International Requirements Prompt Product Changes and Standardization

A multitude of requirements compel manufacturers to default to worldwide commonality.

EU regulations, such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), the US Dodd-Frank Law (involving Conflict Minerals), and California’s Proposition 65 (currently listing over 800 chemicals that must be flagged), affect composition, processing, costs, and supply chain sourcing for interconnect components. After eliminating military/aerospace market sales, Europe accounts for about 22% of worldwide commercial connector sales. While many requirements originate in the EU, most companies cannot afford to offer divergent models for various world markets and, as a result, incorporate EU requirements for all production. This product “mix” for international sales is illustrated by TE Connectivity’s product offerings that serve customers in over 150 countries.

EU regulations, such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), the US Dodd-Frank Law (involving Conflict Minerals), and California’s Proposition 65 (currently listing over 800 chemicals that must be flagged), affect composition, processing, costs, and supply chain sourcing for interconnect components. After eliminating military/aerospace market sales, Europe accounts for about 22% of worldwide commercial connector sales. While many requirements originate in the EU, most companies cannot afford to offer divergent models for various world markets and, as a result, incorporate EU requirements for all production. This product “mix” for international sales is illustrated by TE Connectivity’s product offerings that serve customers in over 150 countries.

Although there is no internationally accepted process or format to present required materials information, the IPC — Association Connecting Electronics Industries (formerly, The Institute for Printed Circuits) has established useful standards. IPC-1751 defines the generic requirements for materials declaration process management, and IPC-1752 covers a reporting format for content exchange between supply chain participants for reporting of materials, components, printed circuit boards (PCBs), sub-assemblies, and related products.

In addition, the IPC, working with the Automotive Industry Action Group (AIAG), the Conflict-Free Sourcing Initiative (CFSI), and the Japan Electronics and Information Technology Industries Association (JEITA), recently published IPC-1755, Conflict Minerals Data Exchange Standard. This provides a common format, although not universal, to enable manufactures and suppliers to exchange Conflict Minerals Data (CMD) within global supply chains.

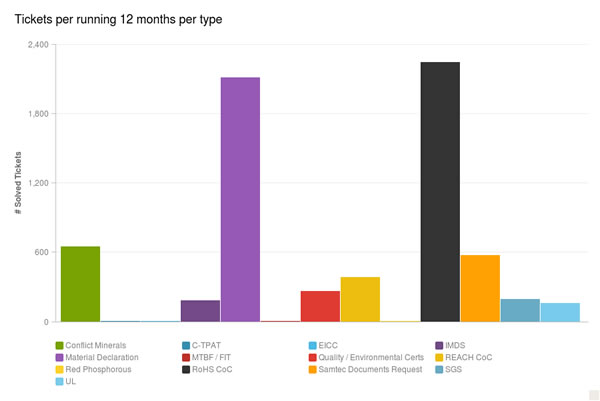

Mark Bobo, Director of Global Compliance for Samtec, Inc., said, “It is this absence of direction that ends up causing companies to search for different ways to solve the problem. Those differences mean a lack of efficiency and effectiveness — in short, higher cost for companies and customers.” Since Samtec operates in 130 countries and has factories in seven international locations, their data may illustrate worldwide requirements and priorities. Bobo said that Samtec has established an extensive online auto-response capability to serve the over 5,000 inquires that they receive daily. Top demand is for RoHS Certs, followed by Material Declarations, and Conflict Materials, as shown below.

Courtesy of Samtec, Inc.

Upcoming changes to REACH and RoHS are prompting companies to implement full material disclosures (FMDs) to help stay ahead of evolving requirements by reducing the need to revisit their supply chain every time a regulation is updated. However, integrating FMDs into a compliance program may be difficult based upon the complexity of company’s products, which could range from backplanes to cable assemblies.

Recent Actions Expand Requirements

Earlier this year, the European Chemicals Agency (ECHA) released a list of 29 substances to be targeted for special compliance checks, asking that registrants revise their registration dossiers by October 31. At the same time, the 84-nation Minamata Convention on Mercury became effective, emphasizing elimination of mercury-related compounds, which are used in the production of many plastics, chlorine solutions, energy-storage batteries, platings, etc.

September included the deadline by the European Chemicals Agency (ECHA) to eliminate the use of chromium VI (hexavalent chromium) compounds. The connector industry uses chromium VI in metal surface treatments, hard chrome plating, conversion coating, passivation, and equipment cooling systems. Additionally, stainless steel, which is used in connector housings, especially for hermetic, microwave, and millimeter wave assemblies, normally has a minimum of 10.5% chromium content by mass, to provide an inert surface of chromium oxide when passivated.

