Let There Be (LED) Light

LED Light

Governments, energy producers, and environmentalists around the world have been on a mission to kill the incandescent light bulb. A very small percentage of the energy these lamps consume is actually converted into visible light; the majority ends up generating wasteful heat. The emergence of more efficient alternatives means obsolescence appears to be inevitable for Edison’s creation.

Governments, energy producers, and environmentalists around the world have been on a mission to kill the incandescent light bulb. A very small percentage of the energy these lamps consume is actually converted into visible light; the majority ends up generating wasteful heat. The emergence of more efficient alternatives means obsolescence appears to be inevitable for Edison’s creation.

The prime contenders to take its place are the compact fluorescent lamp (CFL) in a variety of shapes, and light emitting diodes (LEDs). Both offer much longer service life and energy efficiency, but the similarity ends there. Fluorescent lamps have been around since the 1930s, and although they can reduce power consumption by half, and the quality of the light has been greatly improved over the years, they still are physically large, are affected by low temperatures, and contain a tiny amount of toxic mercury, causing some concerns about recycling. The glass envelope is fragile and dimming can be problematic. The biggest advantage that CFLs offer today is their relative low cost. A common 60-watt equivalent helical CFL bulb can be had for $1 or less. Several electric utilities offer rebates that can further reduce the cost to near zero. Utility companies do this in an effort to reduce demand and delay the need to build more expensive generating capacity.

Despite the initial success of the CFL, the long-term replacement for the common light bulb appears to be the light emitting diode. These solid-state devices have evolved from simple red indicator lights to intense white light sources that today are being used in applications that range from architectural and theatrical lighting applications to automotive taillights.

Individual molded LED lamps have evolved to high-power LED arrays that can provide every color of the visible spectrum in defused or highly focused output. LED lamps now entering the market offer exceptional efficiency with up to 165 lumens per watt. Philips recently announced development of a new tube LED lamp that is capable of generating 200 lumens per watt. A typical incandescent 60-watt bulb produces about 14 lumens per watt.

Few new technologies come without challenges. Unlike incandescent lamps that radiate heat, an LED fixture must conduct heat away from the die. New, high-power LEDs generate considerable heat in a very concentrated area, making thermal management heat sinks or spreaders essential. LED drivers use switched power suppliers that can inject EMI noise into the power line. Early LEDs could not be dimmed using common triac dimmers. That problem has largely been solved with new generations of LEDs and drivers, but issues regarding color quality and consistency over the life of the lamp remain. LED light sources have been promoted as having up to a 50,000-hour service life, but the associated electronic components may fail long before then. Electrolytic capacitors used extensively in SSL circuits are notorious for early failure due to elevated temperatures commonly encountered in lighting fixtures.

One of the biggest challenges for LED adoption today is the high cost. An LED alternative to the standard A19, 60-watt incandescent bulb is currently priced at $10 or more. Prices have dropped by more than 50% over the past year, but are still a barrier to mass-market acceptance.

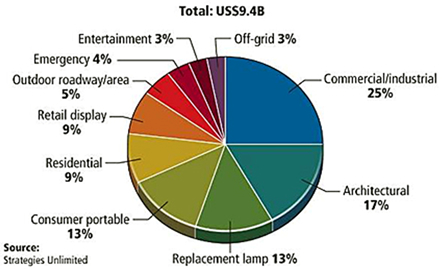

The most successful applications for LED illumination to date include street, architectural, and commercial lighting. Applications that range from large warehouse downlights to commercial showcase lighting are converting to LED sources. Users are adopting LED illumination because of several factors, including lower operating and maintenance costs, clarity of the light, as well as the ability to put a light source in tiny spaces that would be impossible with conventional light sources.

Developing reliable and cost-effective connectivity for solid-state lighting devices has opened up an entirely new market for connector manufacturers, but questions remain about the long-term role of connectors in this segment. At first glance, some luminaire manufacturers questioned the need for a separable interconnect for a device that is promoted to have a 50,000-hour operating life. Will a consumer want to replace the LED array after 10 or 15 years, or simply replace the lamp? Although the cost of the interconnect is relatively low compared to the LED array, heat sink/spreader, and driver, commodity consumer products are always squeezed to take every possible cent out of the cost. Connector cost will be compared with a hand-soldered wire at Asian factory labor rates. Finally, will the introduction of a connector result in a potential failure point? As it turns out, the connector can provide a more consistent and reliable alternative to a hand-soldered connection. The market seems to be evolving around connectors that facilitate the assembly of the light fixture, including connection to the driver and interconnects to PCB-mounted and LED array modules.

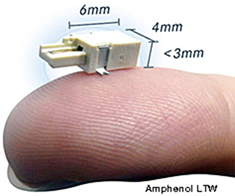

The basic characteristics of connectors used in the SSL industry include relatively low pin count (typically two to four but as many as 12 contacts), very low profile, compatible with hand and automated assembly, adaptable to fit unique applications, and of course, low cost. Tin- and gold-plated contacts are available, depending on the application. Initial interconnects that required only two power contacts are beginning to see demand for six to 10 contacts to address features such as dimming and color hue change.

The basic characteristics of connectors used in the SSL industry include relatively low pin count (typically two to four but as many as 12 contacts), very low profile, compatible with hand and automated assembly, adaptable to fit unique applications, and of course, low cost. Tin- and gold-plated contacts are available, depending on the application. Initial interconnects that required only two power contacts are beginning to see demand for six to 10 contacts to address features such as dimming and color hue change.

