Is it Death by Air for the PC?

Will PCs die as a result of the landslide of new tablets and smartphones?

Non-Stop Growth Gone Poof

Non-Stop Growth Gone Poof

The PC and its peripheral products have been one of the highest volume connector markets over the past two decades, with low-cost manufacturing and assembly primarily centered in Asia. Year after year, in good and bad times, the PC market continued to grow—notebooks experienced double-digit increases—with only a couple years where there was slight negative growth. Now, in 2013, we are seeing an abrupt change: 1Q13 was down anywhere from 17-20%, including notebooks.

Last year, HP considered (but dropped) a plan to spin out its PC business. Dell is trying to go private and was just bolstered by a $2 billion loan from Microsoft. Today, numerous industry-watchers are more or less predicting the death of the PC. The culprit: lighter than air wireless web, fueled by handheld tablets and smartphones. How quickly things change!

- The PC market has been disrupted by this ultra-mobility trend, led by Apple, Samsung, Google, and others. Thin, light, and portable wireless options are replacing desktops and notebooks.

- Associated with the above, there is a major acceleration of ultra-mobile computing as more and more users are no longer deskbound workers – or take their work with them 24/365.

- After years of declining prices, prices seem higher now due to material and labor cost increases in China, more costly ultrabook designs, and HDLCD displays. Price comparisons are elusive because the new designs are different, and these newer models can be two to three times the cost of traditional notebooks.

- The fickle consumer, who became a leading factor in PC sales (over B2B users), has discovered other devices can accomplish some of the same tasks a PC can, as well as other functions they couldn’t do on a PC. Most consumers never really knew (or needed to know) how to use a PC in the first place.

- There has also been a change in the way people use PC devices—shifting from content creation to consumption. There are applications, knowledge, entertainment, books, and other information now available on the Web. Number crunching is not as important to most users, but they used PCs anyway until the game changed with tablets.

A Period of Transition, Selective Death, and New Opportunities

Other changes that will affect PC use are in the offing. One area of impact will be coming from the cloud. As more applications and storage become available in the cloud, users will need less local computing power and software. This fact will further promote tablets and smartphones over PCs, which because of their computing power will remain an important, if not redesigned, information appliance.

How this will affect your business depends on how you look at this market. If your vision is PC motherboards, you’re in trouble. But if you see the entire information appliance market as an opportunity for change and innovation, you may be on the right track.

Now one might ask: How does this affect the player that really let the genie out of the bottle—Apple? Well, its stock is down from the ionosphere to the mesosphere. Time will tell whether there is also an impact on its MacBooks and iMacs. I’ve been in its stores as recently as yesterday, and most of the action is with the iPhone and iPad. Apple does have the Genius Bar and training, which helps consumers considerably when a store is nearby.

PC Study 2013

Bishop recently completed a research study on the shifting samds of the extended PC marketplace: Mobile and Desktop Computing Market Analysis and Forecast: 2010-20. It includes desktop towers and AIO units, notebooks, UltraBooks and hybrids, tablets and eBooks, and smartphones.

The findings show a major drop is in progress on desktop towers – up to a 50% decline over the next five years. Innovative designs like the Maingear units are on the horizon. Attractive AIO units with up to 27” screens are on the rise but will not totally compensate for losses in PCs. The proverbial motherboard will also suffer. AIO units will have a more notebook-like main board and more OEM/ODM custom-designed electronics than de facto standard PC-AT motherboards.

A new category of hybrid notebooks is appearing. These have both tablet and notebook convertibility. Every major notebook manufacturer has them now, and Microsoft has introduced both Surface RT and Professional. We are projecting 75 million of these types of units by 2020, whereas tablets will be in the hundreds of millions. There is a question in the area of UltraBooks and convertible tablets; they’re pricey, have smaller screens, and fewer IO ports. Will they succeed without cost reductions and design changes? Microsoft in particular has pegged its Surface at between $600 (RT) and $1,000 (Pro) with keyboard and Office.

Sony’s very attractive hybrid (above) is $1,500. It seems everyone is following Apple’s pricing and why not? Designs rival and exceed Apple now. Software and application capabilities have improved, with Google Apps approaching par with iOS, and Windows 8 much improved.

Another factor is that perhaps for the first time, individual OEMs are creating refreshing new designs and at a breakneck pace. Not all will succeed; some are  deemed clunky or thrown at the wall, but it is refreshing that OEMs are differentiating themselves via design and packaging innovations, unlike the former market which was shepherded by Intel and Microsoft with same/similar designs. There are also low-cost Atom/ARM notebooks coming out as well as Office 365, showing that Intel and Microsoft are still in the driver’s seat. Windows 8 is being overhauled already and Google is in the game. These newer ultra-mobile devices will do what the flopped netbook couldn’t.

deemed clunky or thrown at the wall, but it is refreshing that OEMs are differentiating themselves via design and packaging innovations, unlike the former market which was shepherded by Intel and Microsoft with same/similar designs. There are also low-cost Atom/ARM notebooks coming out as well as Office 365, showing that Intel and Microsoft are still in the driver’s seat. Windows 8 is being overhauled already and Google is in the game. These newer ultra-mobile devices will do what the flopped netbook couldn’t.

