Connector Industry Sales Performance: The 20th Versus 21st Century

Electronic interconnects have impacted human progress across two centuries. Bishop & Associates looks at this critical industry from a sales perspective to track its growth and its major players.

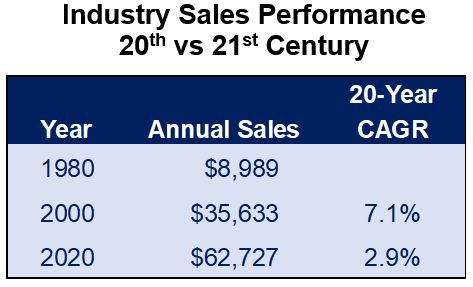

In the last 20 years of the 20th century (1980 through 2000), the connector industry achieved a compound annual growth (CAGR) rate of 7.1%. There were only two years where sales declined: 1985, when the industry declined -2.7%, and 1992, when the industry declined -2.1%.

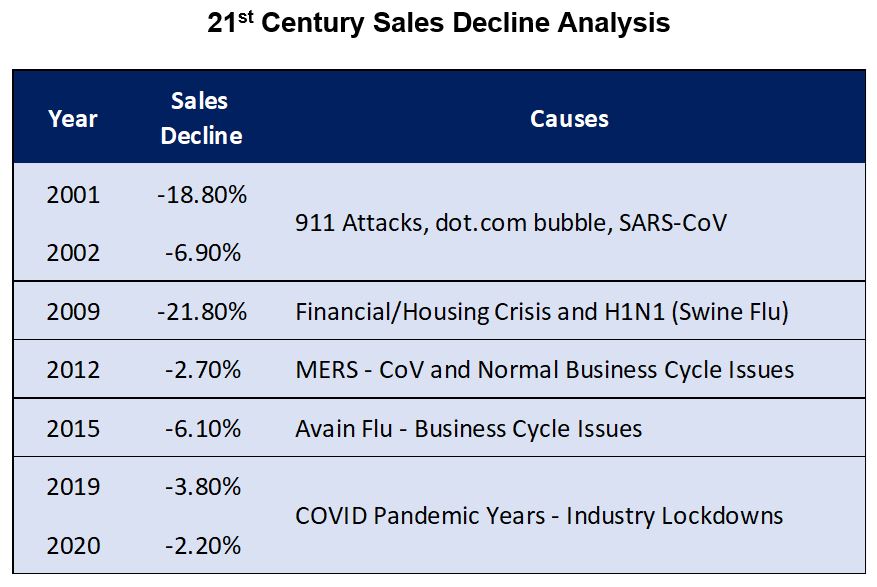

In the first 20 years of the 21st century (2000 through 2020), the connector industry only achieved a CAGR of 2.9%. There were seven years in which sales declined: 2001 when sales declined -18.8%, 2002 when sales declined -6.9%, 2009 when sales declined -21.8%, 2012 when sales declined -2.7%, 2015 when sales declined -6.1%, 2019 when sales declined -3.8%, and 2020 when sales declined -2.2%.

The first 20 years of the 21st century have been a challenge. We have spent a year and nine months (21 months) under the umbrella of the global COVID-19 pandemic. We also suffered through a dot.com bubble bust, the September 11 attacks on the United States, various other global health outbreaks, and a devasting financial and housing crisis.

The connector industry achieved a 7.1% CAGR during the period 1980 to 2000, solidifying the connector industry’s reputation as a growth market. The CAGR declined to 2.9% during the period 2000 to 2020, primarily because of the issues referenced above.

Other major changes during this period included the transferring of jobs and manufacturing to China, an action that started an extensive connector price erosion that has lasted for years. The explosive expansion of the internet and the globalization of the world’s markets have also impacted connector demand.

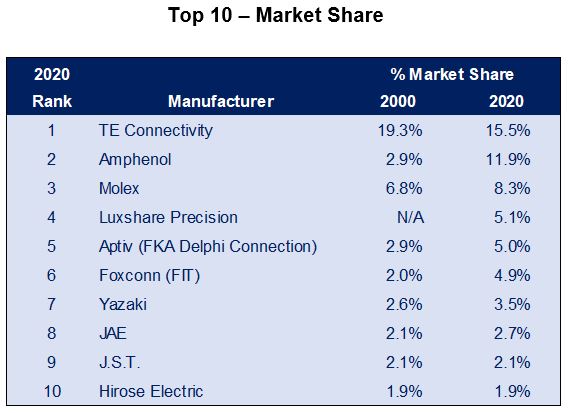

The following table presents the sales performance of the top 10 connector companies in the 21st century.

The major findings from the table above are:

- Amphenol significantly outperformed the connector industry, achieving a 20-year CAGR of 10.4% versus the industry’s CAGR of 2.9% for the same period. This amazing performance is a result of the company’s aggressive acquisition strategy.

- Molex, Aptiv, FIT, Yazaki, Hirose Electric, and JAE beat industry results, while J.S.T. tied.

- It is important to note that during this time, TE Connectivity divested several of its business units in an effort to focus more on the high-speed and harsh environment connector markets. This includes the divesture of a signification portion of their network connectivity business to CommScope in 2015.

Amphenol had 2.9% of the global connector market in 2000. In 2020, Amphenol’s market share is a whopping 11.9%.

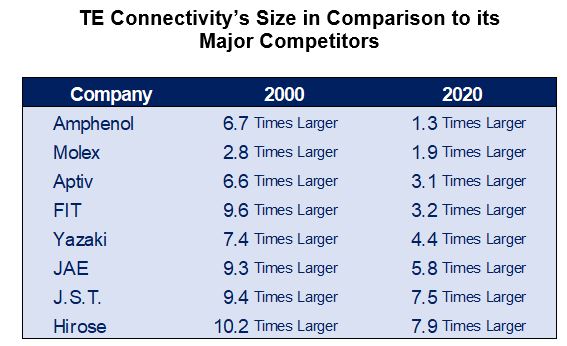

TE Connectivity has been the connector industry leader for the past 40 years. The following table shows TE’s size versus top competitors in the year 2000 versus 2020.

TE Connectivity was 6.7 times larger than Amphenol in 2000, but only 1.3 times larger in 2020.

In 2022, Connector Supplier will publish quarterly industry updates from Ron Bishop, as well as special conversations on the issues and topics that influence the connector world.

Subscribers to the Bishop Report, a publication by Bishop & Associates, receive monthly updates on the performance of the connector industry. To receive a sample issue of The Bishop Report, or to order a subscription, click here. Join the Bishop & Associates’ mailing list to receive information on the electronic connector industry.

Like this article? Check out our other Industry Facts & Figures articles, our articles by Market, and a full listing of our 2021 Articles.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Is the Gold Rush Over for China Connector Sales? - October 17, 2023

- The Top Five European Connector Suppliers for Product Quality and Price Competitiveness - October 10, 2023

- 2023 Top Five European Connector Suppliers - September 26, 2023