REACH affects today’s production. While it prohibits use of arsenic, arsenic salts, and associated compounds, arsenic is gaining increased attention as a gold-hardening plating agent for Low PIM connectors. Alkaline arsenic-cyanide baths have been used in plating to produce a finish known as black nickel. Also, somewhat contrary to the EU’s environmental goals, gallium arsenide (GaAs) has become a key ingredient in enhancing efficiency of solar power cells.

EU Lead-Free Standards Create Problems

The basic EU Directive on RoHS went into effect on July 1, 2006, and required that all electronic products sold in Europe had to be lead-free. Asian countries followed with their own lead-free restrictions. Considering that lead-based electronics have been in use for over 40 years, the requirement for lead-free technology represents significant change. The use of lead-free materials and processes has prompted reliability concerns due to the introduction of different alloy metallurgies and higher assembly process temperatures relative to tin-lead soldering.

Manufacturers have to evaluate both new and current products and the latter often prove difficult due to mixed hardware and accessory parts that may be overlooked, as illustrated below.

Source: Presentation by Julie Silk, Environmental Compliance Program Manager, Keysight Technologies, at IPEX EXPO 2016.

The non-profit International Electronics Manufacturing Initiative (iNEMI) is a major R&D consortium of over 90 leading worldwide electronics manufacturers and suppliers (including: Keysight Technologies, Cisco, Delphi, Hewlett-Packard, IBM, Lucent, Sun Microsystems, and TE Connectivity), plus technical associations, government agencies, and universities. Their published papers reviewed lead-free finishes for risks in inducing failure due to whisker growth. Their top recommendation was for nickel-palladium-gold (NiPdAu) plating. This plating was first used commercially by Texas Instruments in the late 1980s as a solution to lead frame yield losses when solder was post-plated onto leads. It has since become popular with SMT termination, but has not overtaken traditional gold-over nickel for most interconnects.

In those applications needing lower costs (versus nickel-palladium-gold or gold-over-nickel), pure matte tin over nickel underplate was recommended by iNEMi. This finish is now widely accepted for commercial SMT lead reflow soldering.

Most commercial solder assembly operations currently utilize lead-free solder pastes and/or lead-free wave solders. These lead-free solders are usually a combination of tin and silver, and sometimes copper, e.g., 96.4% tin (Sn), 3.5% silver (Ag), and 0.6% copper (Cu). When using lead-free solder versus lead-content solder materials, solderability needs to be equivalent. The problem is that the melt point of these solders is much higher than eutectic tin/lead solder. The 96.4% Sn/3.5% Ag/0.6% Cu alloy mentioned has a reflow temperature of 217°C, which is 34°C higher than 63% Sn/37% Pb, which has a reflow temperature of 183°C. The result is that reflow solder temperatures and reflow oven profiles are increased at least 34°C to insure the same dwell time at maximum temperature as they had when using tin/lead. Since the formation of intermetallic compounds such as tin/copper or tin/nickel occurs much faster at increased temperature, this increases the probability of thick intermetallic layers and potential solderability problems. Many of these compounds are brittle crystal structures, adding to concerns about reliable termination.

Commercial reflow typically follows IPC/JEDECJ-STD-020.1 (March 2008), with Tp = 260°C and tp = 20 seconds. However, 285°C may be used for applications requiring multiple reflow operations, such as double-sided circuit boards. Another problem is a yellow surface discoloration of the lead-free pure tin plating at these higher reflow temperatures. Problems may show up during testing by steam aging and multiple reflow cycles.

Some success has been reported with alloys using antimony (Sb). However, antimony is toxic and replacing lead with another restricted material does not help future production planning. Lead-free alloys with bismuth (Bi) also have been studied, and while this improves tensile strength, it is not recommended for wave soldering due to brittleness, and fillet-lifting for through-hole solder joints may occur if there is any lead impurity in the component’s plating.

Current IPC standards reflecting requirements for lead-free solder include processing per J-STD-001, acceptance standards per IPC-A-610. Solderability of components is per J-STD-002B while J-STD-003A covers bare boards.

The amount of environmental regulation has increased significantly over time. While governments establish requirements based upon perceived benefits to humans and the environment, industry may not always agree, due to the costs involved with documenting and tracking materials, changes in supply chain, reliability studies, and product qualifications.

- New Circular Connectors Add to Multi-Billion Dollar Market - January 9, 2024

- Counterfeit Components Ground Airlines - December 12, 2023

- Cables, Connectors, Waveguides, and Hybrid Products for up to THz at IMS 2023 - July 11, 2023