Which Way Is the Wind Blowing?

Offshore wind power refers to the construction of wind farms in bodies of water to generate electricity from wind.

The first offshore wind farm was installed in 1991 off the Danish coast, and featured eleven 450 kW turbines with a total capacity of 4.95 MW. Today, slightly more than 4.6 GW of offshore wind power has been installed globally, representing about 2% of total installed wind power capacity. More than 90% of it is installed off northern Europe, in the North, Baltic, and Irish Seas, and the English Channel. Interest in the offshore sector continues to grow, with investor commitments, policy support, and technological innovations.

While offshore and onshore wind energy relies on the same input — wind — their performance capabilities are very different. Offshore wind offers a number of advantages over onshore wind:

While offshore and onshore wind energy relies on the same input — wind — their performance capabilities are very different. Offshore wind offers a number of advantages over onshore wind:

- Offshore is particularly suitable for large scale development near the major demand centers represented by the major port cities of the world, avoiding the need for long transmission lines to get power to demand centers, as is so often the case onshore.

- Offshore areas provide more space; onshore areas are generally limited by space restrictions or by ecological and aesthetic considerations.

- Offshore areas provide strong winds, with less turbulence and more predictability than onshore winds. Studies have shown that winds offshore blow nearly 40% more often than on land. Consequently, offshore wind farms can outpace those on land in terms of capacity and possibly offset the higher construction costs.

At the same time, there are challenges to offshore wind:

- Construction. More time, planning, and people are required, especially for the foundations and electrical infrastructure. Access is only possible via boat, barge, or helicopter.

- Operation. Offshore wind turbines operate in harsh environments driven by both wind and wave conditions that can make access to turbines challenging or even impossible for extended periods.

- Grid connection. Currently, there is no existing infrastructure which means each project has to establish an individual solution for its grid connection.

The overall cost of offshore wind energy exceeds that of onshore wind energy due, in part, to higher O&M costs as well as more expensive installation and support structures. As the offshore market expands, wind energy technology specifically tailored for offshore applications will become more prevalent.

Escalating Global Interest in Offshore Wind

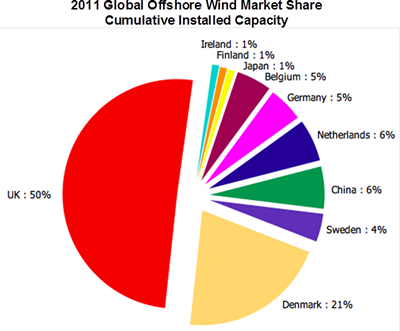

In Europe (including the UK and Scandinavia), offshore wind is an essential component to its 2020 binding target to source 20% of final energy consumption from renewables. A total of 4.3 GW, consisting of 1,503 offshore wind turbines, are fully grid-connected in 56 wind farms across 10 European countries.

The UK and Denmark remain the two biggest markets for offshore wind in Europe. Another 6 GW of offshore capacity is under construction off European coastlines and 17 GW has been consented. Other projects exceeding 100 GW are in the planning stage. The 2020 targets have proven to be effective, allowing offshore wind energy suppliers to invest in new infrastructure and R&D. In order for this technology growth to continue, the industry believes a 2030 binding target must be established.

Despite the upbeat installation figures from the first half of 2012, a slump in sales of offshore turbines is being reported for the second half of the year. The cost of financing and connecting projects to the grid has raised the installed cost of offshore projects by 30% in the first half of this year. Banks curbed lending to developers as Europe’s financial crisis spread, and utilities have placed new projects on hold because of delays in connecting existing ones to high-voltage transmission grids. Connections to grids are being held up by a lack of investment, cable, engineers, and ships capable of building the world’s biggest collection of sea-based wind parks in the North and Baltic Seas.

Interest in offshore wind has spread beyond Europe and is now global, with turbine announcements being made by companies in China, Japan, South Korea, and the US.

- China currently ranks number three globally, with cumulative offshore installed capacity of 258.4 MW at the end of 2011. China has an ambitious target for offshore development of 30 GW by 2020, but a lack of coordination between state administrations is likely to complicate these goals. If conditions improve, Chinese offshore is likely to see sizeable growth in the coming years.

