Strong Finish in 2012 for the Automotive Market

Strong Finish in 2012 for the Automotive Market

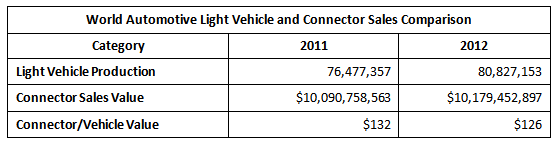

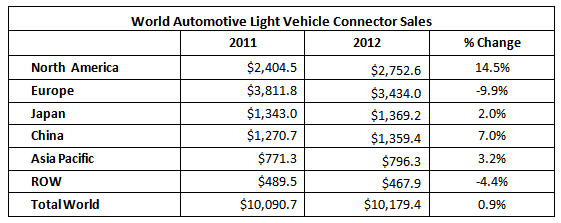

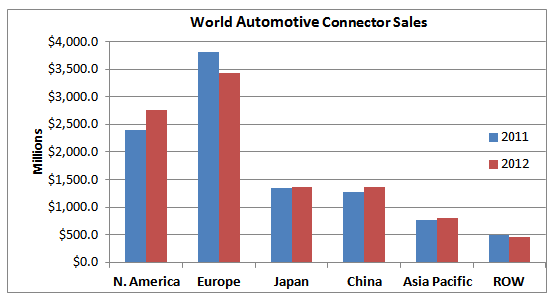

In 2012, the automotive sector continued to dominate the world connector market with sales of $10.179 billion, $89 million over 2011 sales of $10.090 billion.

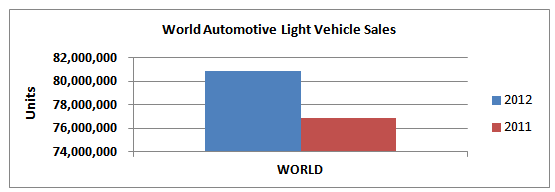

Despite Europe’s economic woes, 2012 world automotive light vehicle sales set a new record of 80.8 million, up 4.8% from 2011’s record sales of 76.9 million, a change of 3.9 million units. This growth was driven mainly by growth in the US (13.5%) and China (6.2%), in addition to Japan’s vehicle sales recovery of 30.1% after the 2011 natural disasters.

For 2012, Toyota regained the global sales crown from General Motors with sales of 9.7 million vehicles. GM was second with sales of 9.2 million and Volkswagen AG finished third with sales of 9.0 million.

Regional Vehicle Sales

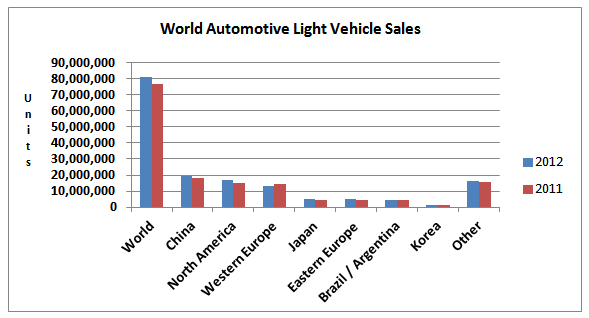

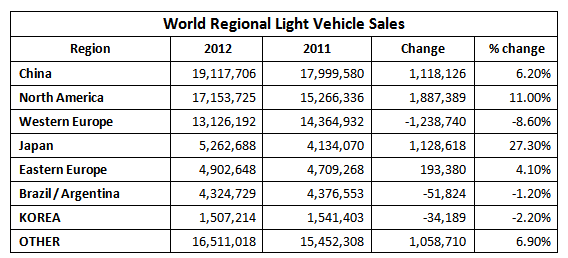

With the exception of Western Europe, all world regions’ vehicle sales improved, due primarily to global population growth and consumers’ need to replace aging vehicles.

In 2012, China continued to dominate the sales race, followed by the US, Western Europe, and Japan. Outside of Western Europe, South Korea was one of the few countries that encountered negative sales growth.

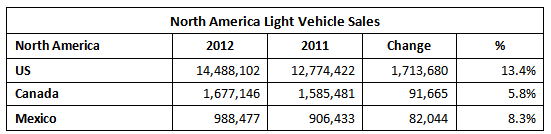

North America

US automotive sales grew an impressive 13.4% to 14.4 million units, with Canada and Mexico growing by 5.8% and 8.3%, respectively.

In the US, General Motors’ market share was 18.7%, with Ford in second place at 15.9%, and Toyota rounding out third place with 15.1% market share. Chrysler-Fiat, Honda, and Nissan finished fifth, sixth, and seventh by capturing 11.3%, 9.0%, and 7.8% market share, respectively.

Western Europe

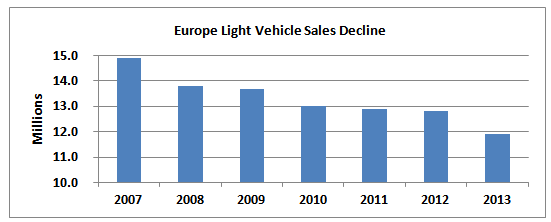

Western Europe continues its fifth straight year of decline in automotive light vehicle sales, from 14.9 million in 2007 to 12.8 million in 2012. 2013 sales are expected to decline to 11.9 million, another 900,000 units.