Another interesting innovation is the HP Z1 Workstation (right), which is massively upgradeable. Just snap open the display and go inside to make repairs or change drives, memory, and more.

Tablets

Tablets, of course, are the rage now. iOS still beats Android and probably will remain the leader. Its apps beat all others but Android is closing in. Our tablet forecast, 50% down to 20% per year CAGR by 2020, is not as aggressive as some who see 400 to 500 million tablets in five years. We have taken a more cautious approach, because we think all the innovation in UltraBooks and hybrids will take a portion of the marketplace — and the tablet craze will cool down a bit and that market eventually will be saturated.

Smartphones

Smartphones are in the process of replacing cell phones. But there may be a large and growing market for basic mobile phones in the developing world. Phone technology will go in two directions: bigger and smaller, more expensive and cheaper. Bigger will be a “phablet” design similar to Samsung’s Galaxy Note II or S3, with >5” diagonal screens. This will allow smartphones to cross into tablet territory, although size could be an issue; it might not fit in your pocket anymore, and users with smaller hands will be more prone to dropping them, unless the industry comes up with an innovative handheld design. Smaller sizes will be down to a wristphone (will Apple introduce it?) – or a design that can be body-worn. With Bluetooth wireless capability and OLED flexible displays, it is possible to change the design dynamic, eliminating dropped or lost phones and rigid, flat displays.

Bottom Line

The PC industry is not dead, depending on how you look at it. However, it is rapidly — faster than anyone thought — moving into a new chapter with tablets, UltraBooks, and hybrids which will be a key part of the new extended PC marketplace — extended because technologies have raced along, particularly in the past few years. This has also happened with film-to-digital cameras, digital cameras-to-smartphones, CRT TV-to-HD/LCD, all changing faster than ever before. The future portends more of this rapid pace of innovation because of an explosion in applications, digital convergence with advanced silicon technology, and advances in electronic packaging. PC use will continue for the foreseeable future because millions of users need a sophisticated computing machine, which thanks to Intel, will trend toward desktop and laptop supercomputing, plus ultra-mobile PCs with near-desktop capability. The cloud may change a lot of this as it provides both applications and computing power.

What does this all mean to the connector industry?

In the broader sense, connector volume will continue to rise in the overall market and new applications will surface, but probably at overall single-digit rates. They will rise rapidly on new devices and fall on others: Principally desktop towers and larger, heavier notebooks. The biggest negative hit will be the significant decline in traditional motherboards.

The number of IO ports on ultra-mobiles and tablets is also dropping, with no internal DVD, because of demand for thinner/lighter ultra-mobile designs and access to multimedia applications and storage in the cloud. Where a desktop has four to six USB ports and a total of 10 ports counting VGA, HDMI, RJ45, and others, UltraBooks have one to two USB 3.0 ports, 1 HDMI, an RJ45, and one or two other connectors. SD and Micro-SD card slots will grow with non-Apple tablets, but seem to be declining in PCs. Apple is famous for limiting the number of IO ports, but I see it has granted four USB 3.0 ports and two 10Gb/s Thunderbolt ports on the new iMac for a total of nine IOs. HDDs are giving way to SSDs, which are increasing in capacity and coming down in price. So far, SSDs are using SATA, but this could change in the future to a faster small form factor design. LCDs and hybrid, convertible devices will favor FPC/FFC interconnects. There will also be a trend toward mini and micro versions of USB, HDMI, DP, and other IO ports. Cloud computing will favor WiFi, which is headed toward 802.11ac and will eventually make some IO connectors unnecessary.

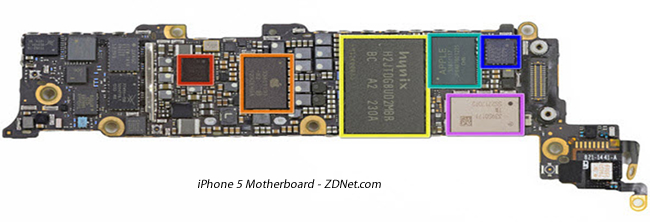

Internally, there are vast differences between tablets and smartphones versus PCs, including far fewer connectors in tablets than notebooks and ultra-thin notebooks. There will be higher levels of integration and additional thin, flexible circuitry, including FPCA (flexible printed circuit assemblies). So, fine-pitch, thin FPC connectors should be on the rise, as well as small form factor board-to-flex/rigid assembly connectors. There will also be a need for flex and some pogo-style connectors in the new convertible/hybrid notebooks and dockable tablets.

Intuitively, taking all these things into consideration, it appears that the connector industry will be challenged, along with the extended PC industry, to provide new, possibly value-added solutions as the industry moves away from the conventional, connective motherboard to an array of innovative but ultrathin and light devices. One question here is the extent to which leading manufacturers will continue to support what is essentially 100% offshore manufacturing. On the other hand, there is talk of an insourcing movement, so even there, the future forecasts change.

- Electric Vehicles Move into the Mainstream with New EV Battery Technologies - September 7, 2021

- The Dynamic Server Market Reflects Ongoing Innovation in Computing - June 1, 2021

- The Electronics Industry Starts to Ease Out of China - November 3, 2020