Facts & Figures: Currency Impact on Regional Industry Growth

As emerging economies slowed almost as dramatically as they had grown, and with the European Union’s attempt to spur economic growth by expanding the money supply, sales abroad are worth a lot less when translated back to US dollars.

†Right now, probably more than any other period in history, currency rates have a major impact on how Bishop & Associates reports sales numbers and growth. Over the last decade, most connector companies have dramatically expanded internationally. When China and other emerging economies were growing rapidly, this expansion translated to greater sales in US dollars. But, as these economies have slowed almost as dramatically as they once grew, and with the European Union’s attempt to spur economic growth by expanding the money supply, sales abroad are worth a lot less when translated back to US dollars.

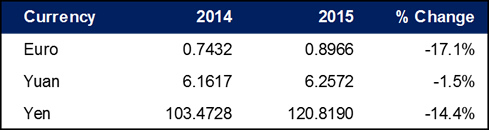

During 2015, the euro and yen continued to decline against the US dollar. The Chinese yuan also declined in value to the dollar but only modestly. The following table measures the decline for the first 10 months of 2015 versus the same period in 2014.

Consider this: Europe, China, and Japan account for 60.0% of world connector sales. Because of the great variety of currency, we haven’t broken out the other regions, but that doesn’t mean they haven’t seen a decline in value to the dollar as well, especially in many of the Asia-Pacific countries. As a result, currency fluctuation to the US dollar is having a significant impact on our reporting of sales performance in US dollars.

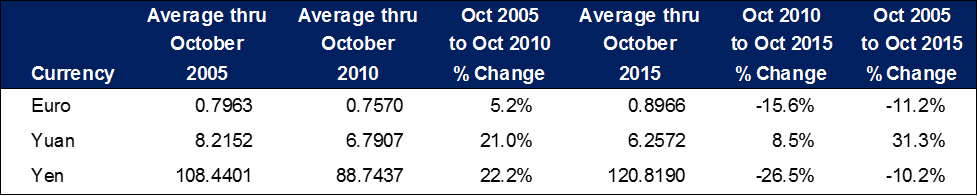

As the table above shows, fluctuations in currency values are nothing new; currency values have never been constant, but we’ve never had an economy that is so internationally intertwined. Although none of us can predict when the value of the dollar will decline in comparison to other currencies, the thing to remember is that when it does, this decline in sales value will revert to an increase in sales dollars.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector and cable assembly industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- Wire & cable cutting services - March 3, 2024

- Belden – REVConnect RJ45 Connectors | First Look - March 3, 2024

- Molex, LLC – 5G25 Series 5G mmWave RF Flex -to-Board Connectors | First Look - March 3, 2024