Server Equipment Paradigm Shift Ahead?

John MacWilliams explores the question – Server Equipment Paradigm Shift Ahead?

As the computer market shifted away from mainframes and minicomputers (IBM, Digital Equipment, Wang, etc.) to PCs, networks, and the Internet, servers began to rise in importance. This sea change gave rise to a wide variety and growing number of server systems, from volume/blade servers to departmental servers, enterprise servers, and many Internet-centric server products. Application servers include database servers, file servers, mail servers, print servers, web servers, and multi-application virtualization servers. Servers can also be classified by architecture: X86, RISC/Unix/Linux, and proprietary. X86 servers tend to be entry-level to midrange, with RISC/Unix servers at the mid to high end. Mainframes still exist for large centralized corporate users, led by IBM System Z, but mini-computers are gone, gobbled up by the relentless shift to client-based PCs, network computing, and servers.

There are similarities between servers, PCs, and mainframes. Typically, servers use similar components and subsystems, yet there are more of them. Some have proprietary system architecture. Servers usually don’t have the sheer computational power of mainframes or scientific computers, but many have multiple CPUs, large memory banks, massive HDD storage, high-speed I/O, and fault-tolerant capabilities. Components used in servers can be the same as those used in PCs, but due to reliability requirements, they may be source-restricted. They also must meet higher performance requirements. Since a server outage can cost more than the system itself, cost is less of a factor than in more commodity-oriented PC products.

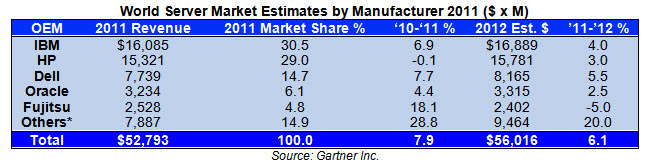

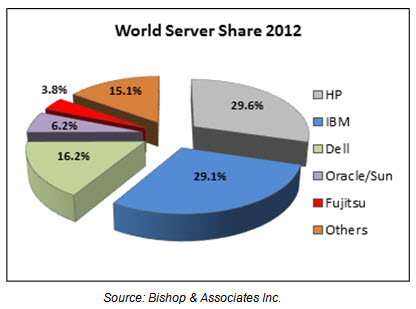

The server market has grown to a $50B segment of the computer industry — about the same size as the world connector market. With the advent of cloud storage and “Big Data,” many intuitively expect the server market to continue to grow, and to grow substantially. That could be a false assumption.

As this market is concentrated and in constant turmoil, it is difficult to get good, solid, forward-looking predictions. We do our best to piece together all the available information and make our own predictions off a baseline of current conditions.

Current Status

The server market is dominated by US-based suppliers: IBM, HP, Dell, Oracle/Sun, and Cisco, but aggressive and innovative smaller firms that embrace cloud computing, server virtualization, and low-power micro-server systems are making headway. Major suppliers outsource and have their own factories in North America, Europe, and Asia. The dynamics of competition are as follows:

- Intel remains strong, due to Xeon and other CPUs, chip sets, motherboards, and overall influence on X86 server designs. However, Intel faces a major challenge from low-power ARM-based server systems and, to some extent, from AMD.

- Microsoft also remains a strong, non-hardware influence with its Windows NT and Server 2012 software. The Intel/Microsoft duopoly in PCs has relentlessly shifted the server market toward “Wintel” designs, typically at lower cost than Unix-based systems.

- HP has stumbled a bit with several corporate shakeups over the past five years and has potential for downsizing. Yet its server business seems solid, although losing a bit of market share.

- Dell has voted to go private under Michael Dell and Silver Lake Partners, most likely to focus on servers and storage to shore up profitability, while spending more on internal R&D. Dell is solidly #3 in server sales.

