Instrumentation Suffers Soft Semi Sales

Instrumentation Suffers Soft Semi Sales

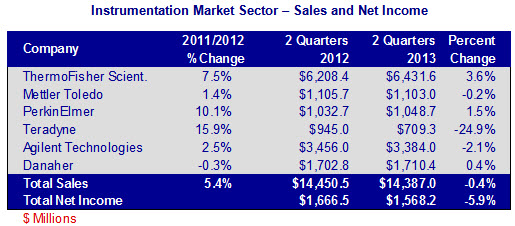

Bishop tracks 13 market sectors for electronic interconnect sales trends. The combined annual revenue of all the market sectors was $4.3 trillion in 2012, an increase of 4.9% over 2011. Of the 13 market sectors, instrumentation was the third-fastest growing market sector in 2012, at 5.4% year-over-year with combined revenues of $29 billion. Profitability was $3.5 billion at 12.1% of sales.

Bishop tracks 13 market sectors for electronic interconnect sales trends. The combined annual revenue of all the market sectors was $4.3 trillion in 2012, an increase of 4.9% over 2011. Of the 13 market sectors, instrumentation was the third-fastest growing market sector in 2012, at 5.4% year-over-year with combined revenues of $29 billion. Profitability was $3.5 billion at 12.1% of sales.

ThermoFisher Scientific had sales growth of 3.6% in the first half of 2013 to $6.4 billion. The company produces scientific equipment used in laboratories and hospitals around the world. They attribute the growth to their technical leadership position in this industry. Sales were up in each of their three business segments — analytical technologies, specialty diagnostics, and laboratory products and services. For the second quarter, the company grew 2% organically and 2% through acquisitions.

PerkinElmer grew 1.5% year-over-year in the first two quarters of 2013 while net income was up 6.4%. In the second quarter, sales were up approximately 4% in each business segment — human health and environmental health.

Mettler Toledo and Danaher both had relatively flat sales for the first half year-over-year reflecting the sluggish macro-economic environment.

Teradyne experienced a sales decline of 24.9% in the first half of 2013. This was partially due to very strong performance in the first half of 2012 and partially due to a comparatively weaker first quarter of 2013. Second quarter revenues were stronger by 53% over the first quarter and they have also experienced strong orders. Teradyne manufactures semiconductor test equipment and wireless test equipment. The soft semiconductor market has impacted several companies in this segment besides Teradyne. Improving semiconductor sales will help these companies in 2014.

The following table shows the results for the six companies we track in this market sector.

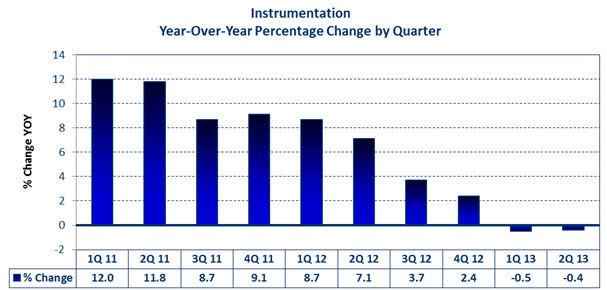

As can be seen in the following chart, year-over-year sales growth started slowing in 3Q12 and was negative for the last two quarters. Sequentially, second quarter 2013 sales increased 2.9% from the first quarter of 2013.

Trends in the Instrumentation Industry

The instrumentation market sector tends to do well when electronics businesses are doing well, which will drive demand for cable assemblies.

- The semiconductor market is a big driver for instrumentation utilizing automatic test equipment. The semiconductor market has been very flat in 2013, up just 1.5% year-to-date. Semiconductor market performance has been strongly impacted by the downturn in sales of PCs.

- While the sale of semiconductors to PC companies is down, the sale of tablets and smartphones is offsetting some of this lost business for semiconductors and will thus help the instrumentation market.

- The expansion of the wireless infrastructure for smartphones and cell phones and the new 4G/LTE rollouts have had a positive impact on the instrumentation market. Wireless test equipment has been selling well to facilitate the expansion.

- Sales of diagnostic/life sciences equipment used in the healthcare industry have slowed over the last few years. This is partially a consequence of the uncertainties surrounding the Affordable Care Act of 2010. Health care providers have been reluctant to spend money on capital equipment in an environment that keeps shifting.

Bishop & Associates projects the worldwide market for instrumentation cable assemblies to grow 2.3% in 2013 to $3.4 billion. At 7% year-over-year growth, ROW will be the fastest-growing region in 2013 for this market sector.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019