Security – A Growing Market Despite Economic Obstacles

Security – A Growing Market Despite Economic Obstacles

Even in uncertain economic times when we see low economic growth in many developed nations, there are always growth opportunities in specific markets or niches. One of those markets is the security systems market.

The security equipment market encompasses many different definitions and specialized niches, and the proliferation of new segments reflects the growth potential of this market. The most common definition of the security equipment market includes equipment for access control, CCTVs and video surveillance, perimeter protection and intruder alarm systems, as well as fire prevention and detection systems. We can also add to this elderly/social/hospital/pool alarms, evacuation technology, emergency lighting, drug and explosive detectors, airport/travel security systems, metal detectors, and biometrics. Equipment ranging from automotive de-mobilizers to pest/animal control systems, along with the important and sizeable market for industrial and machine safety equipment, also falls under this market’s umbrella, although this last segment is usually considered a separate market with separate guidelines and directives for machine safety.

The security equipment market encompasses many different definitions and specialized niches, and the proliferation of new segments reflects the growth potential of this market. The most common definition of the security equipment market includes equipment for access control, CCTVs and video surveillance, perimeter protection and intruder alarm systems, as well as fire prevention and detection systems. We can also add to this elderly/social/hospital/pool alarms, evacuation technology, emergency lighting, drug and explosive detectors, airport/travel security systems, metal detectors, and biometrics. Equipment ranging from automotive de-mobilizers to pest/animal control systems, along with the important and sizeable market for industrial and machine safety equipment, also falls under this market’s umbrella, although this last segment is usually considered a separate market with separate guidelines and directives for machine safety.

The variation in electronic security equipment leads us to identify various end-user markets for safety and security equipment:

- Private individuals (protection of home and belongings, guarding against bodily harm, intrusion, fire)

- Businesses (premises protection, access control, access to information, fire)

- Manufacturers (machine/industrial safety systems)

- Government/institutions/businesses delivering public services (hospitals, shopping streets/malls, airports, train stations, nuclear power/energy plants, water purification plants)

Safety and security concerns are a topic on almost everybody’s mind in our modern society. As a result, electronic security systems such as access control systems, fire alarm equipment, and CCTV and other surveillance equipment are fast becoming an integral part of specifications for new construction, whether for private use or for businesses.

The market is still highly fragmented with many manufacturers serving the security equipment market, but also includes some global players such as Bosch Security Systems, Axis Communications AB, Honeywell International Inc., Panasonic System Networks Co. Ltd., and Tyco Security Products.

World Security Market

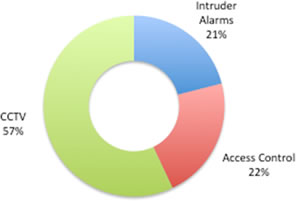

The security market, including CCTV, access control, and intruder alarms, has already reached a volume of $58 billion in 2010, according to BSRIA*, a UK-based research company, and is expected to continue to grow by double digits in the coming years. Although other reports are more conservative and stick to single-digit growth forecasts, again, depending on the definitions used, the market remains lucrative and growing. A globally increased level of safety and security concerns and an increased perception of risk drive this market. According to BSRIA, the security market is dominated by CCTV/surveillance applications, as illustrated in the graph below:

World Market Share

Security Market 2010

Source: © BSRIA

Although the worldwide economic recession tempered growth, the overall demand for security equipment continued to grow during the global economic recession, and the economic malaise had only a limited impact on this market’s expansion.

To cope with the growing demand, technological developments, and migration to digital networked solutions, the International Electro-technical Commission (IEC) set up the technical committee TC79. TC79 is charged with the preparations of international standards “for the protection of buildings, persons, areas, and properties against fraudulent actions having the purpose to enter in a place or to take or to use something without permission and other threat related to persons. The scope includes, but is not limited to, equipment and systems, either used by ordinary persons or by trained people in the following residential and non-residential applications”:

- Access control systems

- Alarm transmission systems

- Video surveillance systems

- Combined and/or integrated systems including fire alarm systems

- Fire detection and fire alarm systems

- Intruder and hold-up alarm systems

- Remote receiving and/or surveillance centers

- Social alarm systems

That the latter segment, social alarm systems and services, is also considered a steady growth market may be no surprise, as developed nations begin to cope with aging populations.

TC 79 created the working groups WG 11 on electronic access control systems and WG 12 on video surveillance systems (VSS).

CCTV / Video Surveillance

IMS Research estimates that 37% of all video surveillance costs in the United States in 2011 was on network video surveillance equipment, an increase of almost 5% versus 2010. Network video surveillance solutions are generally also increasing in size and complexity. IMS Research further estimates that by 2015 more than 70% of all network cameras sold will be megapixel models. The market migrates away from standard definition (VGA or less) network cameras towards HD or greater network cameras. The mass market appears to settle on 720p and 1080p format resolutions. This obviously will have an impact on bandwidth requirements and network management.

IMS Research estimates that 37% of all video surveillance costs in the United States in 2011 was on network video surveillance equipment, an increase of almost 5% versus 2010. Network video surveillance solutions are generally also increasing in size and complexity. IMS Research further estimates that by 2015 more than 70% of all network cameras sold will be megapixel models. The market migrates away from standard definition (VGA or less) network cameras towards HD or greater network cameras. The mass market appears to settle on 720p and 1080p format resolutions. This obviously will have an impact on bandwidth requirements and network management.