- IBM moves along, remaining the industry leader in dollars and profitability, but with the potential for weaker enterprise dollars and the divestiture of its X86 line to Lenovo. IBM has transitioned from a hardware company to software and services — so far with success. However, there are concerns that as a higher-cost supplier with a dwindling hardware base, IBM’s future might be challenging. IBM does have one of the best R&D organizations in the world and a lead in the future-important analytics software area.

- Sun Microsystems was once a leading and is still a fine server manufacturer, but they appear to have been, at least in part, a casualty of the relentless X86 drive. Now, under Oracle management, there appears to be synergy with Oracle’s database business, but other server manufacturers are on the rise. Cisco Systems is one of them, with relatively new servers married to a formidable network equipment position. Technology change is also roiling the server market.

- Lenovo is emerging as a force in China, mainly in ThinkPad PCs, where it is now number 1. With the growth of the Chinese economy, it makes sense for Lenovo to beef up its server offerings, which it will in a big way if it acquires IBM’s X86 lines of server products. There is precedence for this: IBM sold its PC division to Lenovo in 2005, giving Lenovo access to IBM’s Research Triangle Park, N.C. facilities, former IBM engineers and developers, and a soon-to-be added N.C. computer manufacturing facility in Whitsell, N.C.

- Startups and venture firms continue to make the server market space interesting.

Server sales in 2012 and 2013 were essentially flat or down slightly from 2011. The main reasons were:

- Difficult comparison to a strong 2010-11 buying cycle for new server systems and a rebound from recession

- Market softness, particularly in the EU

- The beginnings of a structural shift to server virtualization and cloud computing has begun to impact the number of server systems being deployed.

Volume server sales were up, but mid-range and enterprise server demand declined. Market shares changed slightly, with IBM losing a few points on softness in its large server system sales and other server manufacturers on the increase.

Paradigm Shift in the Making?

Technology and market imperatives are beginning to change the server market. While it is still unclear as to what the changes will ultimately be, they will pose challenges for industry-leading OEMs and for the makeup of the future server market. As we look back to the previous upheaval in the mainframe and minicomputer markets that gave birth to servers, could a similar process now be unfolding for servers?

There are six technology and market shifts going forward:

- Cloud computing, which will impact the number and function of deployed server systems

- Server virtualization software that can result in a 10:1 reduction in server hardware

- Micro-server technology using ARM/Atom CPUs with reduced power and cable usage

- Open-source computing shifts manufacturing to ODMs and end-user build-your-own, like Google

- IBM exiting a significant portion of the market due to unprofitability

- Rise of Asian ODM and OEMs and server makers as that region and open source grows

Connector Usage

The server market (connector sales of ~$1B+) has been important to the connector market for several reasons:

- It typically commands higher ASPs due to source-restricted reliability concerns.

- It provides profitability on lines that, if left strictly to PC business, might not be profitable.

- Server manufacturing is limited; there are six or seven important OEMs with their EMS suppliers.

- Most server manufacturing remains in the developed world, i.e. North America, Europe, Japan, and Taiwan.

- US firms have dominated the market.

- There is a heavier concentration of higher-end connector products, such as CPU sockets.

Connector products used in servers include:

- Most PC-related connector products of the PCI/Intel architecture

- Multiple CPU sockets

- Soon-to-be-introduced DDR4 memory sockets in large quantities

- SATA/SAS/SFF HDD/SSD connectors

- High-performance backplane connectors

- Fiber optic connectors and cable assemblies, including active cables and transceivers

- High-speed I/O: 1-10-40GbE, Cat5-7 Ethernet

- Massive cable assembly plants for computer room applications

Look for Bishop’s new Server Market and Connector Research Report, which will be released soon, for more information on the dynamics of the server market through 2023.

- Electric Vehicles Move into the Mainstream with New EV Battery Technologies - September 7, 2021

- The Dynamic Server Market Reflects Ongoing Innovation in Computing - June 1, 2021

- The Electronics Industry Starts to Ease Out of China - November 3, 2020