- In the aftermath of events at Fukushima, Japan is stepping up its efforts to develop renewables. In 2011, a senior government panel developed plans for a 1 GW offshore wind farm to be operational by 2020. Floating offshore wind energy development is expected to significantly contribute to the domestic energy supply, creating a new industry in Japan.

- The Korean government released a roadmap for offshore wind development in 2010, with the first priority a 2.5 GW offshore wind farm project located in the West-South Sea. The master plan identifies three stages for further offshore development, leading to a fully operational project by 2019.

- No offshore projects have been built to date in the US. Political support is slowly growing, but planning, siting, and permitting procedures remains a challenge.

Offshore Wind Industry

Although its share of total wind capacity remains small, the offshore wind sector continues to expand. Europe maintains the lead in terms of companies actively planning to develop offshore wind turbines. Siemens, REpower, and Vestas are the leading turbine suppliers for offshore wind power, while Dong Energy, Vattenfall, and E.ON are the leading offshore operators. The vast majority (around 80%) of installed offshore capacity was developed, and is owned, by utilities.

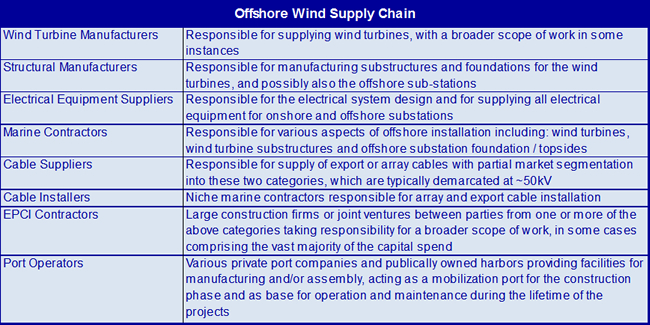

Participants in the upper levels of the offshore wind supply chain generally fall into eight main categories:

The developments in offshore wind turbine design are driving a separation of the supply chain between the onshore and offshore wind sectors. There is a sizeable amount of new investment in plant and facilities for the offshore wind industry. Contracting practices have shifted significantly in the last few years, in part a result of the changes in the available companies in the supply chain mix and also due to the increased technical challenges associated with moving further from shore and into deeper waters.

Offshore Wind Technology Defined by its Demanding Environment

Wind turbines, both onshore and offshore, are comprised of many subsystems working in unison so that the turbine efficiently and safely produces power. A single wind turbine may have more than 10,000 mechanical and electrical parts. A modern utility-scale wind turbine is a sophisticated, highly precise machine with extreme requirements for temperature, humidity, weight, mechanical stress, and vibration. Major components of offshore wind turbines include towers, blades, drive train components, castings (bed frame, hub, and gearbox/bearing housings) and forgings (bearings/gear rings), and subsea cables.

Offshore turbines have technical needs beyond those required of onshore turbines due to the more demanding environmental exposure offshore. These include special sub-structures, strengthening the tower to cope with wind-wave interactions, protecting the nacelle components from sea air, and adding brightly colored access platforms for navigation and maintenance.

Offshore wind turbines are typically equipped with corrosion protection, internal climate control, high-grade exterior paint, and built-in service cranes. To minimize expensive servicing, offshore turbines may have automatic greasing systems to lubricate bearings and blades, and pre-heating and cooling systems to maintain gear oil temperature within a narrow temperature range. Lightning protection systems minimize the risk of damage from lightning strikes that occur frequently in some locations offshore. There are also navigation and aerial warning lights.

Larger offshore turbines, averaging 5 to 7 MW, are being installed today. New model sizes in varying stages of development range from 8 to 15 MW. Eventually, mega-turbines will be installed in deep water far offshore on floating platforms. Their assembly will be done on land and shipped relatively intact to their final destination, where they will “drop anchor.” As offshore wind farms move further out to sea, the installation and capital costs of heavier foundations and longer cables have increased. Those costs are expected to come down in the middle of the decade as technology improves and installation methods become more standardized.

For offshore wind farms, substructure supply and installation represents around 20% of the capital costs. Many countries have a limited number of suitable sites in shallow water (under 25 meters) to deploy fixed substructures. In deeper waters (over 50 meters) it is likely that floating support structures will prove to be more economical. There are many challenges with floating structures, including the electrical infrastructure design and construction, installation, and O&M.

