Brexit Update: UK Connector Industry

Six years after the historic Brexit referendum, trade ties have finally been severed between the United Kingdom and the EU. How is the U.K. connector industry handling the breakup?

When the U.K. Parliament passed the Withdrawal Agreement Act in January 2020, 53% of businesses cited Brexit as the top source of uncertainty. Six years passed between the referendum result and its enactment, and during this period speculation about the nature of future trading relationships, manufacturing, finance, and business operations fueled anxiety across sectors, including the electronics industry.

Admin and couriers

In February 2021, the U.K.’s Interconnect Technology Suppliers Association (ITSA) asked its members for their thoughts on the impact of the Brexit arrangements. The overriding comment was that shipping costs to the EU had increased and caused delays. Many ITSA members criticized couriers, blaming them for increased costs and for delays due to not processing documentation correctly. Kevin Canham, product marketing manager for HARTING, said, “The country and carriers were not ready for the import-export declarations needed to bring goods to the U.K., which resulted in delays.”

Peter Dent, LEMO U.K., has seen business opportunities for local manufacturers as a result of Brexit.

Connector suppliers and their customers also experienced extended lead times for import customs as a result of the extra paperwork required from each member country in the EU; each country has different rules for trade with non-EU nations. This wasn’t helped by “increased administrational errors by shipping companies who seem to be struggling with the new forms,” said Peter Dent, U.K. managing director for LEMO U.K. However, the additional administrative burden is becoming lighter and customs delays have started to fade away, he said.

Supply chains

U.K.-based connector supplier Harwin has taken responsibility for arranging delivery of raw materials for its products which either originate from or are distributed via the EU into the U.K., said Michel Clarner, vice president of sales EMEA at Harwin. “The increased paperwork has meant that EU suppliers are pushing this back onto U.K. companies,” he said, but there have been no changes for exports, as Harwin already met requirements relating to Economic Registration and Identification (EORI).

Michael Clarner, Harwin, planning for Brexit included bringing in a supply of raw materials to mitigate delays.

“In the early stages of Brexit, we saw some delays, but these were quickly resolved,” he said. “A lack of drivers led to a reduction in road freight capacity and there were customs-related hold-ups at ports. Thankfully such issues were only temporary. During the lead up to Brexit, Harwin put in place large volumes of raw materials to mitigate against supply chain risk, and this has served us well during the transitionary period.”

Jonathan Parry, PEI-Genesis, said Brexit meant investments in staff and locations in the EU.

Jonathan Parry, senior vice president and managing director for Europe at PEI-Genesis U.K., said that Brexit has made the company look again at its logistics flow of products from facilities to customers’ premises. It has invested in its operations team to ensure it is able to manage all the additional legislation and requirements, “which are still evolving at different rates across the EU. It has also invested in additional locations within the EU to streamline the flow of products and “give us an even more robust supply chain to withstand any future changes around Europe.”

“The transit time for delivery from our EU suppliers has increased as a result of Brexit,” said Lee Slater, European operations manager for PEI-Genesis. To accommodate unexpected cross-border control delays, the company has increased inventory levels and has also appointed a member of staff specifically to deal with the U.K./EU logistics and trade compliance; before Brexit, it was centralized in the company’s U.S. headquarters in Philadelphia. This is due to the significant increase in paperwork but also allows the company the ability to work directly with certain non-EU countries with more freedom, added Parry.

Marlainer Deslandes, PEI-Genesis’ U.K. logistics manager, also commented on the complexity of customs legislation, pointing out that “because the goal posts keep moving, there is always new red tape to cross per EU country,” she said. “Although we are not a customs house, we have to remain proactive with our knowledge of the changes and the impact to our delivery promise.”

She also sees opportunities as a result of Brexit. “The EU will continue to be an attractive market for the U.K.,” she said. “[Brexit] has encouraged several U.K. exporters to consider expansion into other markets, especially those with Free Trade Agreements. Some of these territories may not have been considered prior [to Brexit.]”

Becoming accustomed

For most respondents, the transit issues were ironed out with most reporting no significant impact in February 2023.

Martin Stoneman, Cambion Electronics, compared Brexit to the millennium bug.