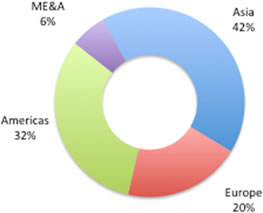

Regional Shares World CCTV/Video Surveillance Market 2010

Source: © BSRIA

Access Control and Biometrics

More and more, electronic access control systems are becoming networked and integrated into advanced network systems. IP-based open-architecture systems enable the integration of existing access control systems with other security services. This will stimulate demand further in the coming years. Access control systems that offer remote access via web browsers or virtual private networks (VPNs) are turning out to be highly popular among business organizations, especially SMBs (Small and Medium-Sized Businesses).

Biometric technologies are also gaining ground. Voice and face identification solutions, iris scanners, hand geometry systems, and fingerprint scanners are already well-known technologies for border control and some other applications and are finding their way into the access control market as the technology becomes more and more refined and robust. This unlocks a great potential for the biometric access control market.

Biometric technologies are also gaining ground. Voice and face identification solutions, iris scanners, hand geometry systems, and fingerprint scanners are already well-known technologies for border control and some other applications and are finding their way into the access control market as the technology becomes more and more refined and robust. This unlocks a great potential for the biometric access control market.

Fire Detection

According to some analysts, the global fire alarm equipment market is projected to reach $4.4 billion by the year 2018. Growth for this equipment is expected to come from a recovery in the building and construction market, especially growth of this market in Asia-Pacific, combined with the implementation of new fire and safety regulations.

Carbon dioxide detection is another hazard that has resulted in the NFPA 720-2009 CO detection standards. Several manufacturers are now designing multi-criterion detectors such as smoke detectors and using carbon dioxide levels as an important fire component. These new developments also drive growth of the use of similar detectors in schools, hospitals, and nursing homes.

Near-Field Communications

IMS Research recently published that it expects to see NFC (near-field communications) to have a significant impact on the security market in the medium term. NFC adoption has lagged in America, so when or how mass adoption of NFC will occur worldwide, especially for making payments, is as yet unclear as widespread use in the US market will be a critical factor. Significantly, Apple’s new iPhone 5 is not equipped with NFC technology, even though many experts expected it would be. With Apple’s influence over the smartphone market, this may slow down the adoption process, even though many other smartphones already contain NFC chips. Once NFC reaches a critical threshold in other applications where it can be better understood and proven to be reliable, the technology could, however, become more commonplace over the medium to long term. The security industry will then be more likely to follow suit, according to IMS Research.

IMS Research recently published that it expects to see NFC (near-field communications) to have a significant impact on the security market in the medium term. NFC adoption has lagged in America, so when or how mass adoption of NFC will occur worldwide, especially for making payments, is as yet unclear as widespread use in the US market will be a critical factor. Significantly, Apple’s new iPhone 5 is not equipped with NFC technology, even though many experts expected it would be. With Apple’s influence over the smartphone market, this may slow down the adoption process, even though many other smartphones already contain NFC chips. Once NFC reaches a critical threshold in other applications where it can be better understood and proven to be reliable, the technology could, however, become more commonplace over the medium to long term. The security industry will then be more likely to follow suit, according to IMS Research.

If NFC becomes a mainstream technology, the connector industry will also feel the impact of NFC, as there are no physical connectors used with near-field communication. The connection does not have to deal with problems of contact wear, corrosion, and dirt experienced by systems using physical connectors. NFC, a form of RFID, utilizes inductive-coupling, at a frequency of 13.56 MHz, a license-free allocation in the HF portion of the radio spectrum that typically works at distances of 4 to 5 cm (maximum two inches). NFC standards determine the contactless operating environment as well as the data formats and data transfer rates, so that devices from various manufacturers can communicate together.

Connectors for the Electronic Security Market

It remains difficult to establish exact connector market volumes for each sector in the electronic security market by region, by product type, or product family. It is clear, however, that the electronic security market utilizes large quantities of connectors for access control equipment, fire detection, CCTV, and intruder alarm systems and remains fairly unaffected by economic downturns. Most of these connectors will be categorized as PCB connectors, I/O connectors, and BNC connectors. With the trend towards increasingly networked systems, the introduction of wireless systems, and, perhaps at a later stage, NFC technology and biometrics, the challenge for connector manufacturers is to become part of this trend and offer the appropriate technology to the system designers, including antennas, network connectors, NFC technology, and perhaps even biometrics technology. While current (analog) security systems in the low-cost ranges contain connectors of similar low-cost designs, the trend towards more sophisticated, more powerful, more reliable, and networked electronic systems will impose higher quality levels on the components used, offering opportunities to established connector manufacturers that wish to service this market.

No doubt Asia-Pacific (including China), Russia, and Latin America will continue to drive volume growth in this market in the next few years, but systems used in developed countries in Europe and North America are likely to drive the technology trend.

This article contains material BSRIA made available to the public summarizing the findings of its World Security Study released in 2011. This article also contains material IMS research made available to the public by means of press releases.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019