The Military/Aerospace Market for Cable Assemblies

The Military/Aerospace Market for Cable Assemblies

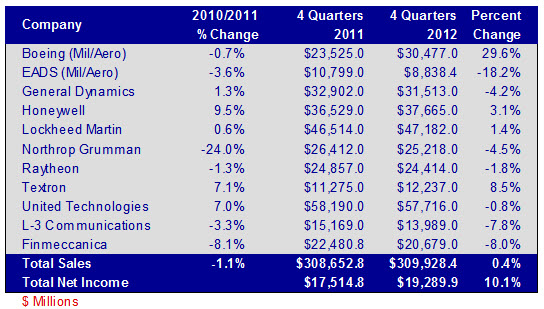

Bishop tracks 13 market sectors for electronic interconnects. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, military/aerospace was the seventh fastest growing market sector in 2012 at 0.4% year-over-year and combined revenues of $309.9 billion. Profitability was $19.3 billion at 6.2% of sales, up 10.1% from 2011.

Bishop tracks 13 market sectors for electronic interconnects. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, military/aerospace was the seventh fastest growing market sector in 2012 at 0.4% year-over-year and combined revenues of $309.9 billion. Profitability was $19.3 billion at 6.2% of sales, up 10.1% from 2011.

Boeing Corporation, for its military/aerospace business, reported full-year 2012 sales up 29.6% to $30.5 billion year-over-year on continuing operations after contracting 0.7% in 2011. Boeing’s growth was driven primarily by military aircraft programs, including the KC-45 Tanker and the Navy’s P-8A Poseidon Multi-mission Maritime Aircraft.

Textron Inc. was the next fastest growing company in this segment with year-over-year sales growth of 8.5% to $12.2 billion in 2012. In its Bell helicopter division, replacement and refurbishment of Kiowa Warrior helicopters contributed to the growth. They were also awarded programs for new vehicles, ships, and unmanned aircraft.

EADS (the European Aeronautic Defense and Space Company), which includes Airbus, had the largest year-over-year decline in this segment with sales of $8.8 billion, down 18.2% over 2011 for their defense business. EADS attributes much of the sales decline to the Cassidian defense division and the budgetary constraints of the European governments.

Finmeccanica, an Italian-based defense company, had an 8% decline in sales in 2012 at $20.7 billion. The company has been similarly hurt by defense budget constraints, but also had a series of problems including management reorganizations and bribery probes.

The following table shows the results for the 11 companies we track in this market sector.

Military/Aerospace Market Sector – Sales and Net Income

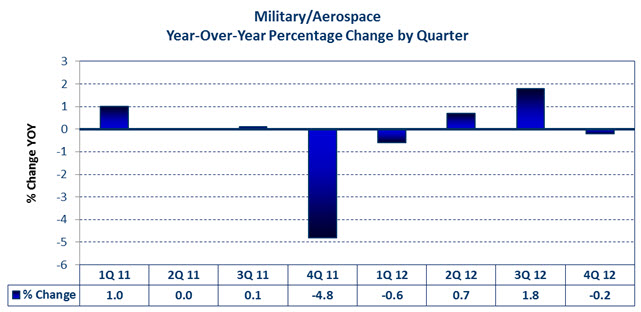

As can be seen in the following chart, year-over-year sales growth has been very low or declining/flat for the past eight quarters. Sequentially, fourth quarter 2012 sales increased 4.8% from the third quarter of 2012.

Trends of Defense Industry

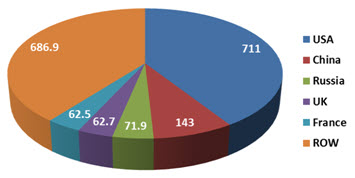

According to SIPRI (the Stockholm International Peace Research Institute), the world’s governments spent approximately $1,738 billion on their militaries in 2012. The United States accounted for 41% of that spending with $711 billion. China came in second at $143 billion or 8.2% of the total. The top five can be seen in the following chart.

2012 Military Spending by Country (US$ Billions)

Defense spending is expected to decline over the next 10 years in the US and Europe in an effort to reduce the overall deficit of these governments. In the United States, the 2011 Budget Control Act mandated a $350 billion reduction in armed forces spending over the next 10 years. Sequestration, or a Simpson-Bowels-type deficit reduction plan, would eliminate another $500 billion over 10 years. Combined, these reductions would equate to a reduction of $85 billion per year or a 12% cut in spending each year. Clearly, this magnitude of reduction will have an impact on the defense industry in the United States and elsewhere.

The likely areas for defense cuts in the US and Europe include:

- Programs like the F-35 Joint Strike Fighter that are very expensive per copy

- New naval vessels to increase the fleet size and, particularly, expensive vessels like aircraft carriers

- New naval vessel development, like a replacement for the Trident ballistic missile submarines

- Replacement/refurbishment for tanks, armored personnel carriers, etc. used in the Middle East wars

- Replacement/stockpiling of munitions of all kinds

Areas that may see continued or increasing expenditures worldwide:

- Unmanned aircraft and vehicles

- Ballistic missile defense systems

- Naval vessels for China and countries in Asia Pacific to beef up their abilities to patrol their territorial waters

Impact on the Cable Assembly Industry

- Spending for repair/replacement for the war in Afghanistan will continue to wind down. For cable assembly companies currently involved in this business, the expectation should be for decreasing business.

- For cable assembly companies servicing defense contractors that are servicing China and Asia Pacific governments, there will be an increase in defense spending.

- Given the financial and political instabilities in Europe, the military/aerospace market for cable assemblies is expected to contract in the low single digits.

- The market in North America is expected to grow slightly in 2013 due to continuing programs and the wind-down of the war in Afghanistan.

Bishop & Associates projects the worldwide market for military/aerospace cable assemblies to be up 1.5% in 2013 to $13.6 billion. China will be the fastest growing region in 2013.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019