Martin Stoneman, managing director of Cambion Electronics, likened the Brexit impact to the anxiety that preceded the Y2K computer bug. “The world was to end, but in truth nothing majorly effected operations. Yes, it took until February [2020] for the carrier to understand the new ways of working and get the correct resourcing in place, but thereafter – fine,” he said.

Other companies also reported initial wrinkles appear to have been ironed out. João Rocha, managing director of Fischer Connectors, said, “Apart from some couriers and customs delays [which were] workable, we have not experienced any significant impact.”

The pandemic factor

For Harwin’s Clarner, “Brexit has made little impact on trade. The disruptions that we saw in the early days have proved short-term and have not hampered our trade with customers in the EU,” he said.

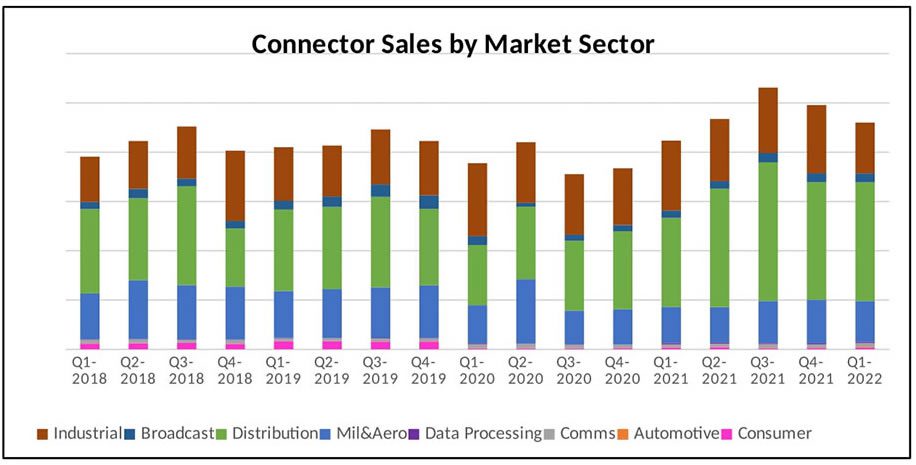

Figure 1: U.K. connector sales by market summary. (Source: ITSA member summary Q1 2022.)

“The overall impact of Brexit on the local business trade has been relatively marginal and, if anything, slightly positive,” said LEMO’s Dent. “A very small percentage of international customers moved production offshore, but this has been offset by increased numbers of customers bringing work back to the U.K.,” he said. “Our business has seen increased business opportunities for locally manufactured items as there seems to be a manufacturing trend to ‘onshore’ supply chains where possible. This trend was initiated by Brexit fears but has gained momentum with the pandemic, raw material shortages, manufacturing backlogs, and subsequent changes in purchasing behaviors, along with the general increase in transport costs driven by fuel surcharges.”

“From my perspective, the main impact of Brexit has been on the labor force and whilst Brexit is not the cause of the skilled labor shortage which most manufacturing businesses face, it has not helped with the problem.”

The U.K. market seems to be generally positive despite setbacks from Brexit and the COVID-19 pandemic. In May 2022, ITSA published its summary for Q1, reporting a 7% decrease in revenues compared to Q4 2021, despite members reporting a “bumper order intake” in Q1. They also reported sales increases of 40% over the same period in 2021 and an average book to bill ratio of 1.22:1. There was a suggestion, said the report, that some customers are placing multiple orders across different suppliers to try and mitigate lead time and stock issues. Overall, however, members are now “significantly above 2019 (pre-pandemic) levels but with this exceptional growth comes supply chain issues,” said ITSA. The summary said automotive, communications, and data centers all experienced double-digit growth in the period and that the broadcast market is beginning to show small growth, while mil-aero remains slow (see Figure 1).

To learn more about the companies mentioned in this article, visit the Preferred Supplier pages for Fischer Connectors, HARTING, Harwin, LEMO Connectors, and PEI Genesis.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Matter: A Show of Unity for Connectivity - September 5, 2023

- Brexit Update: UK Connector Industry - March 28, 2023

- Sensors Make it Plain Sailing for a Smart Ferry - February 21, 2023