Transport of Wind-Generated Energy

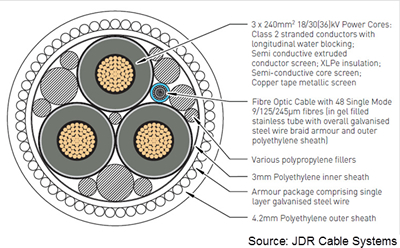

Undersea collection cables connect multiple turbines in the wind facility and transport the electricity to a transformer. The combined electricity is converted to a high voltage for transmission via undersea cables to a substation, where it is connected to the onshore electricity grid. Demand for subsea cables and large high-voltage transformers are rising with increasing project size and extended distance from shore.

Although the arrangement and voltage of the MV cables between turbines and to shore are identical to onshore wind farms, it is necessary to use submarine cable technology for offshore wind. Subsea cable construction is “tri-core” — a single cable containing three phase conductors inside an external covering. The equivalent practice onshore is to use three separate single-phase conductors, as this allows better cooling of the cable and longer runs between joints. The subsea cable also contains an optical fiber communications cable, whereas in onshore wind farms this is provided by a separate cable laid in the same trench as the MV cables.

Although the arrangement and voltage of the MV cables between turbines and to shore are identical to onshore wind farms, it is necessary to use submarine cable technology for offshore wind. Subsea cable construction is “tri-core” — a single cable containing three phase conductors inside an external covering. The equivalent practice onshore is to use three separate single-phase conductors, as this allows better cooling of the cable and longer runs between joints. The subsea cable also contains an optical fiber communications cable, whereas in onshore wind farms this is provided by a separate cable laid in the same trench as the MV cables.

High-voltage direct current (HVDC) transmission technology is capable of connecting remote offshore wind farms to mainland networks, eliminating distance restrictions and grid constriction. An HVDC transmission link consists primarily of a converter station, in which the AC voltage of the conventional power grid is converted into DC voltage, a transmission line, and another converter station on the other end, where the voltage is converted back into AC. The electricity can be transported in both directions. The growing deployment of HVDC technology is driving momentum toward the development of multi-terminal capability.

Outlook for the Offshore Wind Energy Market

The long-term outlook for offshore wind is favorable. Offshore wind is an important component of global plans to increase the amount of renewable generation and reduce dependence on the use of fossil fuels. Offshore wind will play a significant role in the supply of energy to many of the world’s power grids in the relatively near future and will play an even larger role as the technologies evolve.

Much of the near-term market growth for offshore wind will remain in Europe; however long-term growth opportunities are projected in Korea, China, and Japan. Opportunities in the United States are significant, but continue to be over-shadowed by a lack of policy support from the government. The global offshore market is expected to reach 89 GW of installed wind energy capacity by 2025.

Much of the near-term market growth for offshore wind will remain in Europe; however long-term growth opportunities are projected in Korea, China, and Japan. Opportunities in the United States are significant, but continue to be over-shadowed by a lack of policy support from the government. The global offshore market is expected to reach 89 GW of installed wind energy capacity by 2025.

The major challenge for offshore wind is to bring down costs. Selection of sites in deeper waters, further from shore, has contributed to driving the costs up faster than the technology has been able to drive them down. Construction costs, measures to protect machinery and external surfaces from salt spray, electrical cabling, and grid connection are more expensive, while higher wind speeds necessitate the use of more robust wind turbines. Industry analysts expect those costs to fall as installation techniques become more standardized and financing bottlenecks open up.

On the technology side, cost reductions continue to be achieved, and this is the main reason for confidence regarding offshore wind. Advances are continually occurring in power electronics, which are expected to reduce cost, increase reliability, and provide better control, with system-friendly characteristics. System analysis tools, techniques, and experience are also improving. The cost of energy from offshore wind is expected to come down substantially as the industrialization of the next generation of offshore wind turbines begins to take place.

For detailed forecast, connector usage and technology trends in the renewable energy market, see Bishop & Associates research report on Renewable Energy.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to subscribe to the Connector Industry Forecast, go to connectorindustry.com and select “Research Reports.” You may also contact us at [email protected], or by calling 630.443.2702.

- State of the Industry: 2022-2023 Connector Sales - April 16, 2024

- Amphenol is On a Roll - April 2, 2024

- Nicomatic Proves That Two Heads are Better Than One - March 26, 2024