Top 10 Supplier of Connectors for the Military/Aerospace Market

The military/aerospace market encompasses a wide variety of applications requiring numerous high-speed, rugged, and high-reliability interconnects. Who are the top connector companies that serve this market?

The military/aerospace market is among the largest users of interconnect products. In 2021, military spending reached a record $2.1 trillion, a figure that includes a wide range of spending areas, including raw materials and human resources costs. It is anticipated that the global military budget for 2023 will show a significant increase. Since Russia’s invasion of Ukraine, at least six NATO countries have indicated that they plan on spending a much larger percentage of annual GDP on defense. The top five spenders were the United States, China, India, the United Kingdom, and Russia.

Increases to military budgets will not result in an immediate increase in connector spending. Procurement of major equipment generally takes anywhere from three to 10 years, so in the early years, little effect will be seen in the military/aerospace connector market. Supply chain problems and labor shortages continue to present challenges to the military. An additional problem that will plague countries aiming to increase or refresh their inventory of military hardware is the shortage of many raw materials, including steel.

For 2022, based on percentage growth, the North American region will show the greatest growth, followed by China with percentage growths of 8.4% and 5.9% respectively. From a dollar perspective, the greatest growth will once again be in the North American region where connector sales dollars will increase by $188 million to $2,423.4 million. This means that at the end of 2022, North America will account for over 48% of the entire dollar value of connectors used in military/aerospace applications.

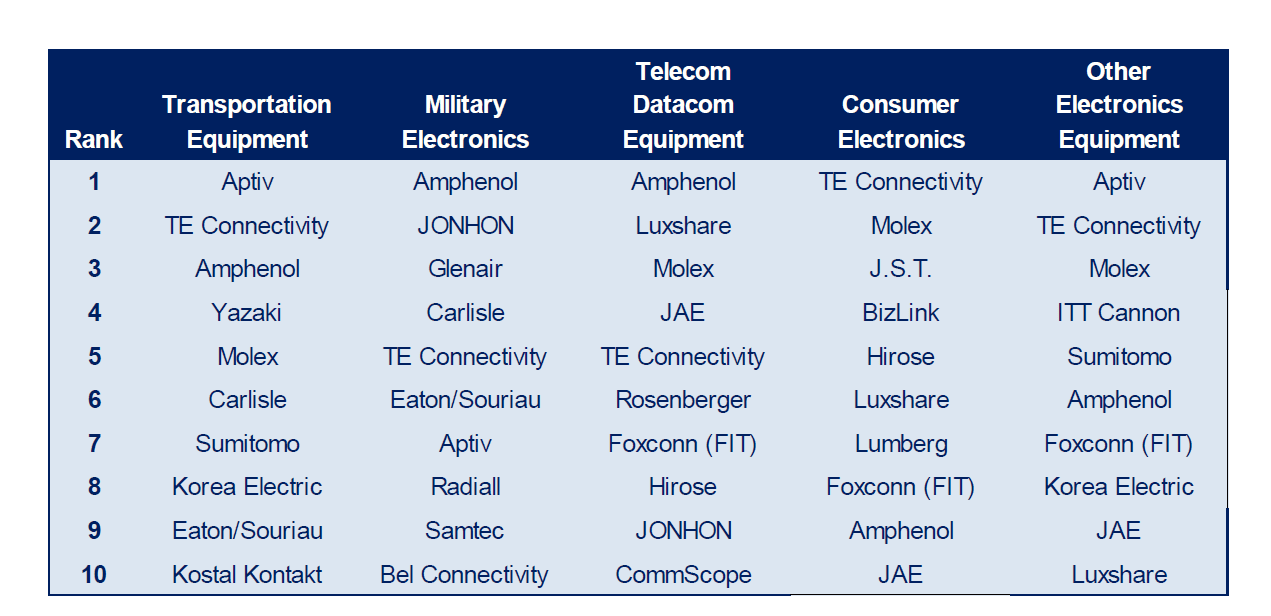

The MIL/Aero market ranks in the top 10 end-use equipment sectors for the top 10 manufacturers in 2021, with $1,759.3 million in total sales. This significant market also involves many smaller manufacturers, particularly those that offer specialty products and compatible standard interconnects. Second-tier manufacturers sold $760.3 million to the MIL/Aero end-use equipment sector; for third-tier manufacturers, $532.8 million; fourth-tier, $380.5; fifth-tier, $40.5 million, and so on.

Note: Top 10 ranking by equipment sector and product type is based on the ranking of the top 50 connector manufacturers. There may be companies that focus on individual markets or product types that have greater sales than those companies mentioned above, but whose TOTAL sales did not place them in the top 50 connector manufacturers.

Military electronics include connected soldier and solder-worn technologies, heavy ground vehicles, communications systems, robotics, weaponry, defense systems, transport vehicles, marine and aquatic vehicles and equipment, rocketry, radar, and military aircraft and equipment. This market also includes specialized products for use in space applications, including satellites, manned and unmanned commercial and military space vehicles, and technologies for use in low-Earth orbit. As space-grade applications continue to proliferate, connector suppliers with this area of expertise are expanding their offerings (Note: Connector Supplier and Bishop & Associates classify commercial aerospace as part of the Transportation market.)

The products used by this market include a wide range of MIL-Spec standard interconnects, commercial products, as well as custom and highly specialized interconnects. Most specified products include circular, rectangular I/O, and D-type connectors; PCB connectors, IC sockets, RF connectors, fiber optics, terminal blocks, and heavy duty and high-voltage products.

This data comes from the Top 100 Connector Manufacturers report, released by Bishop & Associates in August 2022, and the Connector Industry Forecast, released in November 2022. To learn more about the companies, products, and end-use sectors that are involved in the military/aerospace market, please consult these resources. Additionally, to learn more about the outlook for the military ground vehicles market, see Military Ground Vehicle Market for Connectors from Bishop & Associates.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

Like this article? Check out our other Market Update and Industry Facts & Figures articles, our 2022 Article Archives, and our Markets Page, which features the latest articles in each of nine markets.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Wire & cable cutting services - March 3, 2024

- Belden – REVConnect RJ45 Connectors | First Look - March 3, 2024

- Molex, LLC – 5G25 Series 5G mmWave RF Flex -to-Board Connectors | First Look - March 3, 2024