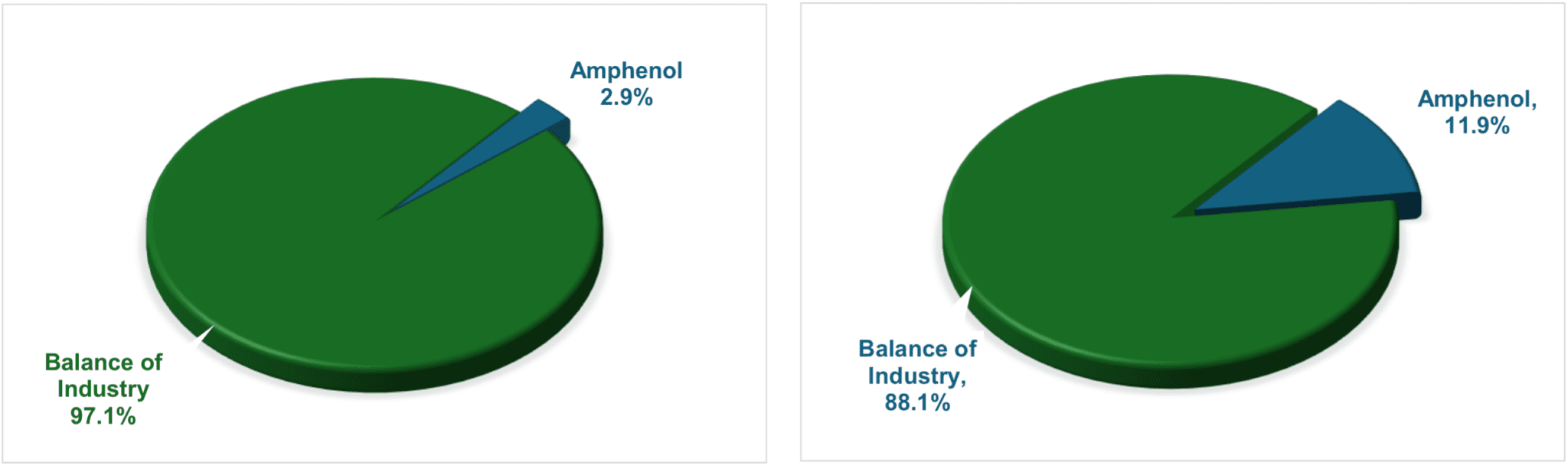

Amphenol grows from 2.9% share of the connector market in 2000 to 11.9% now.

Amphenol Market Share

Since 2000, Amphenol has added $8.9 billion in connector and cable assembly sales.

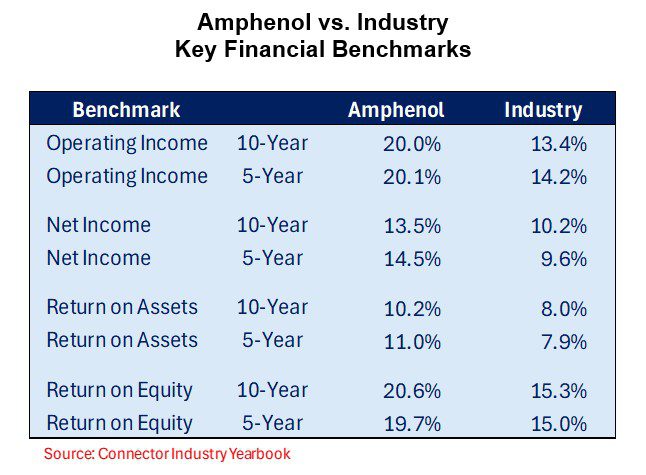

A solid operator

Considering the large number of acquisitions, it would be understandable if key financial benchmarks were to slip a bit. That is not the situation with Amphenol. Throughout the process of acquiring, and rapid internal growth, Amphenol has outperformed the industry in key financial benchmarks.

Like this article? Check out our other articles on Acquisitions and Personnel, our Automotive Market Page, and our 2023 and 2024 Article Archive.

Like this article? Check out our other articles on Acquisitions and Personnel, our Automotive Market Page, and our 2023 and 2024 Article Archive.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- State of the Industry: 2022-2023 Connector Sales - April 16, 2024

- Amphenol is On a Roll - April 2, 2024

- Nicomatic Proves That Two Heads are Better Than One - March 26, 2024