Connector Industry Books Record Sales in 2022

The connector industry achieves a new industry record for sales in 2022.

Connector Industry Sales 2022

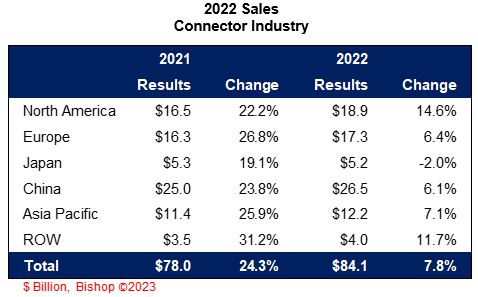

The connector industry achieved full year 2022 sales growth of +7.8%, reaching global sales of $84.1 billion. This is a new industry record for sales. The following table displays 2022 sales results by geographic region.

It is interesting to note that North America achieved better sales growth than China in 2022. In fact, North America outperformed China in three of the past five years. The days of China consistently outpacing North America in sales growth is probably ending.

First, labor costs have risen in China, creating an opportunity for other countries to compete for Western investment. As a result, companies are moving production out of China to Vietnam, India, and elsewhere.

Second, China’s aggressive stance on Taiwan threatens peace in that part of the world. Companies are diversifying their manufacturing footprint to be less dependent on China. Additionally, Western governments are becoming concerned about critical industries being in China, especially electronics and pharmaceuticals.

Third, China’s “no COVID policy” shut down significant portions of China’s manufacturing industry, which caused global shortages of many products. This was another warning that companies needed to diversify their manufacturing footprint away from China.

Impact of Currency & Inflation

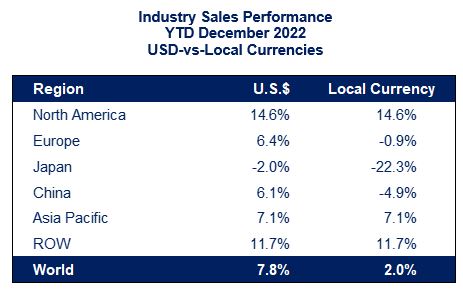

The U.S. dollar significantly strengthened in 2022, reducing industry growth in real terms. The industry achieved +7.8% sales growth in U.S. dollars but only +2.0% growth in local currencies. This is shown in the following table.

Considering that global inflation in 2022 was in the 8% to 10% range and the industry implemented price increases in the same range, the connector industry probably did not achieve growth when measured in units.

Full year 2022 financial results have not been reported at the time of publication, but we believe price increases were able to offset raw material and labor cost increases. Anecdotally, we expect that connector profitability in 2022 was good to excellent.

Healthy Backlog Going into 2023

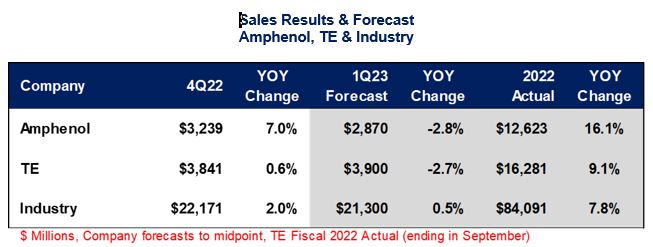

The 2023 beginning backlog is $22,983 million or 14.8 weeks of sales. We averaged $21,023 million sales per quarter in 2022. So, we should have sufficient backlog to achieve flat, or low single digit, sales in the first quarter.

Note, Amphenol and TE Connectivity forecast 2023 first calendar quarter sales of -2.8% and -2.7% respectively. Bishop forecast sales growth of +0.5%. We believe the industry may do better than these forecasts because:

- Amphenol and TE results generally exceed expectations.

- The backlog is sufficient to produce growth in the first quarter assuming no significant order cancellations.

The following displays first quarter 2023 forecasts by Amphenol, TE, and Bishop (Industry).

The connector industry achieved a fourth quarter sales increase of +2.0%. This is down from full year 2022 growth of +7.8%, an indication demand is slowing. Also, confirming this trend is the fact Amphenol achieved fourth quarter growth of +7.0% while full year was +16.1% and TE achieved fourth quarter growth of +0.6% and full year of +9.1%. Both strong indicators of slowing demand.

Amphenol and TE forecasts for the first quarter of negative growth is further evidence of a slowdown.

Economic consensus is that we will not have a serious recession.

If you are interested in tracking the connector industry, subscribe to the Bishop Report, a publication by Bishop & Associates, to receive monthly updates on the performance of the connector industry. Learn more here.

Subscribe to our weekly e-newsletters, follow us on LinkedIn, Twitter, and Facebook, and check out our eBook archives for more applicable, expert-informed connectivity content.

- Wire & cable cutting services - March 3, 2024

- Belden – REVConnect RJ45 Connectors | First Look - March 3, 2024

- Molex, LLC – 5G25 Series 5G mmWave RF Flex -to-Board Connectors | First Look - March 3, 2024