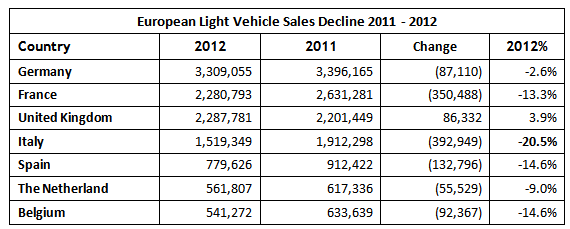

Percentage-wise, Italy has suffered the greatest sales decline in 2012, at 20%. The ever-strong Germany also experienced a sales loss of 2.6%.

China

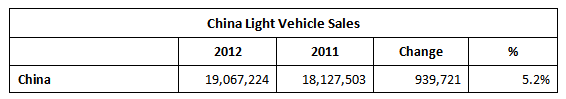

After starting the year slowly, China’s light vehicle sales became brisk, and thanks to strong fourth quarter sales, finished the year at 19.1 million units, up 6.2% from 2011.

Japan

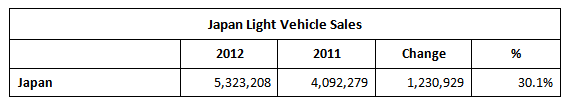

Having survived the 2011 natural disaster, Japan’s light vehicle market rebounded 30.1% to 5.3 million units. Despite the end of the eco-car subsidy in September, December sales recorded their third consecutive month of sales gains. The new governmental fiscal stimulus package should continue to boost 2013 sales.

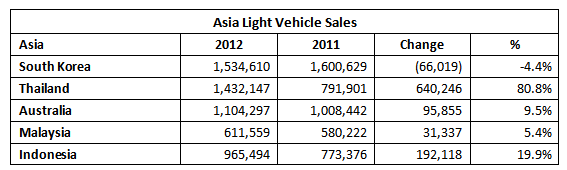

Asia

Other than South Korea, which experienced a 4.4% decline in sales, the remainder of Asian countries continued light vehicle growth during 2012. Thailand’s light vehicle sales exploded by an amazing 80.8%.

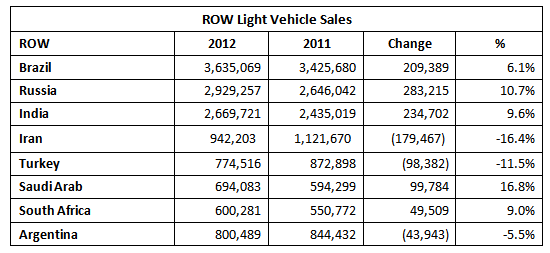

ROW

In South America, Brazil’s 2012 light vehicle sales grew 6.1% while Argentina sales plunged 5.5% from the election-driven 2011 sales euphoria. Russia and Saudi Arabia experienced double-digit sales growth, while Iran and Turkey were hampered by Europe’s economic crisis.

Connector Sales

Although world connector sales grew $88.7 million in 2012, the connector-per-vehicle value decreased approximately $6 per vehicle due to the decline in the number of large vehicle sales, as opposed to the significant increase in the small vehicle population sales mix.

World connector sales grew only 0.9% in 2012, primarily due to the poor European economic conditions; and globally, as a result from the greater shift from large vehicles to small vehicles, which have lesser connector value content.

2013 Forecast

2013 automotive light vehicle connector sales are expected to grow to $10.8 billion (5.8%) while light vehicle sales are expected to grow to 85.7 million units (5.7%).

Except for Europe, 2013 light vehicle market growth is expected to continue. US sales are projected to grow to 15.5 million. The Chinese economy continues to improve, which should drive light vehicle sales another 9%. China accounted for a third of light vehicle sales growth in the last five years, which has partially accounted for the reduction in connector-per-vehicle sales value. An 8.3% growth is expected to come from India and another 4.2% from South America.

Connector manufacturers’ revenues are expected to continue to grow in 2013.

Roger E. Rickey, Market Director, Automotive

Roger E. Rickey, Market Director, Automotive

Bishop & Associates Inc.

Roger E. Rickey has more than 30 years experience in the automotive and electronics industries, including four years experience as plant manager with Chrysler Huntsville Electronics Division, a leading electronics manufacturer. Most recently, as president of R.E. Rickey & Associates Inc., he worked as an international management consultant with several Fortune 500 clients, including major automotive OEMs.

Rickey began his career in engineering with Ford Motor Co. and was chief engineer and director of engineering with United Technologies Automotive Products Division. He holds degrees from Eastern Michigan University and Southern Illinois University, and served as an officer with the U.S. Army in Vietnam. He holds two Bronze Star Medals and an Army Commendation Medal.