Since there are no established connector standards yet, each luminaire manufacturer has different dimensional and assembly requirements, resulting in opportunities for nimble suppliers willing to address the needs of several thousand relatively low-volume customers. Zhaga is a global consortium that is attempting to create a specification that will allow light sources from multiple manufacturers to be interchangeable by specifying the electrical, mechanical, thermal, and photometric interface of the light engine. Success of Zhaga would go a long way to bringing order to this emerging industry. Molex, TE Connectivity, and WAGO are members of the Zhaga organization.

A select group of connector suppliers have chosen among several basic strategies for addressing interconnects for solid-state lighting devices.

Suppliers such as Amphenol LTW, ept, ERNI, Hirose, JST, JAE, Samtec, and WAGO are promoting a variety of low-profile, low pin count, edge card, pin-and-socket, and discrete wire connectors that allow simple interconnection to LED fixtures. In some cases, these are connector families that have existed for some time, but fit many common board-to-board and wire-to-board LED interconnect applications.

Some of these connectors offer discrete wire IDC termination, while others provide very low cost coplanar board interconnects required in LED replacement fluorescent tube applications where rows of LEDs mounted on narrow PCB strips are mated end to end.

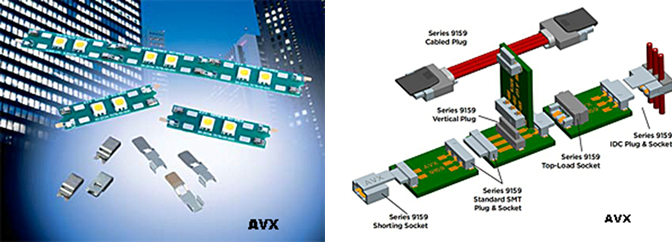

AVX is an example of a company that has made a major commitment to supporting niche applications in LED luminaires. They offer 25 product lines, which are outlined in a 78-page catalog and feature many variations of wire and PCB interconnects specifically designed for SSL applications.

One- and two-piece connectors for discrete wire as well as perpendicular and edge-to-edge PCB links are available in multiple configurations. An open-ended back-to-back card-edge connector provides four contacts in a 4mm-wide housing. AVX recently introduced a simple surface mounted poke-home contact that accepts as large as 12-gauge stripped wire.

AVX and similar suppliers have chosen to focus on connectors associated with the wiring or PCBs that lead up to the LED source itself, as opposed to contacts that actually touch the LED array.

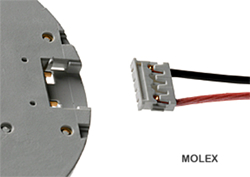

Molex has entered the SSL market using its extensive line of standard connectors to address applications in indoor and outdoor illumination, displays and signage, transportation lighting, and intelligent lighting controls.

Molex has entered the SSL market using its extensive line of standard connectors to address applications in indoor and outdoor illumination, displays and signage, transportation lighting, and intelligent lighting controls.

In addition to its standard connectors, Molex has carved a major niche in LED array holders. Holder assemblies are at the heart of an LED fixture, as they provide mechanical support, electrical connection, and a platform for attachment of thermal management devices as well as secondary optics. Molex has produced holder assemblies that are customized to accept modules manufactured by Bridgelux, Citizen, Cree, lllumitex, and Sharp.

A recent collaboration with Bridgelux has resulted in the introduction of a new holder for the Vero LED array. Luminaire manufacturers have the option of simply plugging a two- or four-position Pico-EZmate connector into the integrated receptacle or direct solder-attach it to designated pad areas built into the holder.

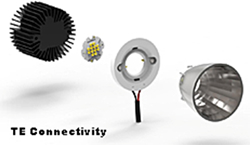

TE Connectivity has shifted its focus to concentrate on a wide variety of both LED infrastructure interconnects as well as holder assemblies. Its extensive line of dedicated SSL interconnects includes multiple wire-to-wire, wire-to-board, and board-to-board product lines. Its SlimSeal connector features a low-profile, single row of contacts in an IP67-rated, UV-resistant housing to support applications in wet outdoor lighting applications.

The NECTOR S line is a two- and four-position mini-circular connector family that is rated to 125 VAC. The 7.5mm diameter connector easily fits through an 8mm hole, making it ideal for bringing power to SSL fixtures embedded into furniture and cabinetry. Two- and six-way splitters as well as right-angle headers provide design flexibility.

TE also offers an extensive array of holder assemblies designed to be compatible with a variety of LED arrays from Philips, Sharp, Citizen, and Cree. Compressive contacts secure the LED array while simple “poke-in” contacts terminate discrete wires to the driver. TE’s “Z” series of holders allows its customers to build Zhaga-compatible products.

It may be several years before solid state lighting becomes the dominant light source in the United States, but a combination of environmental concerns, energy conservation, and government mandates are making the domination of LED lighting inevitable. The value of luminaires using LED sources will grow to over $20 billion by 2016 with a CAGR of 19%. Several industry forecasts estimate that LEDs will replace 50% of the world’s florescent tubes in commercial workplaces by 2023. The rate of adoption will likely accelerate as consumers discover the unique capabilities that LEDs offer, such as automated mood lighting controlled via mobile devices. Connectors are likely to play a major role in that growth curve, especially as standards bring order to this currently fractured industry.

- Optics Outpace Copper at OFC 2024 - April 16, 2024

- Digital Lighting Enhances your Theatrical Experience - March 5, 2024

- DesignCon 2024 in Review - February 13, 2024